AUTHOR : BELLA

DATE : FEBRUARY 27, 2024

Introduction to Payment Gateways

In today’s digital age, payment gateways have become integral to the functioning of online transactions. These gateways facilitate the secure transfer of funds between buyers and sellers over the internet, ensuring smooth and hassle-free payments. In India, with the rapid growth of e-commerce and digital transactions, the role of payment gateway software has become even more pronounced.

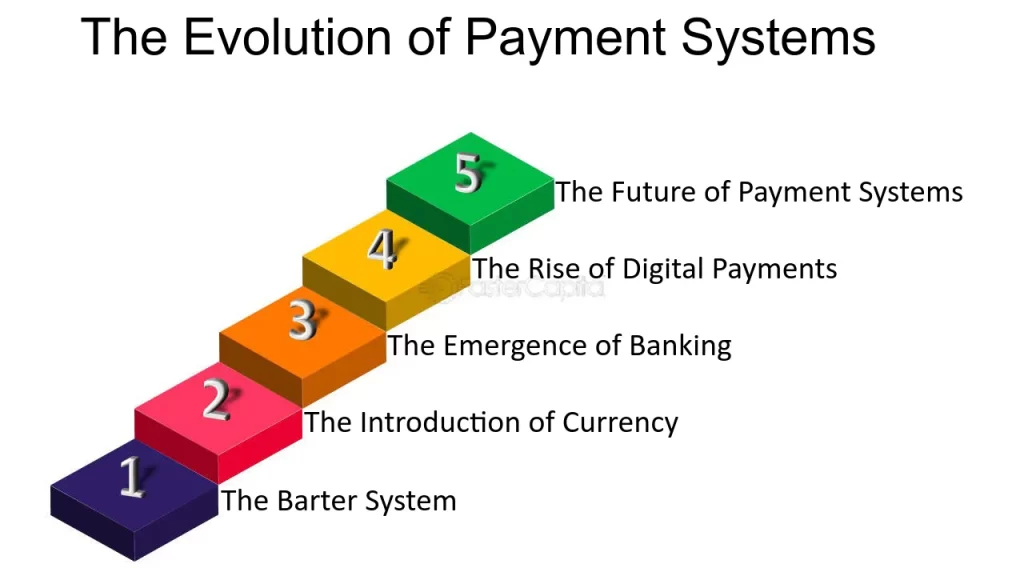

Evolution of Payment Gateway Software

The concept of payment gateways traces back to the early days of e-commerce, when businesses needed a reliable way to process online payments. Over the years, these gateways have evolved from basic transaction processing tools to sophisticated electronic payment systems capable of handling various forms of digital transactions.

Role of Payment Gateway Software in India

India has witnessed a significant surge in online shopping and digital payments in recent years. With millions of people now making purchases online, the demand for secure and efficient payment solutions has never been higher. Payment gateway software plays a crucial role in facilitating these transactions by providing a secure platform for processing payments.

Key Features of Payment Gateway Software

Payment gateway [1] software comes with a range of features designed to ensure the security and efficiency of online transactions. These include robust encryption methods, support for multiple payment methods, and seamless integration with websites and mobile apps.

Popular Payment Gateway Providers in India

In India, several payment gateway providers offer their services to businesses of all sizes. Some of the leading players in the market include Paytm, Razorpay, Instamojo, and CCAvenue. Each of these providers offers unique features and pricing plans, catering to the diverse needs of businesses [2].

Challenges and Solutions

Despite the numerous benefits of payment gateway software, businesses may face challenges such as security concerns and technical issues. However, these challenges can be addressed through the implementation of robust security [3] measures, regular system updates, and compliance with industry regulations.

Benefits for Businesses

For businesses, the adoption of payment gateway software offers several benefits, including streamlined transactions, expanded customer [4] reach, and enhanced credibility. By providing customers with a convenient and secure payment experience, businesses can increase sales and build trust with their audience.

Impact on Consumer Experience

From the consumer’s perspective, payment gateway software enhances the online shopping experience by offering convenience, accessibility, and peace of mind. With secure payment options and seamless checkout processes, customers are more likely to complete their purchases and return [5] for future transactions.

