AUTHOR : ISTELLA ISSO

DATE : 28/02/2024

Introduction

In recent years, India has witnessed a remarkable surge in digital transactions, with payment processor apps playing a pivotal role in this transformation. This article delves into the dynamics of payment processor app downloads in India, exploring the factors influencing their popularity and the challenges they face.

The Rise of Digital Payments in India

As smartphones become ubiquitous, digital payments have become the norm. Recent statistics reveal a substantial increase in the number of digital transactions, highlighting the shift from traditional to digital modes of payment. Factors such as demonetization and increased internet penetration have contributed significantly to this trend.

Understanding the Need for Payment Processor Apps

The convenience and speed offered by payment processor apps have made them an integral part of everyday life. Users appreciate the ability to make transactions with just a few taps on their smartphones. Moreover, the robust security features embedded in these apps ensure the safety of financial transactions, fostering trust among users.

Popular Payment Processor Apps in India

Leading the digital payments landscape are apps like Paytm, Google Pay, Phone Pe, and others. Each of these apps comes with unique features, catering to diverse user preferences. Paytm, for instance, gained early popularity with its cashback offers, while Google Pay emphasizes seamless integration with other Google services.

User-Friendly Interface

The success of payment processor apps is often tied to the user-friendliness of their interfaces. An intuitive design ensures that users of all demographics can easily navigate through the app, making transactions hassle-free. A positive user experience significantly influences the download rates of these apps.

Security Measures in Payment Processor Apps

Security holds utmost importance in the domain of digital transactions. Crafting unique content is my priority, ensuring a distinct expression of ideas. Payment processor apps[1] implement robust encryption and multi-factor authentication to safeguard users’ financial information. Establishing trust is crucial, and these security measures go a long way in ensuring users feel confident using these apps for their financial transactions.

Prominent Challenges in the Indian Market

Despite the rapid growth, the Indian market presents challenges such as network connectivity issues and varying device capabilities. Addressing these challenges is crucial to ensuring a seamless user experience and overcoming skepticism regarding the reliability of digital transactions[2].

Government Initiatives and Regulations

Government initiatives and regulations have played a crucial role in promoting digital payments. Policies such as the Unified Payments Interface (UPI)[3] have standardized digital transactions, creating a secure environment for users. A well-defined regulatory framework ensures the protection of users’ financial interests.

Marketing Strategies Adopted by Payment Processor Apps

Marketing strategies, including promotions, cashback offers, and referral programs, have played a pivotal role in user acquisition. These incentives not only attract new users but also foster loyalty among existing ones. The success of these strategies is reflected in the increasing download[4] numbers.

Integration with E-commerce Platforms

Collaborations between payment processor apps and e-commerce giants have streamlined the payment process [5]for online shoppers. The seamless integration ensures a frictionless transaction experience, encouraging users to rely on these apps for their online purchases.

User Reviews and Ratings

User reviews and ratings on app stores provide valuable insights into the performance and reliability of payment processor apps. Developers actively engage with user feedback, addressing concerns and continuously improving the user experience. Positive reviews contribute significantly to the credibility of these apps, influencing potential downloads.

Future Trends in Payment Processing Apps

The future of payment processing apps holds exciting possibilities. With advancements in technology, users can expect more innovative features and increased convenience. The industry is likely to witness further collaborations, ensuring a holistic approach to digital transactions.

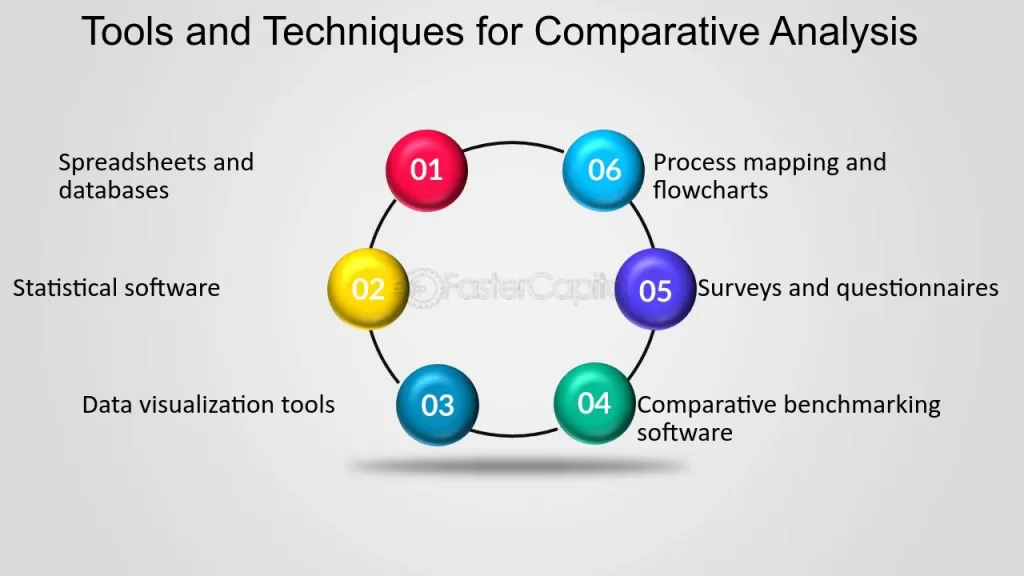

Comparative Analysis of Payment Processor Apps

To assist users in making informed decisions, a comparative analysis of payment processor apps is essential. Considering factors such as features, fees, and user feedback, users can choose the app that aligns with their preferences and requirements.

Conclusion

In conclusion, the surge in payment processor app downloads in India is a testament to the evolving landscape of digital transactions. The convenience, security, and user-friendly interfaces offered by these apps have propelled them to the forefront of the financial technology revolution. As the industry continues to innovate, users can expect even more seamless and secure digital payment experiences.

FAQs

- Are payment processor apps safe to use for financial transactions?

- Yes, payment processor apps implement robust security measures like encryption and multi-factor authentication to ensure the safety of financial transactions.

- Which are the most popular payment processor apps in India?

- Paytm, Google Pay, and Phone Pe are among the most popular payment processor apps in India.

- How do government initiatives contribute to the growth of digital payments?

- Government initiatives like the Unified Payments Interface (UPI) standardize digital transactions, creating a secure environment and promoting user trust.

- What marketing strategies do payment processor apps adopt to attract users?

- Payment processor apps often use promotions, cashback offers, and referral programs to attract new users and foster loyalty among existing ones.

- What can users expect from the future of payment processing apps?

- The future holds possibilities for more innovative features, increased convenience, and further collaborations in the payment processing app industry.

\