AUTHOR: SELENA GIL

DATE : 1/1/2024

Introduction

Discount shopping alliances have revolutionized India’s retail landscape, offering consumers unparalleled access to discount deals and a diverse array of products and services. These alliances bring together multiple vendors under a single umbrella, enticing customers with attractive offers.

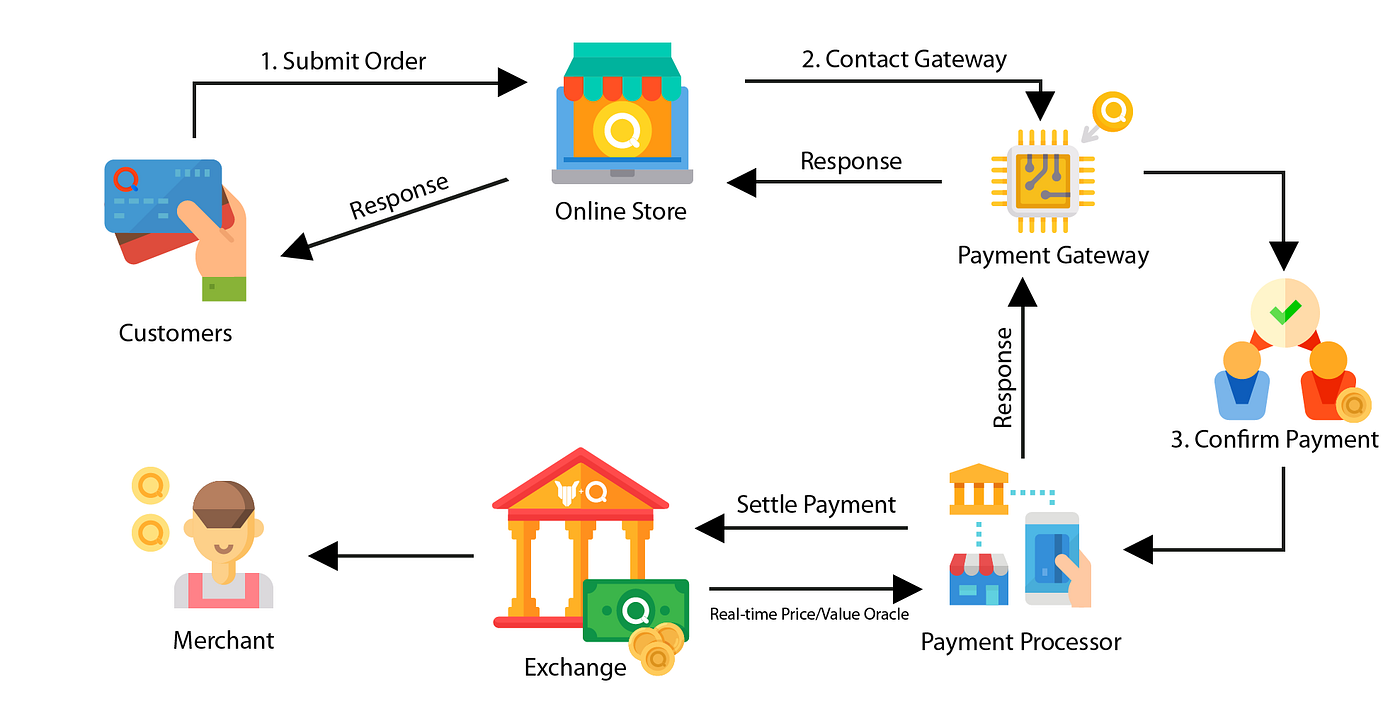

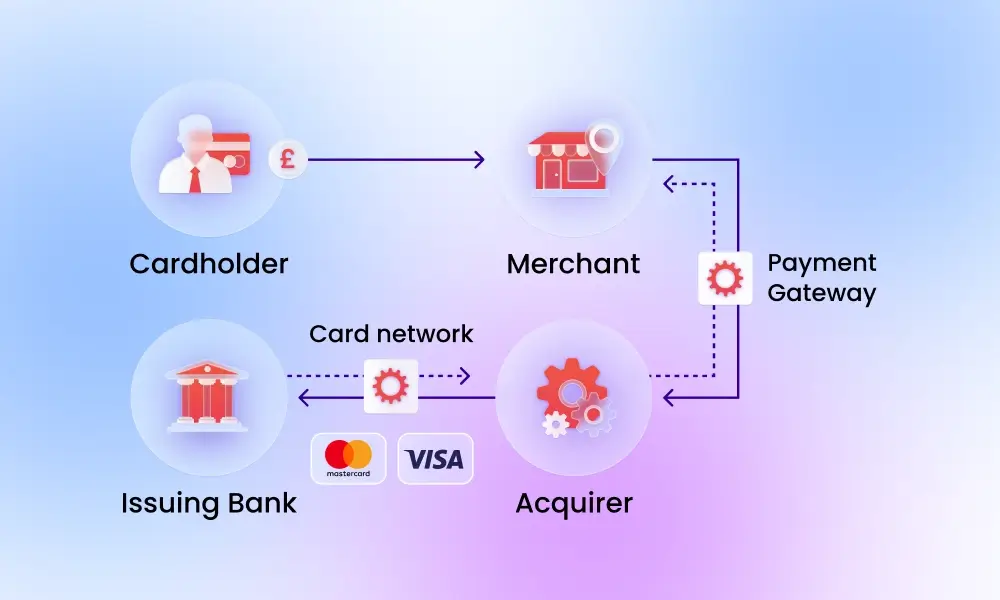

