AUTHOR : KIM FERNANDEZ

DATE : 27/02/2024

Introduction

A. Brief Overview of Payment Gateway Software

Payment gateway software acts as a bridge between the merchant’s website and also the financial institutions, ensuring the secure transfer of payment data. It is a fundamental component for businesses operating in the online space.

B. Importance of Payment Gateways in India

As India witnesses a surge in online transactions, the need for robust payment gateway software installations in India has become indispensable. From small businesses to large enterprises, everyone is embracing digital transactions, making payment gateway software a key enabler.

Popular Payment Gateway Software in India

A. Razorpay

Razorpay stands out as a popular choice for its user-friendly interface and comprehensive comprehensive features. It caters to businesses of all sizes, offering a seamless payment experience.

B. Instamojo

Instamojo is renowned for its simplicity and flexibility, making it a preferred choice not only for small businesses[1] and startups but also for those seeking a hassle-free installation process, emphasizing its user-friendly approach and broad appeal.

C. PayU

PayU stands out as a prominent player in the payment gateway[2] landscape, offering a wide range of features. Its notable versatility and compatibility make it a preferred and go-to option for businesses operating across diverse industries, showcasing its broad applicability.

Steps for Installing Payment Gateway Software

A. System Requirements

Before embarking on the installation journey, it’s imperative to thoroughly verify that your system aligns with the essential prerequisites. This encompasses not only server specifications but also software dependencies and network configurations, providing a comprehensive[3] understanding of the critical components essential for a successful implementation and ensuring a smooth and efficient integration process.

B. Selecting the Right Software

Choosing the right Payment Gateway Software Installations In India, software depends on your business needs, transaction volume, and the level of customization required. Evaluate the options thoroughly before making a decision[4].

C. Installation Process

Once the software is chosen, follow a step-by-step installation process provided by the vendor. This typically involves downloading the software [5] configuring settings, and also integrating it into your website.

IV. Integration with E-commerce Platforms

A. Shopify

For businesses utilizing Shopify as their e-commerce platform, the integration with payment gateway software is seamlessly streamlined. Most payment gateways provide dedicated plugins specifically designed for Shopify, simplifying the setup process and also enhancing the overall efficiency of the online transaction system.

B. WooCommerce

WooCommerce, renowned as a widely embraced WordPress plugin, not only effortlessly integrates with diverse payment gateways but also ensures a seamless transaction experience, making it an ideal choice for businesses seeking both flexibility and user-friendly payment processing on their websites. Ensure compatibility with your chosen gateway and also meticulously adhere to the plugin’s guidelines for a flawless installation process.

C. Magento

Magento, being a robust e-commerce solution, supports integration with multiple payment gateways. When selecting a gateway, it is essential to choose one that aligns with your business requirements and to meticulously follow Magento’s integration guidelines, ensuring a seamless and optimized payment processing experience for your online store.

V. Security Measures in Payment Gateway Installations

A. SSL Certificates

To ensure the utmost security of online transactions, possessing a valid SSL certificate is imperative, as it actively encrypts the data transmitted between the user and the server, thereby effectively safeguarding sensitive information and also bolstering the overall integrity of the transaction process.

B. PCI DSS Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is a non-negotiable aspect; therefore, it is crucial to ensure that the selected payment gateway software aligns seamlessly with and also adheres to these established security standards, providing an additional layer of assurance for secure and compliant online transactions.

C. Two-Factor Authentication

Incorporating two-step verification significantly fortifies security measures by introducing an additional tier of authentication. This robust process ensures that exclusive access to and management of payment gateway settings is granted solely to authorized individuals, enhancing overall transaction security.

