AUTHOR:AYAKA SHAIKH

DATE:01/01/2024

Introduction

Hey there, ever wondered how those massive group deals work so smoothly? Let’s dive into the intriguing[1] world of affordable purchase groups in India. These groups empower consumers[2] to buy products in bulk, slashing prices significantly[3].Payment Provider For Affordable Purchase Group in India.

Challenges in Group Purchases

But hold on a sec! It’s not all rainbows and sunshine. Trust issues and complicated payment processes often loom large, casting shadows on these fantastic deals[4].Payment Provider For Affordable Purchase[5] Group in India.

Trust Issues

Would you hand over your hard-earned money without trust? Neither would I! Building trust[1]is paramount, especially when pooling resources for group purchases.

Payment Complexities

And let’s not forget the headache of juggling multiple payments. One wrong move, and the entire group purchase could tumble like a house of cards!

The Need for Reliable Payment Providers

So, what’s the solution? Enter reliable payment[2] providers, the unsung heroes ensuring smooth sailing in the turbulent seas of group purchases.

Ensuring Secure Transactions

Safety first! A trustworthy payment provider guarantees secure transactions[3], protecting your precious rupees from prying eyes.

Building Trust Among Consumers

Remember that warm fuzzy feeling when things go right? A reliable payment provider fosters trust, encouraging[4] more people to jump aboard the group purchase train.

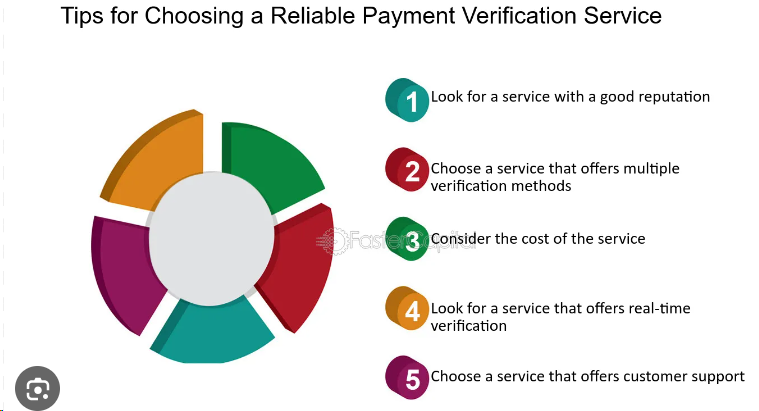

Criteria for Selecting a Payment Provider

Choosing the right payment provider is no walk in the park. Let’s break down the essential[5] criteria.

Cost-Effectiveness

Penny-pinching? Us too! A cost-effective payment provider offers value for money, ensuring you get bang for your buck.

User-Friendly Interface

Simplicity is bliss! An intuitive interface makes transactions a breeze, even for tech novices like Aunt Martha.

Integration Capabilities

Compatibility is key! A versatile payment provider seamlessly integrates with various platforms, ensuring hassle-free transactions.

Popular Payment Providers in India

Ready to meet the stars of the show? Here’s a rundown of India’s top payment providers.

Review of Top Providers

From giants like Paytm to emerging players, the Indian market offers a plethora of options tailored to your needs.

Features and Benefits

Whether it’s lightning-fast transactions or robust security measures, each provider brings unique features to the table. Choose wisely!

Benefits of Using a Payment Provider

Why should you care? Well, using a payment provider offers a slew of benefits.

Streamlined Transactions

Say goodbye to payment woes! A reliable provider ensures seamless transactions, saving you time and headaches.

Enhanced Security Measures

Safety first, remember? A top-notch payment provider employs advanced security measures, protecting your sensitive data from cyber threats.

Case Study: Successful Group Purchase Platforms

Enough theory, let’s get practical! Here are some real-life examples that nailed group purchases.

Real-Life Examples

From online marketplaces to niche platforms, these success stories offer valuable insights into the world of group purchases.

Key Takeaways

What can we learn? These case studies highlight the dos and don’ts of group purchases, guiding you towards success.

Future Trends in Payment Solutions

Brace yourselves! The future of payment solutions promises exciting developments.

Digital Advancements

From blockchain to AI, cutting-edge technologies are revolutionizing the payment landscape, offering unparalleled convenience.

Consumer Preferences

Adapt or perish! As consumer preferences evolve, payment providers must innovate, catering to ever-changing demands.

Diving Deeper into Payment Innovations

Hold onto your hats because the payment industry is buzzing with innovation! As technology continues to evolve, payment providers are stepping up their game, introducing groundbreaking features and services.

Mobile Wallet Integration

Ever dreamt of leaving your bulky wallet at home? With mobile wallet integration, your smartphone becomes your new best friend. Popular platforms like Paytm offer seamless mobile wallet solutions, enabling quick and convenient transactions on the go.

Cryptocurrency Adoption

Ready to jump on the crypto bandwagon? Some payment providers are embracing cryptocurrency, allowing users to make group purchases using digital currencies like Bitcoin and Ethereum. While still in its infancy, cryptocurrency offers a glimpse into the future of digital transactions.

Navigating Regulatory Challenges

But wait, it’s not all smooth sailing! Navigating regulatory challenges remains a significant hurdle for payment providers in India. From compliance issues to legal complexities, providers must tread carefully to avoid pitfalls.

Compliance with Regulations

Staying ahead of the curve? Compliance with local and international regulations is crucial for payment providers, ensuring transparency and accountability.

Legal Framework

Navigating the maze of legalities? A robust legal framework safeguards both consumers and providers, fostering trust and promoting responsible business practices.

Harnessing Data Analytics

Data is the new gold! Payment providers are leveraging advanced analytics tools to gain insights into consumer behavior, preferences, and trends.

Personalized User Experience

Ever wondered why you receive tailored recommendations? Data analytics enables payment providers to offer personalized user experiences, enhancing customer satisfaction and loyalty.

Predictive Analytics

Predicting the future? Advanced analytics tools employ predictive modeling techniques, forecasting market trends and helping providers stay one step ahead of the competition.

Conclusion

Phew! That was quite a journey, wasn’t it? From navigating trust issues to exploring payment providers, we’ve covered it all. Remember, choosing the right payment provider is crucial for a successful group purchase. So, do your homework and make informed decisions.

FAQs

- Why are payment providers essential for group purchases?

- Payment providers ensure secure and streamlined transactions, fostering trust among consumers.

- How do I choose the right payment provider?

- Consider factors like cost-effectiveness, user-friendly interface, and integration capabilities.

- What are the benefits of using a payment provider?

- Benefits include enhanced security measures, seamless transactions, and increased consumer trust.

- Can you recommend any popular payment providers in India?

- Sure! Providers like Paytm, Razorpay, and Instamojo are popular choices in India.

- What does the future hold for payment solutions?

- The future promises exciting advancements, including blockchain technology and AI-driven solutions.