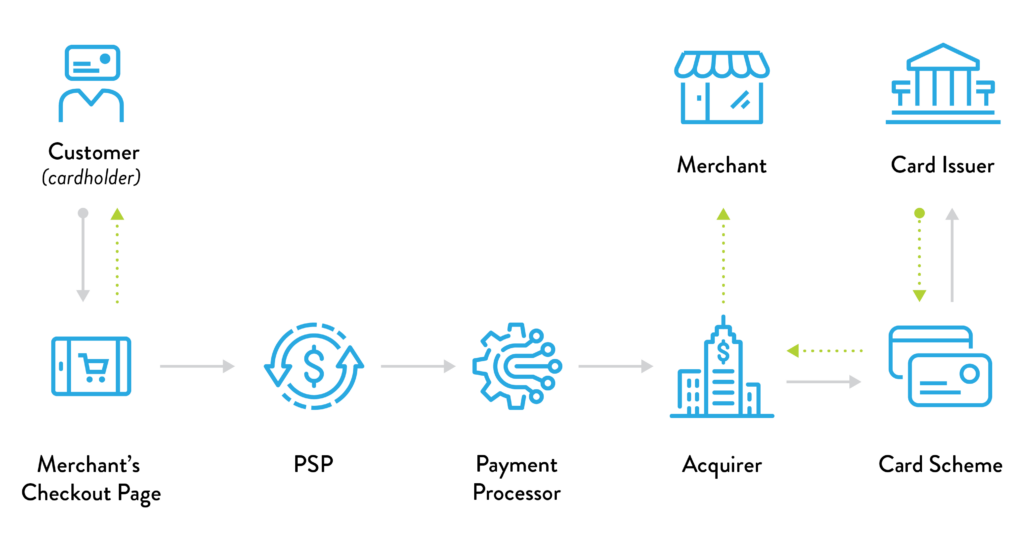

Importance of Payment Processors in India’s Discounted Shopping Sector

In this dynamic market, the role of payment processors is pivotal. They serve as the backbone, facilitating seamless transactions between consumers and vendors. The efficiency and reliability of these processors significantly impact the success of discounted shopping alliances.

