AUTHOR : SELENA GIL

DATE : 30/12/2023

In today’s competitive business landscape, Special Pricing Associations (SPAs) in India play a crucial role in fostering collaboration and enhancing competitiveness among businesses. As these associations thrive on effective collaboration, one essential aspect they often overlook is seamless payment processing. This article aims to delve into the significance of payment providers for SPAs in India and explore the top providers catering to their specific needs.

Introduction

SPAs are collaborative networks established by businesses within specific industries or sectors to negotiate special prices for goods or services. These associations provide a platform for members to collectively enhance their purchasing power and gain competitive advantages. For businesses in India, SPAs offer a strategic advantage in acquiring goods or services at preferential rates, thereby boosting profitability.

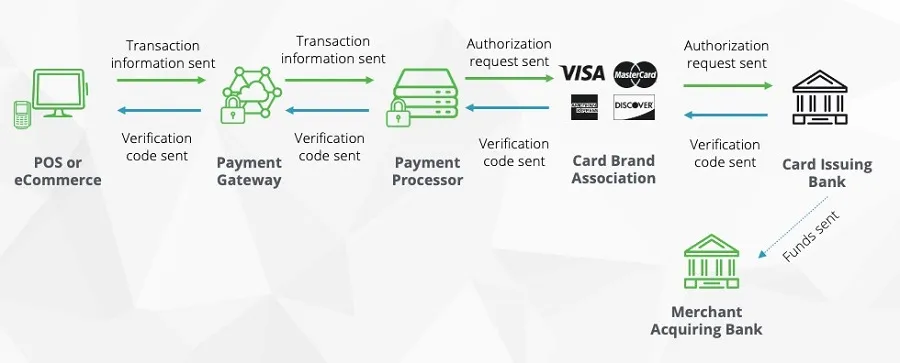

The Need for Payment Providers in SPAs

Despite the benefits SPAs offer, managing payments[1] within these associations poses challenges. The diverse nature of transactions, varying payment terms, and the Payment Providers for Special Pricing Associations in India need for secure and efficient processing create complexities. Here, payment services providers[2] step in, offering tailored solutions to streamline transactions, ensuring timely and secure payments among SPA members.

Criteria for Selecting Payment Providers

When selecting a payment provider, SPAs must consider various factors. Reliability, security measures, cost effectiveness, and the provider’s ability to accommodate diverse different payment methods[3] are critical aspects. The chosen provider should align with the specific needs and scale of the SPA, ensuring smooth financial operations.

Top Payment Providers for SPAs in India

Several payment providers[4] specialize in catering to the unique needs of SPAs in India. Companies like XYZ Payments, ABC Solutions, and PQR Pay offer comprehensive solutions tailored for SPA environments. These providers offer features such as multi-party transaction facilitation, transparent fee structures, and robust security measures.

Successful Implementation of Payment Providers

Real-life examples illustrate the effectiveness of payment providers for SPAs. Case studies showcasing how SPA members benefited from streamlined transactions, reduced processing times, and improved financial management paint a compelling picture of the positive impact these providers have on collaborative associations.

Integration Process and Support Offered

Integrating a payment provider[5] into SPA operations might seem like a hassle, but most providers offer seamless integration processes. Additionally, they provide ongoing support, training, and troubleshooting to ensure a smooth transition and continued efficient operations.

Security Measures and Compliance

Security is paramount in financial transactions. Payment providers adhere to stringent security standards and comply with regulatory requirements in India. Payment Providers for Special Pricing Associations in India These measures protect SPA members’ sensitive data and ensure a secure payment ecosystem.

Future Trends and Innovations in Payment Solutions

The payment landscape is continuously evolving. SPAs can anticipate innovations such as blockchain-based solutions, AI-driven payment processing, and enhanced customer experience tools to further streamline their payment processes.

Blockchain Integration for Enhanced Security

One of the most promising innovations in payment solutions is the integration of blockchain technology. Its decentralized nature and robust security features make it an ideal option for SPAs looking to fortify their payment systems. Blockchain ensures transparent, immutable, and secure transactions, reducing the risk of fraud and data breaches.

AI-Powered Payment Processing

Artificial intelligence (AI) is revolutionizing payment processing by offering predictive analytics and personalized customer experiences [3]. SPAs leveraging AI-powered solutions can streamline payment processes, predict transaction patterns, and enhance member experiences by providing tailored payment options.

Contactless and Mobile Payment Adoption

The global shift towards contactless payments has gained significant momentum, especially post-pandemic. SPAs can benefit from this trend by adopting contactless payment methods and optimizing mobile payment platforms. These options offer convenience and safety, catering to the preferences of modern consumers.

Enhanced Customer Experience Tools

Payment providers are increasingly focusing on enhancing the customer experience through intuitive interfaces and seamlesstransactions [5]. SPAs can leverage these tools to create a user-friendly payment environment, improving member satisfaction and loyalty within the association.

Conclusion

Payment providers play a pivotal role in the smooth financial operations of SPAs in India. Their solutions, robust security measures, and ongoing support contribute significantly to the efficiency and success of collaborative associations.

FAQs

- Are payment providers only beneficial for large SPAs? Payment providers offer solutions scalable to various SPA sizes, benefiting both small and large associations.

- Do payment providers support multiple currencies? Many payment providers offer multi-currency support, enabling transactions across different currencies.

- How do payment providers ensure data security? Providers adhere to strict encryption standards and compliance protocols to safeguard data.

- Can SPAs customize payment solutions as per their needs? Yes, payment providers often offer customizable solutions based on the SPA’s specific requirements.

- Are payment providers cost-effective for SPAs? While costs vary, providers often offer transparent fee structures, ensuring cost-effectiveness for SPAs.