AUTHOR : AYAKA SHAIKH

DATE:8/03/2024

Payment Processors and Distance Learning Software in India

In our contemporary digital era, characterized by the ubiquitous nature of online transactions, payment processors are undeniably indispensable in ensuring both security and smoothness in financial dealings. When it comes to the education sector, particularly in India, the integration of payment processors with distance learning software is becoming increasingly vital. Let’s delve into the significance of payment processors and how they intertwine with distance learning software in the Indian context.

Introduction to Payment Processors

What is a payment processor?

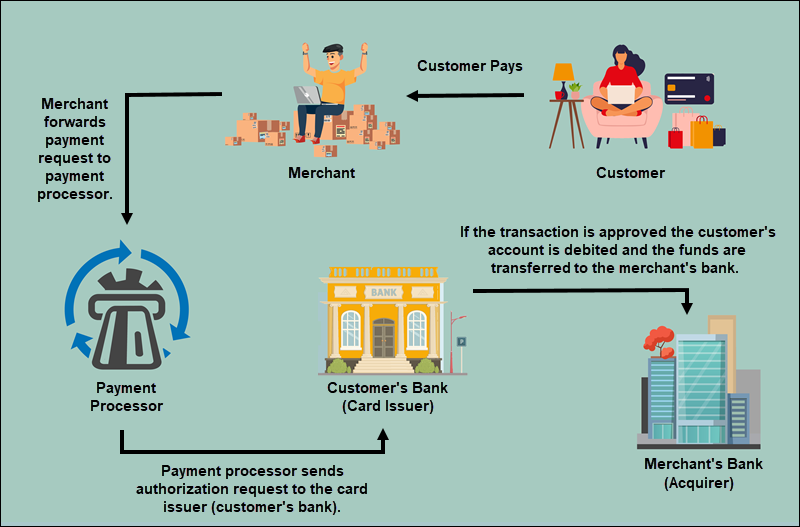

A payment processor is a third-party service that acts as an intermediary between a merchant and the financial institutions involved in a transaction. It ensures that the funds are securely transferred from the buyer’s account to the seller’s account.

Payment processors are essential for online transactions as they provide a secure and reliable platform for processing payments. They encrypt sensitive financial information, such as credit card details, to prevent unauthorized access and fraud.

Popular Payment Processors in India

India, being a rapidly growing market for online transactions, boasts several popular payment processors. From traditional banking channels to modern digital wallets, there are a plethora of options available to cater to diverse consumer preferences.

Some of the prominent payment processors in India include:

- Paytm is a leading digital payments platform offering a wide range of services, including mobile recharges, bill payments, and online shopping.

- Google Pay is a digital wallet platform that enables users to make payments using their smartphones, leveraging the power of NFC (near-field communication) technology.

- Razorpay is a payment gateway that provides businesses with the tools to accept online payments seamlessly through various channels, including debit and credit cards, net banking, and UPI.

Advantages of Using Payment Processors for Distance Learning Software

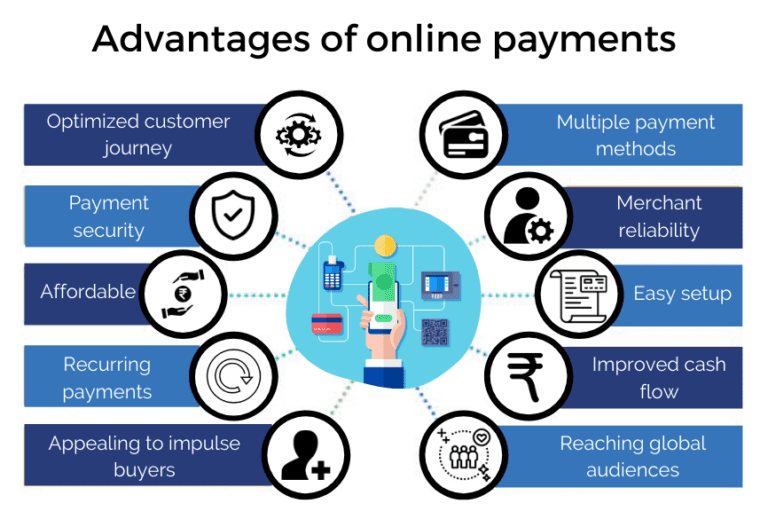

22In the realm of education, especially with the rise of distance learning, integrating payment processors with software platforms offers numerous benefits. Payment processors employ advanced encryption technologies to ensure that sensitive financial data is protected during transactions. This instills trust among users and mitigates the risk of data breaches or fraudulent activities.

Convenience for Students and Institutions

By incorporating payment processors into distance learning software, educational institutions can offer a convenient payment experience to students. Whether it’s paying course fees, purchasing study materials, or accessing premium content, students can make transactions hassle-free from the comfort of their homes.

Integration Possibilities

Payment processors can be seamlessly integrated with various features of distance learning software, such as course enrollment, subscription management, and fee collection. This integration streamlines administrative tasks for institutions and enhances the overall user experience for students.