Challenges Faced by Payment Processors in Discounted Shopping Alliances

However, navigating this domain isn’t without hurdles. Payment processors encounter challenges such as UPI payment providers security concerns, diverse payment preferences, and technological complexities.

Key Features of Ideal Payment Processors for Discounted Shopping Alliances

The ideal payment processor for discounted shopping alliances in India must offer versatility, robust security measures, compatibility across various platforms, and swift transaction processing.

Popular Payment Processors in India’s Discounted Shopping Sector

Multipal payment gateway[1] processors dominate this sector, each offering unique advantages. From established entities to innovative startups, the market boasts diverse options catering to varying business needs.

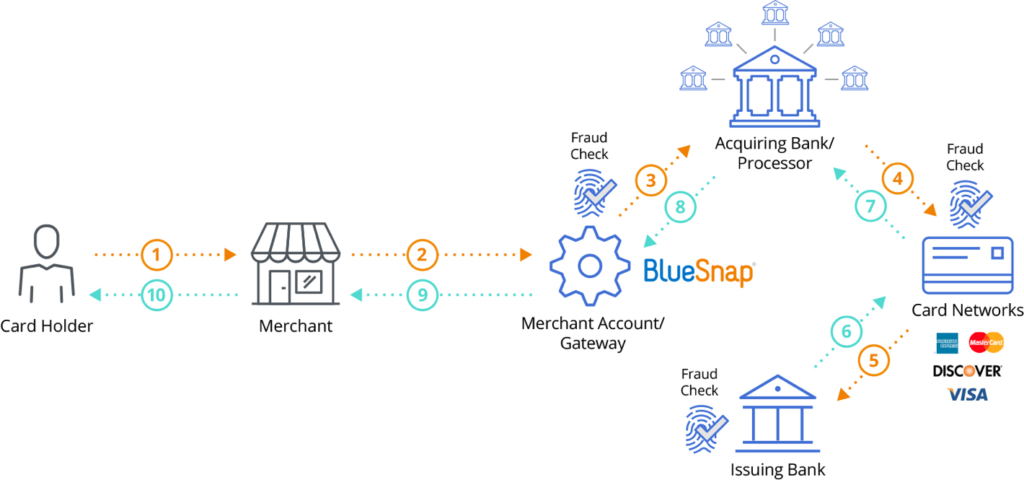

Security Measures Employed by Payment Processors

Security remains a paramount concern in online transactions. Top-tier payment processors gateway[2] deploy advanced encryption, fraud detection, and authentication protocols to ensure customer data safety.

The Role of Payment Processors in Customer Experience

The user experience is another focal point. Efficient processors[3] streamline the checkout process, enhancing user satisfaction and driving customer loyalty.

Integration and User-Friendliness of Payment Processors

Integration ease with different platforms and user-friendly interfaces significantly impacts the adoption rate. Payment processors need to be easily integrated into existing systems and offer a smooth user experience.

Successful Utilization of Payment Processors in Discounted Shopping Alliances

Examining successful case studies sheds light on how adeptly implemented payment processors[4] can fuel the growth and success of discounted shopping alliances.

