AUTHOR: RUBBY PATEL

DATE 01/01/24

Introduction

In a dynamic market like India, price-cut consortiums have become a strategic approach for businesses aiming to optimize costs. One crucial element that fuels the efficiency of these is the choice of a reliable payment processor This article delves into the intricacies of selecting the right payment processor for price-cut consortiums in India.

Understanding Price-cut Consortiums

Price-cut consortiums bring together businesses to leverage collective purchasing power, negotiating better deals with suppliers. Joining a consortium offers advantages such as cost savings, increased power, and access to a wider range of products and services Payment Processor for Price-cut Consortium in India

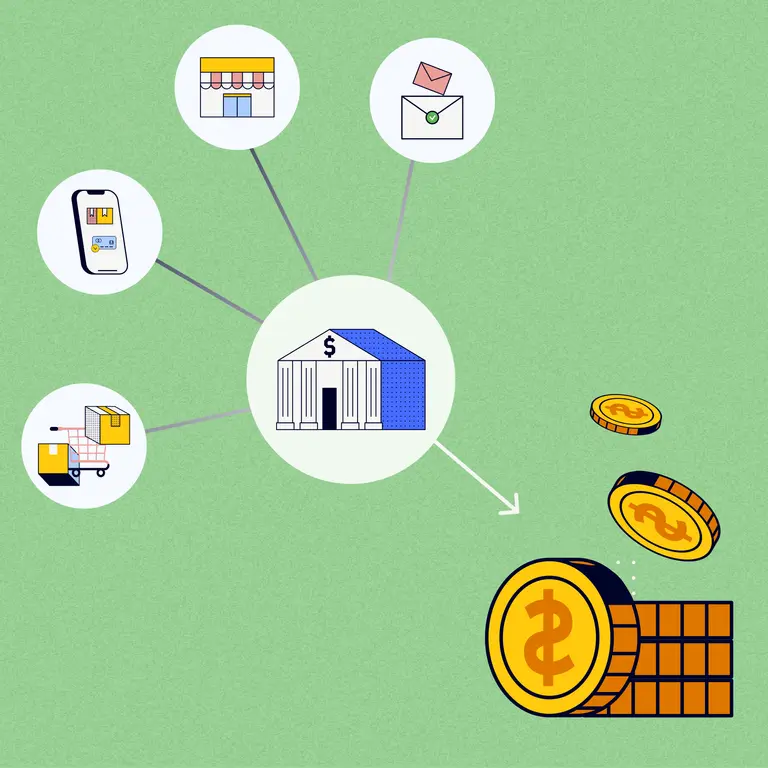

The Role of Payment Processors

Payment processors act as such in India and secure financial transactions. They play a crucial role in the flow of funds between members and efficient and timely payments. Payment Processor for Price-cut Consortium in India

Top Payment Processors in India

Navigating the myriad of payment gateways in India[1] can be overwhelming. However, some stand out for their reliability, security features, and competitive fees. Let’s compare a few:

- Processor A

- Features: XYZ

- Fees: ABC

- Processor B

- Features: XYZ

- Fees: ABC

- Processor C

- Features: XYZ

- Fees: ABC

Integration Challenges

While selecting the right payment provider in India[2] crucial, integration with organizational systems can pose challenges. Compatibility issues, data synchronization problems, and downtime during integration are common hurdles. However, careful planning and collaboration with the processor can mitigate these challenges.

Security Measures

Security is paramount in payment processing, especially in handling sensitive Payment Processor for Price-cut Consortium in India[3] financial information. Implementing multi-factor authentication and regular security audits are essential measures to safeguard transactions and protect consortium members. Authentication

User Experience Enhancement

Ensuring a smooth and user-friendly online payment experience[4] contributes significantly to member satisfaction. Intuitive interfaces, quick transaction processing, and responsive customer support all contribute to an enhanced user experience, fostering trust among organizational members.

