AUTHOR : LISA WEBB

DATE : FEBRUARY 28, 2024

Introduction

In today’s fast-paced digital economy, the Payment Gateway plays a pivotal role in facilitating online transactions. As we delve into the Indian landscape, the adoption of downloadable payment apps has become increasingly prevalent, contributing to the nation’s push towards a more cashless economy.

Evolution of Payment Gateways

The journey of payment gateways has evolved from traditional barter systems to the digital era, where online transactions have become the norm. With the rise of e-commerce, payment gateways have adapted to provide secure and seamless transactions.

Payment Gateway in India

India, with its Digital India initiative, has witnessed a significant surge in the usage of payment gateways. The ease of transactions and the government push towards a digital economy have played a crucial role in this widespread adoption.

Popular Downloadable Payment Apps

Several downloadable payment apps have gained prominence in India, each offering unique features and functionalities. From mobile wallets to UPI-based apps, users have a plethora of options to choose from, making transactions [1] more convenient than ever.

Security Measures

Ensuring the security [2] of online transactions is paramount. Downloadable payment apps employ robust security measures, including SSL encryption and two-factor authentication, to safeguard users’ sensitive information.

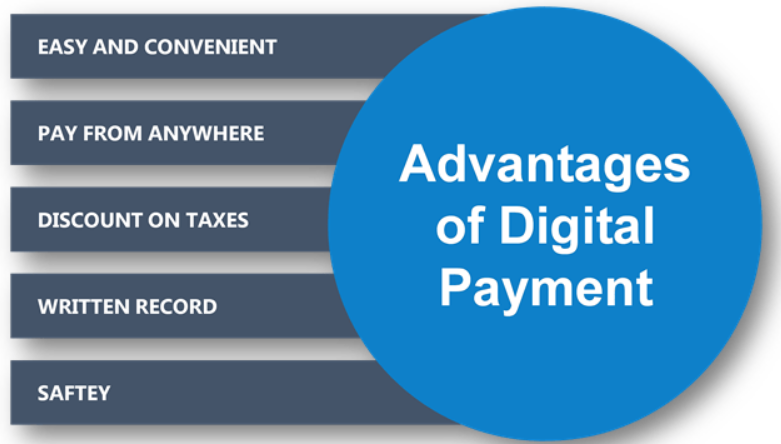

Benefits of Downloadable Payment Apps

Payment Gateway: Downloadable Apps In India, The convenience and accessibility offered by downloadable payment apps have revolutionized the way we conduct transactions. These apps seamlessly integrate with various platforms, providing [3] users with a hassle-free payment experience.

Challenges Faced by Users

While downloadable payment apps offer numerous advantages, users face challenges such as technical issues and concerns about the security of their financial information. Addressing [4] these issues is crucial for ensuring widespread trust and adoption.

Comparison with Traditional Payment Methods

Downloadable payment apps stand out for their speed and efficiency compared to traditional payment methods. Additionally, they often prove to be more cost-effective [5], making them an attractive choice for businesses and consumers alike.

Regulatory Framework

Government regulations play a vital role in shaping the landscape of payment gateways. Understanding and complying with these regulations is essential for businesses operating in the digital payment space.

Future Trends in Payment Gateways

The future of payment gateways in India is promising, with anticipated integration with emerging technologies. Enhanced user experiences, coupled with innovative features, are set to define the next generation of downloadable payment apps.

Case Studies

Examining successful businesses that have embraced downloadable payment apps provides valuable insights into the benefits and challenges associated with these platforms. Learning from these case studies can guide other businesses in their adoption journey.

User Reviews and Feedback

Payment Gateway: Downloadable Apps In India, gauging user satisfaction through reviews and feedback is crucial for continuously improving downloadable payment apps. Addressing common concerns and implementing user suggestions contributes to the evolution of these platforms.

Tips for Choosing a Payment Gateway

For businesses and individuals looking to choose a payment gateway, considering factors such as reliability, customization options, and integration capabilities is essential. Tailoring the choice to specific needs ensures a seamless payment experience.

Impact on Small Businesses

Downloadable payment apps empower small businesses by providing them with a platform to conduct transactions efficiently. This not only contributes to financial inclusion but also boosts the growth of local entrepreneurs.

Conclusion

The landscape of downloadable payment apps in India is dynamic and promising. As we witness the ongoing evolution of payment gateways, their impact on the digital economy cannot be overstated. The convenience, security, and accessibility offered by these apps position them as key players in shaping the future of financial transactions in the country.

FAQs

- Are downloadable payment apps safe to use?

- Yes, most downloadable payment apps employ advanced security measures like SSL encryption and two-factor authentication to ensure the safety of transactions.

- How do downloadable payment apps benefit small businesses?

- Downloadable payment apps empower small businesses by providing efficient transaction platforms, contributing to financial inclusion and growth.

- ctive than traditional methods?

- Consider reliability, customization options, and integration capabilities when choosing a payment gateway that aligns with your specific needs.

- What is the future of payment gateways in India?

- The future is promising, with anticipated integration with emerging technologies and a focus on enhancing user experiences in downloadable payment apps.