AUTHOR : AYAKA SHAIKH

DATE: 2/03/2024

Introduction

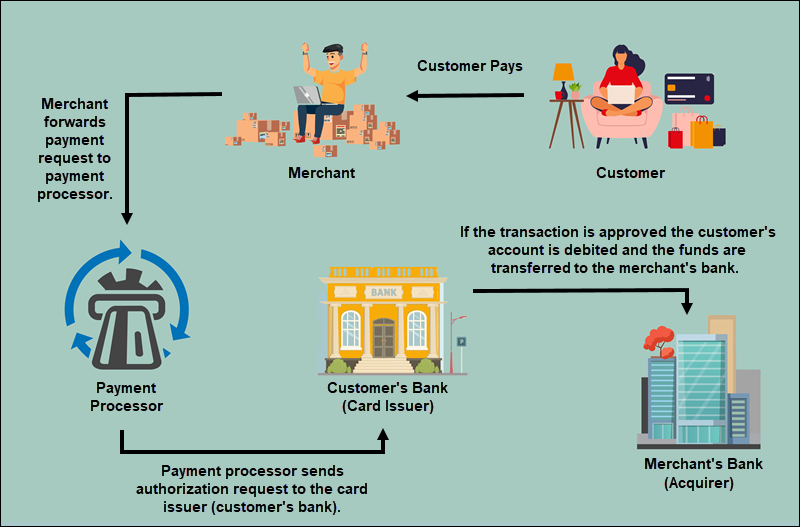

Payment processors play a crucial role in facilitating seamless transactions between businesses and consumers. These platforms serve as intermediaries, securely transmitting payment data from the buyer to the seller, thereby enabling online purchases and transactions. Over the years, payment processors have evolved to meet the increasing demand for efficient and reliable payment solutions in India. Payment Processor: Downloadable Programs in India.

Challenges with Traditional Payment Systems

Traditional payment methods such as cash transactions, checks, and demand drafts pose several limitations in today’s digital age. Cash transactions are not only cumbersome but also prone to theft and misplacement. Similarly, checks and demand drafts involve manual processing and are susceptible to fraud and forgery, raising security concerns for both businesses and consumers Payment Processor: Downloadable Programs in India.

Introduction to Downloadable Programs

Downloadable programs refer to software applications that can be downloaded and installed on electronic devices such as computers, smartphones, and tablets. These programs serve various purposes, ranging from productivity tools to entertainment software. With the proliferation of smartphones and high-speed internet connectivity, downloadable programs have become an integral part of India’s digital ecosystem.

Integration of Payment Processors with Downloadable Programs

The integration of payment processors[1] with downloadable programs offers numerous benefits for businesses and consumers alike. On the other hand, consumers benefit from a seamless checkout experience, with multiple payment options available at their fingertips.

Popular Payment Processors in India

Several payment gateway[2] providers cater to the diverse needs of businesses operating in India. From industry giants like Paytm and Razorpay to international players like PayPal and Stripe, there is no shortage of options for businesses looking to integrate payment processing into their downloadable programs. Each provider offers unique features and services, allowing businesses to choose the one that best suits their requirements.

Steps to Integrate Payment Processors with Downloadable Programs

Integrating payment processors[3] with downloadable programs involves several steps, starting with setting up merchant accounts, customizing payment options, and finally testing and deploying the integration. Businesses must follow industry best practices and guidelines to ensure a seamless integration that meets the needs of both the business and its customers.

Benefits of Using Payment Processors for Downloadable Programs

The benefits of using payment processors for downloadable programs are manifold. Not only do they streamline the payment process, but they also contribute to increased sales and revenue for businesses. Furthermore, by offering secure payment options[4], businesses can build trust and loyalty among their customer base, leading to long-term success and growth.

Security Measures and Fraud Prevention

Payment processors employ various security measures, such as SSL encryption, two-factor authentication, and fraud detection algorithms, to safeguard against unauthorized access and fraudulent activities. By implementing these measures, businesses can instill confidence in their customers and mitigate the risk of fraud.

Future Trends and Innovations

The future of payment processing lies in innovation and technology. AI-driven payment solutions are poised to revolutionize the way businesses accept payments, offering personalized and frictionless experiences for both businesses and consumers. Similarly, blockchain technology holds promise for enhancing security and transparency in payment[5] processing, paving the way for a more secure and efficient payment ecosystem.

Regulatory Compliance

In addition to technological advancements, businesses must also adhere to regulatory requirements governing online transactions. The Reserve Bank of India (RBI) has issued guidelines for online transactions to ensure the security and integrity of the payment ecosystem. Furthermore, businesses must comply with data protection laws such as the GDPR to protect customer data and privacy.

Customer Support and Assistance

Responsive customer support is essential for resolving any issues or queries that may arise during the payment process. Payment processors offer 24/7 helplines and online support channels to assist businesses and consumers with their payment-related needs.

Future Trends and Innovations

As technology continues to advance, the landscape of payment processing is poised for further innovation. One significant trend is the integration of artificial intelligence (AI) into payment solutions. AI-driven systems can analyze customer behavior, detect fraudulent activities in real time, and personalize the payment experience for users.

Regulatory Compliance

In the rapidly evolving landscape of payment processing, regulatory compliance is paramount. Businesses must navigate a complex web of regulations governing online transactions, data protection, and financial services. In India, the Reserve Bank of India (RBI) has issued guidelines and regulations to ensure the safety, security, and integrity of electronic payments. These regulations cover various aspects, such as customer authentication, data security, and dispute resolution mechanisms.

Customer Support and Assistance

In the digital era, customer support is a critical component of the payment processing ecosystem. Businesses must provide responsive and accessible customer support channels to address inquiries, resolve issues, and assist users with their payment-related needs. Payment processors offer a range of support options, including helplines, live chat support, email support, and self-service portals.

Conclusion

In conclusion, payment processors play a pivotal role in enhancing downloadable programs in India. By offering secure, convenient, and reliable payment solutions, these platforms empower businesses to maximize their sales potential and provide an exceptional customer experience. As technology continues to evolve, payment processors will undoubtedly play an increasingly integral role in shaping India’s digital economy.

FAQs

- How do payment processors benefit businesses in India?

- Payment processors streamline the payment process, increase sales, and enhance customer satisfaction by offering secure and convenient payment options.

- While exploring payment processors, it’s essential to thoroughly scrutinize their terms and conditions to uncover any undisclosed fees or charges.

- Can I integrate multiple payment gateways with my downloadable program?

- Yes, many downloadable programs support integration with multiple payment gateways, allowing businesses to offer diverse payment options to their customers.

- To mitigate the risk of fraudulent transactions, businesses can implement multifactor authentication and employ advanced fraud detection algorithms.

- Are there any government regulations I need to comply with when using payment processors?

- Yes, businesses must adhere to regulatory requirements set forth by the Reserve Bank of India (RBI) and comply with data protection.