Distance Learning Software in India

Distance learning, also known as online education or e-learning[1], has gained significant momentum in India, especially in recent years. With advancements in technology and internet penetration, distance learning has become a viable alternative to traditional classroom-based education.

Payment Processors with Distance Learning Software

importance of Integrating

Integrating payment processors with distance learning software is essential for facilitating smooth and efficient transactions within the online learning ecosystem. It allows educational institutions to accept payments securely and efficiently, thereby enhancing the accessibility of educational resources for learners.

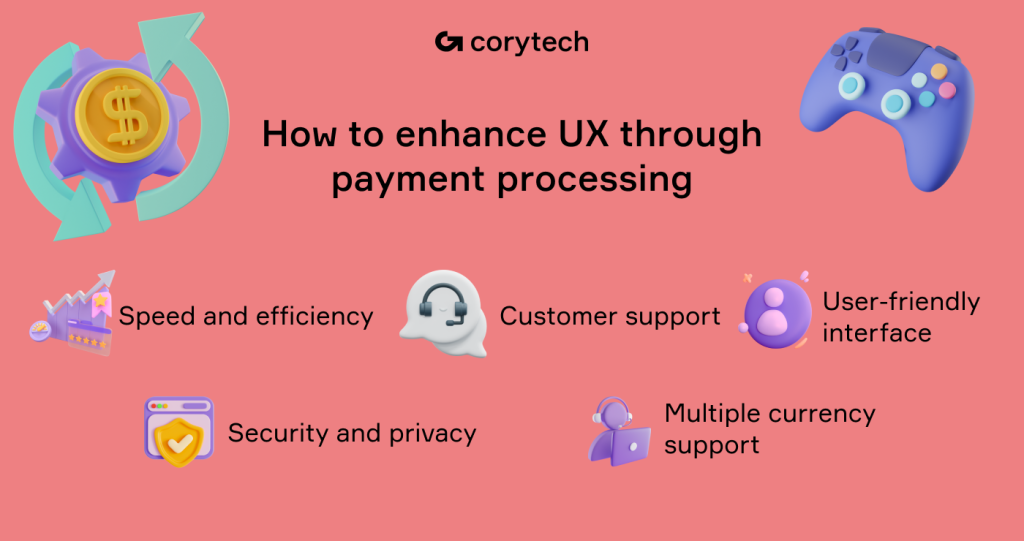

How Payment Processors Enhance the User Experience

By integrating payment processors with distance learning software, educational platforms can offer a seamless and user-friendly payment experience to students. From flexible payment options to instant transaction processing[2], payment processors enhance the overall usability and accessibility of online learning resources.

Payment Processors with Distance Learning Software

Despite the numerous benefits, integrating payment processors with distance learning software poses certain challenges: One of the primary concerns associated with payment processing in online education is security. Educational institutions must ensure robust security measures are in place to safeguard sensitive financial information and protect against cyber threats and data breaches.

Technical Integration Issues

Integrating payment processors[3] with existing distance learning software systems can be complex and may require technical expertise. Compatibility issues, API integration, and system updates are some of the technical challenges that institutions may encounter during the integration process.

Solutions to Overcome Challenges

Implementing Robust Security Measures

To address security concerns, educational institutions should implement robust security measures, such as encryption protocols, firewall protection, and regular security audits. Partnering with trusted payment processor providers that comply with industry standards and regulations can also enhance security.

Collaborating with Experienced

Collaborating with experienced payment processor providers[4] can help educational institutions navigate the complexities of integrating payment processing with distance learning software. These providers offer tailored solutions, technical support, and expertise to streamline the integration process and ensure its success.

Best Practices for Utilizing

To maximize the benefits of payment processors in distance learning software, educational institutions should adhere to the following best practices:

- Ensuring Compatibility with Various Payment Methods[5] Offer multiple payment options to cater to diverse student preferences, including credit/debit cards, net banking, digital wallets, and UPI.

- Offering Seamless Payment Experiences: Optimize the payment process to be intuitive, fast, and user-friendly, reducing friction and enhancing the overall user experience for students.

Conclusion

In conclusion, payment processors play a crucial role in facilitating secure and efficient transactions within the realm of distance learning software in India. By integrating payment processors with educational platforms, institutions can streamline payment processes, enhance user experiences, and expand access to educational resources. Despite the challenges involved, implementing robust security measures and collaborating with experienced payment processor providers can help overcome obstacles and unlock the full potential of online education.

FAQs

- Are payment processors secure for online transactions?

- Yes, payment processors employ advanced encryption technologies to ensure secure transactions and protect sensitive financial information.

- Can I use multiple payment methods with distance learning software?

- Yes, most distance learning software platforms offer support for various payment methods.

- How can educational institutions ensure the seamless integration of payment processors?

- By collaborating with experienced payment processor providers and implementing robust security measures, educational institutions can ensure a smooth integration process.

- What are the benefits of integrating payment processors with distance learning software?

- Integrating payment processors enhances the accessibility of educational resources, streamlines payment processes, and improves the overall user experience for students.

- What steps should I take to address security concerns when integrating payment processors with educational platforms?

- Implementing encryption protocols, firewall protection, and regular security audits are essential steps to address security concerns when integrating payment processors.