AUTHOR: BABLI GUPTA

DATE: 04/01/24

Introduction

In the dynamic landscape of digital payments, ensuring a seamless and swift transaction experience is paramount. This has led payment providers in India to focus extensively on response rate optimization (RRO). In this article, we delve into the nuances of RRO, its challenges, strategies for improvement, and the significance it holds for the payment industry in India.

Understanding Response Rate Optimization

Response rate optimization is the process of enhancing the speed and efficiency of payment transactions. It involves analyzing and optimizing various elements within the payment ecosystem to ensure a prompt response to user-initiated actions. Key metrics for measuring response rates include transaction speed, success rates, and error resolution times.

Challenges Faced by Payment Providers in India

India’s diverse landscape poses unique challenges for payment providers Connectivity issues, a multitude of payment methods, and stringent regulatory requirements can impede the seamless flow of transactions. Overcoming these challenges is crucial for achieving optimal response rates.

Why Response Rate Matters in the Payment Industry

The speed at which a payment provider responds directly impacts user experience and influences customer trust. In a market where competition is fierce, a delayed or inefficient payment process can lead to customer dissatisfaction and, ultimately, a loss of business.

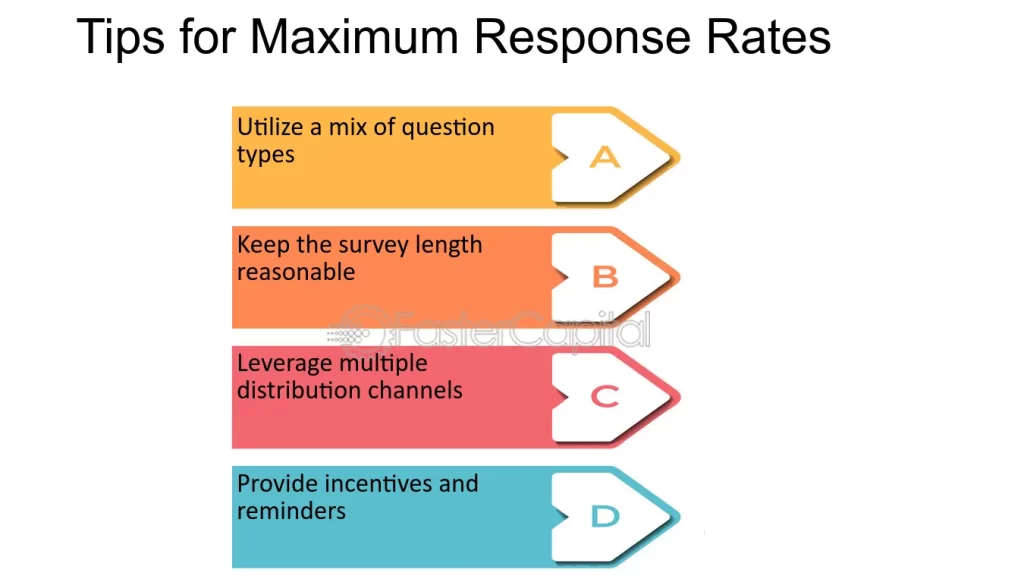

Strategies for Improving Response Rates

To combat challenges and enhance response rates, payment providers must invest in infrastructure, streamline payment processes[1], and strictly adhere to regulatory standards. Payment Provider Response Rate Optimization in India The implementation of these strategies ensures a smoother transaction experience for users.

Case Studies of Successful Response Rate Optimization

Examining real-world examples of payment service providers[2] in India that have successfully optimized response rates provides valuable insights. By understanding their strategies and outcomes, other providers can adapt and implement similar practices.

Technological Innovations Driving RRO

The integration of artificial intelligence (AI) and machine learning (ML) applications has revolutionized RRO. Real-time transaction monitoring, predictive analytics, and automated issue resolution contribute to faster and more reliable payment processing explained[3]

User-Centric Approach to Response Rate Optimization

Understanding user behavior is paramount to optimizing response rates[4] Payment Provider Response Rate Optimization in India Tailoring solutions to meet user expectations, providing personalized experiences, and addressing pain points contribute to a user-centric approach that positively influences response rates.