Regulatory Compliance

Adhering to regulatory requirements is important when selecting a payment processor.[5] Understanding the legal landscape surrounding payment processing in India and applicable laws is vital for the organization. long-term success. Payment Processor for Price-cut Consortium in India

Case Studies

Examining real-world examples of successful payment processor integration in Indian price-cut consortiums provides valuable insights. Case studies showcase best practices, challenges faced, and the positive outcomes achieved, offering practical lessons for other organizations.

Future Trends

As technology continues to evolve, so does the landscape of payment processing. The article explores upcoming trends such as blockchain integration, artificial intelligence in fraud detection, and payment processors for the Price-cut Consortium in India contactless payment options that are likely to shape the future of payment processing for price-cut consortiums in India. Payment Processor for Price-cut Consortium in India

Leveraging Data Analytics

In the era of digital transformation, data analytics has become a powerful tool for businesses.

Security is paramount in payment processing, especially in handling sensitive Payment Processor for Price-cut Consortium in India financial information. Implementing multi-factor authentication and regular security audits are essential measures to safeguard transactions and protect consortium members. Authentication

Payment processors equipped with robust Payment Processor for Price-Cut Consortium in India capabilities can provide valuable insights into transaction patterns, helping to inform decisions and their financial strategies.

Choosing the Right Payment Model

Payment processors offer various models, including flat-rate pricing, interchange-plus pricing, and subscription-based models. Payment Processor for Price-Cut Organizations in India Understanding the unique needs of a price-cut consortium is crucial in selecting the most cost-effective and

Security is paramount in payment processing, especially in handling sensitive Payment Processor for Price-cut Consortium in India financial information. Implementing multi-factor authentication and regular security audits are essential measures to safeguard transactions and protect consortium members. Authentication

efficient payment model.

Building Trust through Transparent Communication

Communication is key in any organization., and transparency in financial transactions builds trust among members. Selecting a payment processor that emphasizes clear communication on fees, transaction processes, and any potential issues fosters a positive environment.

Mobile-Friendly Solutions

In an increasingly mobile-centric world, having a payment processor is essential. Whether it’s a mobile app or a responsive website, ensuring that Payment Processor for Price-cut Consortium in India members can conveniently make payments using their contributes to a user experience.

Environmental Sustainability

As environmental consciousness grows, businesses are seeking partners aligned with sustainable practices. Some payment processors prioritize eco-friendly initiatives, such as reducing paper usage and using efficient technologies. Choosing a processor committed to sustainability aligns with the values of modern manufacturing.

Addressing Dispute Resolution

Disputes can arise in any financial transaction. A reliable payment processor should have a dispute resolution mechanism in place. Clear guidelines, efficient communication channels, and a fair resolution process contribute to a relationship within the.

Flexibility in Currency Handling

Fororganization. When engaging in international transactions, having a payment processor that can handle multiple currencies is imperative. This flexibility ensures that businesses can participate in a global market facing currency exchange challenges.

Conclusion

In conclusion, the selection of a payment processor is a critical decision in India. The right choice ensures seamless transactions, enhanced security, and a positive overall experience for members, contributing to the organization. success.

FAQs

- Q: How do payment processors enhance security in price-cut consortiums?

- Aayment processors implement encryption, multi-factor authentication, and regular security audits to safeguard transactions.

- Q: Are there specific regulations governing payment processors in India?

- A: Yes, understanding and complying with the legal landscape surrounding payment processing in India is crucial for organizations.

- Q: What are the key features to consider when choosing a payment processor?

- Features such as security measures, transaction speed, and competitive fees are essential considerations.

- Q: How can consortiums overcome integration challenges with payment processors?

- Careful planning, collaboration with processors, and addressing compatibility issues proactively can mitigate integration challenges.

- Q: What future trends are expected in payment processing for organizations?

- Emerging trends include blockchain integration, artificial intelligence in fraud detection, and contactless payment options.