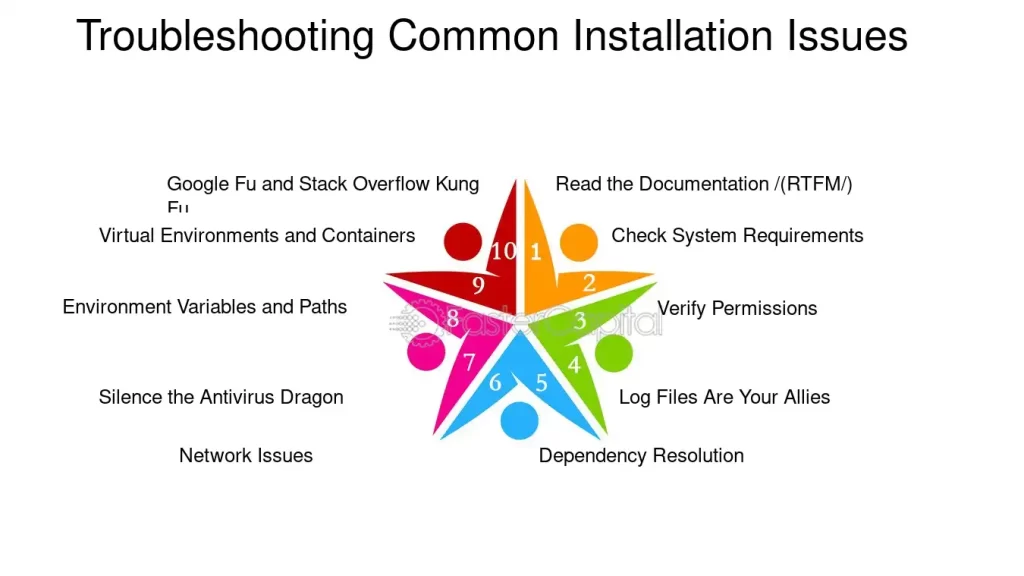

Troubleshooting Common Installation Issues

Connection Errors

Addressing connection issues promptly is essential for maintaining seamless operations. To identify and also resolve connection problems efficiently, businesses should thoroughly check server configurations, internet connectivity, and firewall settings, ensuring a swift and effective resolution to any encountered issues.

B. Compatibility Issues

Incompatibility with existing systems can potentially hinder a smooth installation process. Thus, it is imperative to diligently verify the compatibility of the selected payment gateway software with your website’s technology stack, ensuring seamless integration and optimal performance for a successful and trouble-free implementation.

Advantages of Using Payment Gateway Software

A. Enhanced Customer Experience

The integration of payment gateway software not only contributes to a seamless and secure online shopping experience but also significantly enhances customer trust and satisfaction, fostering a positive and reliable transaction environment.

Streamlined Transactions

Automated processes, coupled with real-time transaction processing, effectively streamline the payment flow, markedly diminishing the need for manual efforts and also minimizing the occurrence of errors throughout the entire transaction process.

Future Trends in Payment Gateway Software

Contactless Payments

With the escalating prominence of contactless transactions, payment gateways are actively evolving to seamlessly support NFC technology, thereby fostering faster and more convenient payments, aligning with the prevailing trend of modern and efficient transaction methods.

B. Cryptocurrency Integration

The integration of cryptocurrencies into payment gateways not only reflects the growing acceptance of digital currencies but also expands the range of options available for users, diversifying and enhancing the overall landscape of modern payment methods.

C. Artificial Intelligence

The seamless incorporation of artificial intelligence significantly elevates the capabilities of fraud detection and security measures, rendering payment gateway software not only smarter but also markedly more effective in safeguarding transactions with enhanced efficiency.

Case Studies

A. Successful Implementations

Explore case studies that delve into businesses successfully implementing payment gateway software, showcasing not only the positive impact on their operations but also the demonstrable improvements in customer satisfaction, providing valuable insights into the transformative potential of these solutions.

B. Impact on Businesses

Gain a comprehensive understanding of how the widespread adoption of payment gateway software has unequivocally and also positively influenced businesses, resulting in substantial increases in revenue and a notable enhancement of overall financial processes.

Best Practices for Payment Gateway Software Maintenance

A. Regular Updates

To maximize benefits, stay consistently updated with the latest versions of the payment gateway software, ensuring access to new features and also promptly integrating essential security patches for a secure and optimized transaction environment.

B. Monitoring Transactions

Regularly monitoring transactions for any anomalies or suspicious activities is crucial, ensuring the ongoing security and integrity of your payment gateway while proactively safeguarding against potential risks.

Conclusion

In conclusion, the installation of payment gateway software in India is not just a necessity but a strategic move for businesses navigating the digital landscape. Choosing the right software, ensuring security, and staying abreast of emerging trends are pivotal for successful implementations.

FAQs

- Is it necessary to have a payment gateway for my online business in India?

- Yes, having a payment gateway is crucial for secure and efficient online transactions.

- What payment gateway stands out as the optimal choice for small businesses in India?

- Instamojo is often recommended for its simplicity and suitability for small businesses.

- How often should I update my payment gateway software?

- Regular updates are recommended to ensure the latest features and security measures are in place.

- What steps can I take to enhance the security of my payment gateway?

- Implement SSL certificates, adhere to PCI DSS compliance, and use two-factor authentication for added security.

- Are there any upcoming trends in payment gateway software that businesses should be aware of?

- Yes, trends such as contactless payments, cryptocurrency integration, and artificial intelligence are shaping the future