AUTHOR: AYAKA SHAIKH

DATE:01/01/2024

Introduction

In today’s digital era, the term PSP or Payment Service Provider, has become increasingly common But have you ever heard about high-risk PSPs? These are specialized entities that cater to businesses operating in riskier industries or those with elevated transaction volumes. Let’s dive deeper into understanding this realm.High Risk PSP Volume Purchase Benefits in India.

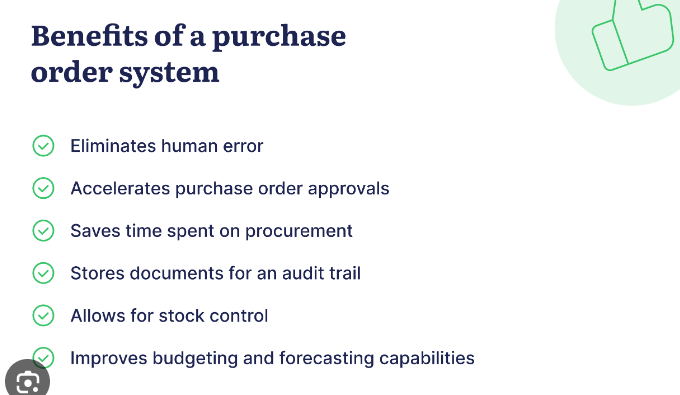

Importance of Volume Purchase Benefits

When businesses scale up, the need for efficient and cost-effective payment solutions becomes paramount. Volume purchase benefits aren’t just about saving money; they’re about optimizing operations, ensuring liquidity, and fostering growth. So, why do businesses gravitate towards high-volume transactions? Let’s explore High Risk PSP Volume Purchase benefits in India.

Challenges in Traditional PSPs

Traditional high PSPs have their merits, but they come with limitations. From stringent regulations to hefty transaction fees, businesses often find themselves constrained. Imagine running a marathon with weights tied to your ankles; that’s how some businesses feel with conventional PSPs.

Why India is a Focal Point

India, with its burgeoning e-commerce landscape and regulatory reforms, is emerging as a hotspot for high-risk PSPs. The market potential coupled with a proactive regulatory environment makes it an attractive destination for businesses seeking to expand their horizons.

Key Features of High-Risk PSP in India

Security reigns supreme in the realm of payments. High-risk PSPs[1] in India offer robust security protocols tailored to meet the unique needs of businesses. Moreover, their flexible transaction models accommodate varying business requirements, ensuring seamless operations.

Case Studies: Success Stories in India

Several businesses in India have reaped the benefits of partnering with high-risk PSPs. merchant[2] From startups to established enterprises, these success stories underscore the transformative impact of choosing the right payment service provider.

How to Choose the Right High-Risk PSP

Selecting the right high-risk PSP payment processing[3] can be daunting. However, by evaluating security measures, comparing transaction costs, and understanding your business needs, you can make an informed decision that propels your business forward.

Future Trends and Predictions

As advancements in technology persist, payment mechanisms also undergo transformative changes From blockchain to AI-driven solutions, the future of high-risk PSPs in India looks promising. Market predictions suggest a surge in adoption, paving Benefits in India[4] the way for innovative solutions tailored for businesses

Navigating Payment Solutions in India:

In the intricate landscape of digital transactions, India stands out as a dynamic market with immense potential. The country’s shift towards a digital economy, coupled with regulatory reforms, has paved the way for specialized payment solutions, particularly high-risk PSPs. But what sets these entities apart, and why should Volume Purchase[5] businesses consider them? Let’s delve further.

Understanding the Unique Needs of Businesses

Every business is unique, with its challenges, opportunities, and aspirations. While traditional payment solutions may suffice for some, others require specialized services tailored to their specific needs. High-risk PSPs understand this dynamic, offering bespoke solutions designed to navigate the complexities of industries deemed riskier or those with high transaction volumes.

The Regulatory Landscape:

Regulations play a pivotal role in shaping the payment ecosystem. In India, regulatory bodies have adopted a balanced approach, fostering innovation while safeguarding consumer interests. High-risk PSPs operating in this environment adhere to stringent guidelines, ensuring compliance while enabling businesses to thrive.

The Evolution of Payment Technologies

The era where cash held dominion is now a thing of the past. Today, technology drives payment solutions, with innovations such as mobile wallets, UPI, and contactless payments gaining traction. High-risk PSPs in India leverage these technologies, offering seamless, secure, and efficient payment solutions that resonate with modern-day businesses and consumers alike.

The Cornerstone of High-Risk PSPs

Trust forms the bedrock of any successful business relationship. High-risk PSPs in India prioritize trust, fostering transparent, ethical, and collaborative partnerships with businesses. By prioritizing customer-centric approaches, these entities cultivate long-term relationships, driving mutual growth and success.

Harnessing Data: The Power of Insights

Data holds the key to unlocking growth opportunities. High-risk PSPs in India harness data analytics, providing businesses with actionable insights to optimize operations, mitigate risks, and capitalize on emerging trends. By leveraging data-driven strategies, these entities empower businesses to make informed decisions, driving efficiency and profitability.

The Road Ahead: Embracing Innovation

As we navigate the future, innovation remains paramount. High-risk PSPs in India are at the forefront of embracing emerging technologies, from blockchain to artificial intelligence, to deliver unparalleled payment solutions. By continuously evolving and adapting to changing landscapes, these entities remain poised to shape the future of payments in India and beyond

Conclusion

Navigating the world of high-risk PSPs in India requires diligence, research, and a keen understanding of your business needs. By leveraging volume purchase benefits and harnessing the capabilities of specialized PSPs, businesses can unlock growth opportunities and streamline operations.

FAQs

- What is a High-Risk PSP?

- A high-risk PSP caters to businesses in riskier industries or those with elevated transaction volumes, offering tailored solutions to meet specific needs.

- Why are Volume Purchase Benefits Essential?

- Volume purchase benefits optimize operations, ensure liquidity, and foster growth, making them indispensable for scaling businesses.

- How do High-Risk PSPs in India Differ from Traditional PSPs?

- High-risk PSPs in India offer robust security protocols, flexible transaction models, and tailored solutions catering to specific business requirements.

- What Factors Should Businesses Consider When Choosing a High-Risk PSP?

- Businesses should evaluate security measures, compare transaction costs, and understand their unique requirements when selecting a high-risk PSP.

- What Does the Future Hold for High-Risk PSPs in India?

- The future looks promising, with evolving technologies and market predictions suggesting increased adoption and innovative solutions tailored for businesses