AUTHOR: SELENA GIL

DATE: 3/1/2024

Introduction

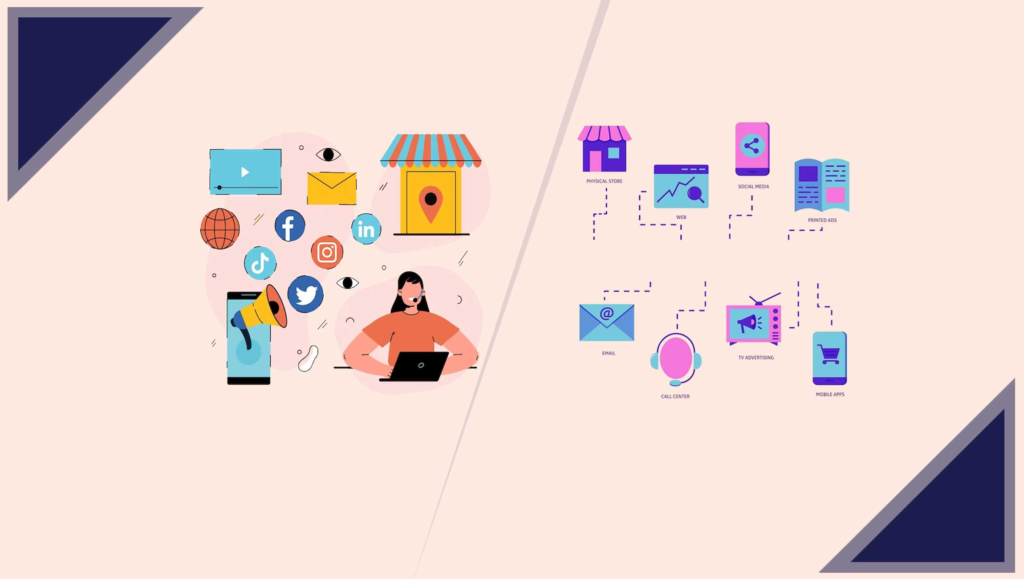

In the dynamic landscape[1] of the Indian payment[2] sector, the utilization of multi-channel campaigns has emerged as a pivotal strategy for payment providers[3] to engage customers across various platforms. These campaigns, spanning multiple channels like mobile, web, social media, and traditional[4] advertising, have become indispensable[5] in reaching diverse audiences efficiently.

Evolution of Payment Providers in India

The evolution of payment providers in India has been marked by remarkable growth and innovation. From traditional banking systems to the advent of digital wallets, UPIs, and mobile payments, the sector has witnessed a transformative journey, fueled by technological advancements and changing consumer behavior.

Challenges Faced by Payment Providers

Despite the progress, payment providers encounter multifaceted challenges. Regulatory complexities, concerns regarding data security, and the task of encouraging widespread user adoption pose significant hurdles.

Role of Multi-Channel Campaigns in Overcoming Challenges

Multi-channel campaigns serve as a linchpin in mitigating challenges faced by payment providers. By instilling trust, diversifying outreach strategies, and ensuring compliance, these campaigns play a vital role in navigating the intricate landscape.

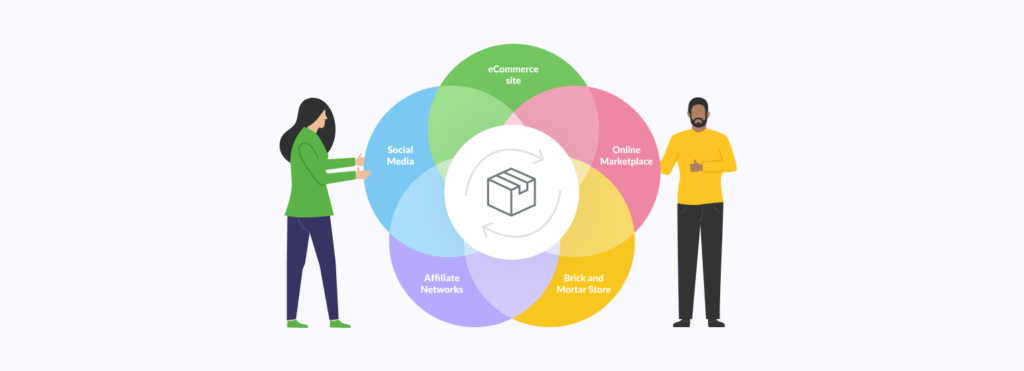

Effective Strategies for Multi-Channel Campaigns

Implementing an omnichannel approach, tailoring messages for distinct channels, and leveraging advanced technology for seamless integration are key strategies that payment providers adopt to maximize the impact of their campaigns.

