AUTHOR : SELENA GIL

DATE : 1/1/2024

The modern shopping landscape in India has witnessed a surge in economical shopping clubs offering discounts, memberships, and exclusive deals to consumers. Behind the scenes, these clubs rely heavily on high-risk payment service providers (PSPs) to manage their transactions efficiently.

Introduction

In the realm of e-commerce, the integration of payment solutions holds importance. Understanding the dynamics of payment service providers (PSPs) within the context of India’s economic shopping clubs is crucial. This article delves into the challenges and advantages of such PSPs in this specific market.

Understanding High-Risk PSPs

PSPs serve as a link between merchants and financial institutions for online transactions. High-risk PSPs specifically cater to industries prone to increased financial risks, such as online gaming, adult entertainment, and discount shopping clubs.

Types of High-Risk PSPs

There are various types of PSPs, ranging from traditional banks offering merchant accounts to PSPs focusing solely on industries.

Economical Shopping Clubs in India: A Brief Overview

In India, shopping clubs have gained immense popularity, providing cost-effective shopping options to a vast consumer base. These clubs often rely on memberships and bulk buying to offer significant discounts to their customers.

Importance of High-Risk PSPs for Shopping Clubs

For these clubs to thrive, having a reliable and efficient high-risk PSP paymnet[1] crucial. However, operating in India’s market presents unique challenges for such service providers.

Challenges Faced by High-Risk PSPs in India

Regulatory Hurdles

India’s financial regulations[2] pose significant challenges for high-risk PSPs requiring compliance with norms and leading to operational complexities.

Security Concerns

With the increasing frequency of cyber threats and fraudulent activities, maintaining robust security measures becomes imperative for high-risk PSPs merchant account[3] operating in India.

Factors Influencing High-Risk PSP Selection

When shopping clubs in India choose a PSP, several factors come into play.

Cost-Effectiveness

Balancing service charges with the club’s financial viability is crucial for choosing a PSP.

Security Protocols

Ensuring secure transactions for both the club and its customers is paramount.

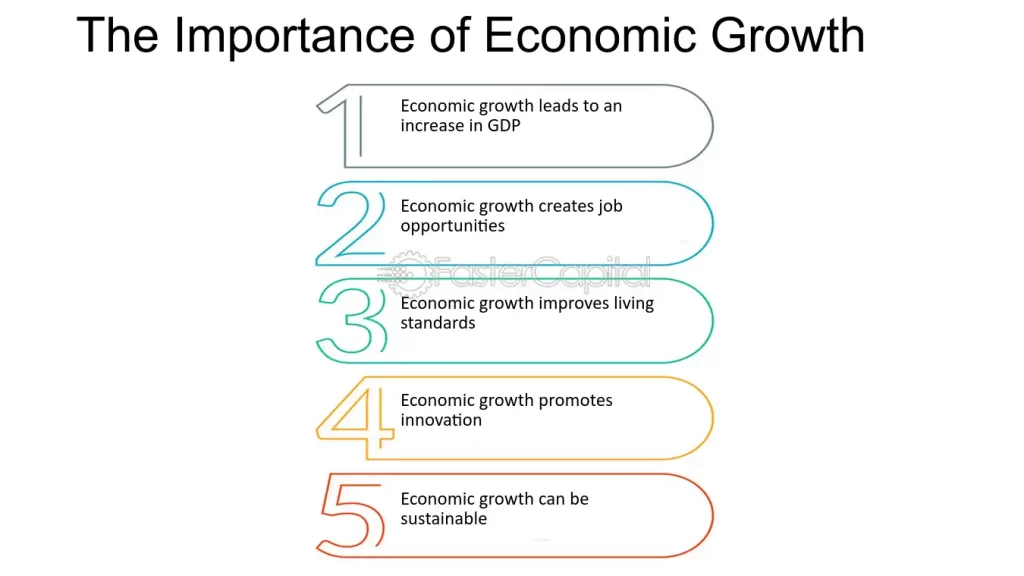

Role of High-Risk PSPs in Economic Growth

High-risk PSPs play a significant role in fostering economic growth, especially in developing markets like India.

Support for Small Businesses

By providing payment solutions for small businesses within these clubs, high-risk PSPs contribute to their growth and sustainability.

Facilitating International Transactions

Enabling seamless international transactions empowers Indian shopping clubs to access a global consumer base.

Adaptability and Innovation in High-Risk PSPs

To thrive in India’s dynamic market, high-risk PSPs must adapt and innovate their services.

Technological Advancements

Incorporating cutting-edge technologies like AI and blockchain enhances security and transaction efficiency.

Tailored Solutions for India’s Market

Customizing services to align with the Indian market’s preferences and needs is essential for PSPs’ success.

Future Prospects and Trends

Emerging Technologies

The future of high-risk PSPs in India lies in embracing innovative technologies to address evolving challenges.

Market Predictions

Experts foresee a continued growth trajectory for high-risk PSPs in India, driven by technological advancements and market demand.

Exploring High-Risk PSPs in India

The Indian Market Dynamics

India’s e-commerce sector has witnessed an exponential surge, particularly with the rise of economical shopping[4] clubs. These clubs, relying on subscription-based models and recurring payments, face unique challenges in the payment processing realm.

Unique Challenges Faced by Shopping Clubs

Economical shopping clubs inherently operate on memberships and recurrent transactions, which can be categorized as higher risk due to potential chargebacks and fraud. This necessitates specialized payment solutions tailored to their business models.

The Role of High-Risk PSPs

Enterprises in India[5] are increasingly turning to high-risk payment service providers to address these challenges. These PSPs offer customized solutions equipped to handle the nuances of subscription-based businesses, fortifying the security and risks associated with such transactions.

Market Trends and Evolution

In recent years, the Indian market has seen the emergence of specialized, high-risk PSPs focusing on catering to economical shopping clubs. These providers offer a range of tools and technologies to streamline payments, reduce fraud, and enhance the user experience within this niche market.

Regulatory Landscape and Compliance

Operating within India’s regulatory framework requires high-risk PSPs to adhere to stringent standards to ensure data security, compliance with payment regulations, and protection of consumers’ financial interests.

Mitigating Risks and Optimizing Operations

Successfully navigating the high-risk landscap involves implementing robust risk management strategies and leveraging the expertise of high-risk PSPs. By doing so, shopping clubs can streamline operations, enhance customer trust, and safeguard their financial stability.

Conclusion

In conclusion, high-risk PSPs play a pivotal role in sustaining the growth of economic shopping clubs in India, despite facing regulatory and security challenges. With a focus on innovation and adaptation, these PSPs are poised for substantial growth in the country’s evolving market.

FAQs

- Are all PSPs considered high-risk in India?

- No, PSPs serving various industries are not categorized as high-risk; it depends on the industry they cater to.

- What security measures do high-risk PSPs employ in India?

- High-risk PSPs implement robust encryption, tokenization, and fraud detection systems to ensure secure transactions.

- How do high-risk PSPs benefit economic shopping clubs in India?

- They provide efficient payment solutions, enabling discounts, memberships, and international transactions, boosting the clubs’ growth.

- Can high-risk PSPs operate without adhering to India’s regulatory norms?

- No, compliance with India’s financial regulations is mandatory for all PSPs operating in the country.

- What role do technological advancements play in the future of high-risk PSPs in India?

- Technological advancements enhance security measures and transaction efficiency, driving the future growth of high-risk PSPs.