Future Trends in Payment Gateway Software

Looking ahead, the future of payment gateway software looks promising, with advancements in technology driving innovation in the industry. From mobile payments to contactless transactions, the landscape of digital payments is constantly evolving, offering new opportunities for businesses and consumers alike.

Case Studies

Several businesses in India have successfully implemented payment gateway software to improve their online payment processes. By studying these case studies, businesses can gain valuable insights into the best practices for implementing and optimizing payment gateway solutions.

Tips for Choosing the Right Payment Gateway Software

When selecting a payment gateway provider, businesses should consider factors such as security features, pricing, integration options, and customer support. By thoroughly evaluating their options and choosing a provider that meets their specific needs, businesses can ensure a smooth and seamless payment experience for their customers.

Integration with Other Software Solutions

Payment gateway software often integrates with other software solutions such as e-commerce platforms, accounting software, and customer relationship management systems. This integration enables businesses to streamline their operations and provide a seamless experience for both customers and employees.

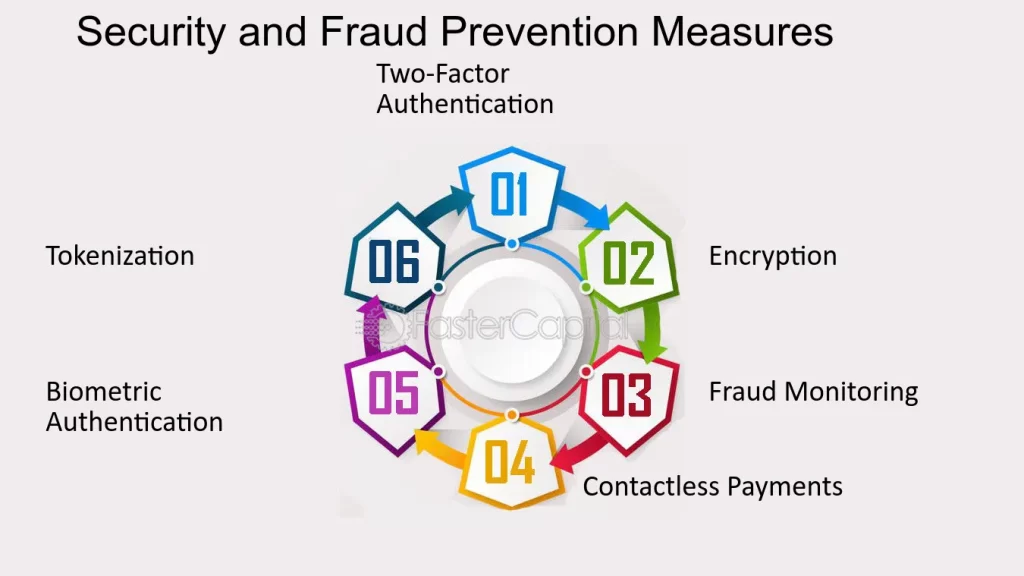

Security Measures and Fraud Prevention

Security is a top priority for businesses handling online payments. Payment gateway software employs various security measures, such as encryption, tokenization, and fraud detection algorithms, to protect against unauthorized transactions and data breaches.

Regulatory Landscape

In India, the digital payments industry is subject to various laws and regulations aimed at ensuring the security and integrity of online transactions. Businesses must stay informed about these regulations and ensure compliance to avoid legal issues and penalties.

Conclusion

In conclusion, payment gateway software plays a vital role in India’s digital economy by enabling secure and efficient online transactions. As e-commerce continues to thrive and evolve, businesses must prioritize the adoption of robust payment gateway solutions to meet the growing demands of consumers and stay ahead of the competition.

FAQs

- What is a payment gateway?

A payment gateway is a software application that facilitates online transactions by securely transferring funds between buyers and sellers. - How does payment gateway software enhance security?

Payment gateway software employs various security measures, such as encryption and fraud detection, to protect against unauthorized transactions and data breaches. - What are some popular payment gateway providers in India?

Some popular payment gateway providers in India include Paytm, Razorpay, Instamojo, and CCAvenue. - How can businesses benefit from using payment gateway software?

Businesses can benefit from using payment gateway software by streamlining transactions, expanding their customer base, and enhancing credibility. - What are the future trends in payment gateway software?

Future trends in payment gateway software include advancements in technology, such as mobile payments and contactless transactions, driving innovation in the industry.