Success Stories of Payment Providers Using Multi-Channel Campaigns

Several payment providers have witnessed substantial success through the astute employment of multi-channel campaigns.

Future Trends and Innovations

Looking ahead, the future holds promising advancements in payment campaigns. Innovations in technologies such as AI, blockchain, and IoT are expected to revolutionize the landscape, offering new avenues for engaging users.

The Impact of Multi-Channel Campaigns

In India, the impact of multi-channel campaigns on payment providers cannot be overstated. These campaigns have not only widened the reach of payment solutions but have also transformed the way users interact with financial services.

User Engagement and Trust Building

One of the primary advantages of multi-channel campaigns for payment providers is their enhanced ability to engage users across various touchpoints. Payment Provider Multi-Channel Campaigns in India From social media engagement to personalized email campaigns and interactive mobile applications, these channels foster direct and meaningful connections with users.

Challenges and Adaptive Strategies

Navigating regulatory hurdles remains a challenge for payment providers in India. However, innovative multi-channel campaigns have allowed companies to adapt swiftly to changing regulations, ensuring compliance while maintaining user-centric experiences.

Security concerns also loom large in the Payment Provider Multi-Channel Campaigns in the Indian digital payment space. Multi-channel campaigns incorporate transparent communication about security measures, assuaging apprehensions and fostering confidence among users.

Personalization and Customer-Centric Approach

The beauty of multi-channel campaigns lies in their capacity for personalization. Payment providers can tailor messages and services according to user preferences, behaviors, and demographics, creating a more customer-centric approach.

Innovations Shaping Multi-Channel Campaigns

The future of multi-channel campaigns in India’s payment sector is underpinned by technological innovations. Advancements in AI-driven analytics offer unprecedented insights into user behavior, allowing payment providers to craft hyper-personalized campaigns that cater to individual preferences.

Blockchain[2] technology, with its emphasis on transparency and security, holds immense promise for transforming payment campaigns. Its decentralized nature ensures secure transactions, providing a robust foundation for multi-channel strategies.

Adoption and Adaptation

The success of multi-channel campaigns relies on the seamless[3] adoption and adaptation of emerging technologies. Payment providers that embrace these innovations can create agile campaigns that resonate with the rapidly changing expectations of their users.

Collaboration and Ecosystem Expansion

Collaboration among various stakeholders within the payment ecosystem will be pivotal. By leveraging partnerships, payment providers can expand their reach and Payment Provider Multi-Channel Campaigns in India create comprehensive[4] strategies that cater to diverse user needs.

Ethical Considerations and Trust

As technology[5] evolves, ethical considerations surrounding data privacy and user consent become paramount. Payment providers must use ethical practices in their campaigns to build trust and credibility among users.

Conclusion

In the competitive arena of payment provision in India, the adoption of campaigns stands as a beacon of innovation and effectiveness. As the sector continues to evolve, these strategies will be for growth and development.

FAQs

- How do multi-channel campaigns benefit payment providers? Multi-channel campaigns enable payment providers to reach a wider audience, build trust, and overcome regulatory challenges more effectively.

- What role does technology play in shaping these campaigns? Technology acts as a catalyst, enabling seamless communication across various channels and personalized messaging and user experiences.

- Are there specific challenges unique to India’s payment sector? Yes, India’s payment sector faces regulatory complexities, rapid technological changes, and the need to address diverse user needs.

- Can multi-channel campaigns help in combating security concerns? Yes, through robust security measures and communication, these campaigns contribute to security

- What are the future prospects for multi-channel campaigns in India? The future looks promising, with emerging technologies fostering more innovative campaigns and offering immense growth potential for payment providers.