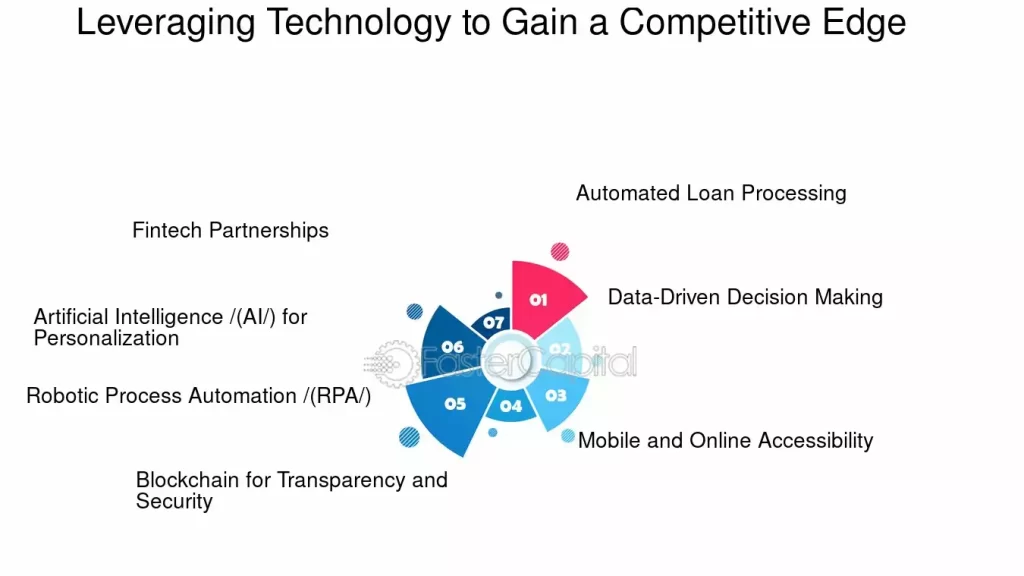

Future Trends in Payment Processing for Discounted Shopping Alliances

The future holds exciting prospects with advancements in digital payment[5] technologies like contactless payments, AI-driven fraud prevention, and enhanced personalization.

Impact of Payment Processors on Business Growth

Efficient payment processing directly influences revenue and business expansion strategies. It fosters trust among consumers and merchants alike, propelling growth.

Leveraging Payment Processors for Competitive Advantage

Differentiating factors among payment processors, including transaction fees, reliability, and additional services, can serve as a competitive advantage for alliances and their associated vendors.

Ensuring Regulatory Compliance in Payment Processing

Adherence to evolving regulatory standards is crucial. Payment processors must continually update their practices to comply with legal frameworks.

The Evolution of Payment Processors in India’s Discounted Shopping Sector

Reflecting on the evolution of payment processors showcases the rapid advancements and transformative impact on the shopping landscape.

Are payment processors secure for online transactions in discounted shopping alliances?

Absolutely. Payment processors employ robust security measures like encryption, tokenization, and multi-factor authentication to safeguard sensitive information. These technologies ensure that transactions within discounted shopping alliances are secure, offering customers peace of mind while making purchases.

How do payment processors contribute to customer satisfaction?

Payment processors streamline the checkout process, making it quicker and hassle-free. By offering various payment options and ensuring transaction reliability, they enhance the overall shopping experience, leading to increased customer satisfaction and retention.

What Trends Can We Expect in Payment Processing for Discounted Shopping Alliances?

The future of payment processing in discounted shopping alliances is exciting. Emerging trends include the rise of contactless payments, the integration of AI for fraud detection, and enhanced personalization in payment experiences, catering to evolving consumer preferences.

Can payment processors help businesses gain a competitive edge?

Absolutely. Payment processors offering lower transaction fees, faster processing times, innovative features, and exemplary customer service can become a significant competitive advantage for businesses within discounted shopping alliances.

What measures should payment processors take to ensure regulatory compliance?

Adherence to evolving regulatory standards is crucial. Payment processors must continuously update their protocols, comply with data protection laws, and stay abreast of changing regulations to ensure complete regulatory compliance.

Conclusion

In conclusion, payment processes empower businesses to scale their operations and maximize savings. While challenges like higher fees exist, the benefits far outweigh the risks for companies dealing with large transactions. are the unsung heroes powering the success of discounted shopping alliances in India, shaping consumer experiences, and fueling industry growth.

FAQs

- Are payment processors secure for online transactions in discounted shopping alliances?

- How do payment processors contribute to customer satisfaction?

- What trends can we expect in payment processing for discounted shopping alliances?

- Can payment processors help businesses gain a competitive edge?

- What measures should payment processors take to ensure regulatory compliance?