Collaboration and Partnerships in the Payment Ecosystem

Payment providers can benefit from collaborating with banks, financial institutions, and technology companies. Such partnerships enable the development of innovative solutions and foster a collaborative ecosystem that supports response rate optimization.

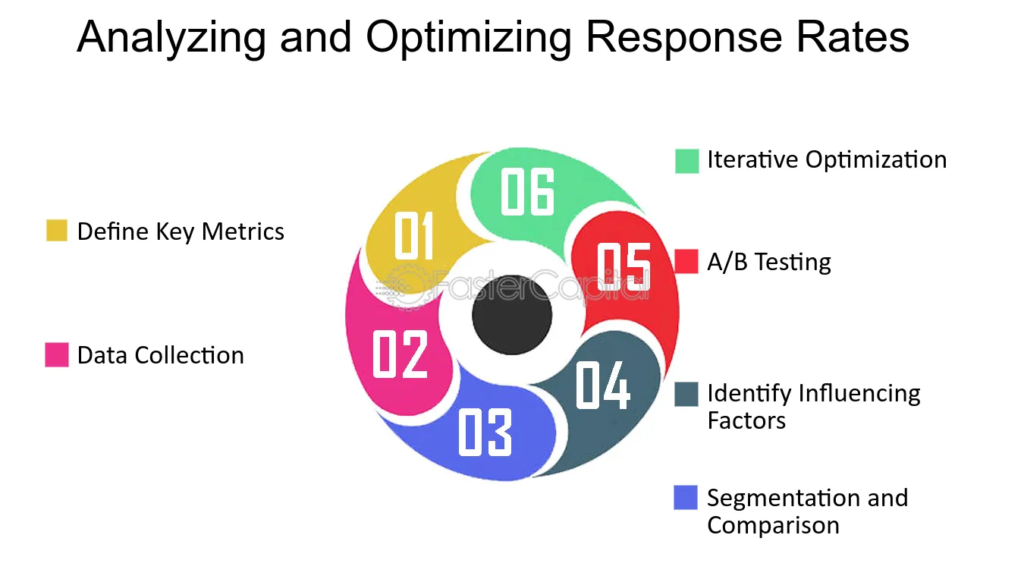

Measuring and Analyzing Response Rate Data

Utilizing advanced analytics tools allows payment providers to measure and analyze response rate data. Data-driven decision-making ensures that strategies are refined based on real-time insights, leading to continuous improvement.

Future Trends in Response Rate Optimization

The future of response rate optimization[5] lies in emerging technologies and anticipated changes in the regulatory landscape. Staying abreast of these trends is crucial for payment providers to remain competitive and responsive to evolving user needs.

Challenges and Solutions in Implementation

Implementing response rate optimization strategies may face resistance to change within organizations. Developing a phased implementation strategy, addressing concerns, and showcasing the long-term benefits can overcome these challenges.

Educating Stakeholders on the Importance of RRO

Internal and external communication strategies are vital in educating stakeholders about the importance of RRO [4]. Building awareness among users and partners fosters a collaborative environment focused on optimizing response rates.

Global Comparison of Response Rate Practices

Contrasting response rate optimization approaches in other countries provides a broader perspective. Learning from international markets and adopting successful practices can further enhance the effectiveness of RRO in the Indian context.

Conclusion

In conclusion, payment provider Response Rate Optimization is a critical aspect of ensuring a seamless and efficient transaction experience. By understanding the challenges, implementing innovative strategies, and prioritizing user-centric approaches, payment providers in India can elevate their response rates and, consequently, their overall service quality.

FAQs

- How does response rate optimization impact user satisfaction?

- Response rate optimization directly influences the speed and efficiency of payment transactions, contributing to a positive user experience.

- What role do emerging technologies play in RRO?

- Emerging technologies like AI and machine learning are integral to automating processes and enhancing response rates.

- How can payment providers overcome connectivity issues in India?

- Payment providers can invest in robust infrastructure and collaborate with telecom providers to address connectivity challenges.

- Why is a user-centric approach crucial to optimizing response rates?

- Understanding user behavior allows payment providers to tailor solutions, providing personalized experiences that positively impact response rates.

- How can organizations educate stakeholders about the importance of RRO?

- Effective internal and external communication strategies are key to building awareness and educating stakeholders about the significance of RRO.