AUTHOR :SELENA GIL

DATE : 27/12/2023

Introduction

Payment processors play a pivotal role in facilitating transactions, especially in the digital realm. When it comes to software licenses in India, the choice of a reliable payment processor becomes paramount for seamless and secure transactions.

Payment Processor Criteria in India

In India, specific criteria define an ideal payment processor for software license transactions. Legal compliance, support for multiple currencies, and integration flexibility are crucial aspects that companies must consider.

Popular Payment Processors in India for Software Licenses

Several payment processors dominate the Indian market for software license transactions. Names like Razorpay, PayU, and CCAvenue stand out for their user-friendly interfaces and comprehensive services.

Comparative Analysis of Payment Processors

Comparing these payment processors involves evaluating various factors, such as fee structures, security measures, and user interfaces. Understanding these differences aids in making an informed decision based on business needs.

Challenges and Solutions in Payment Processing for Software Licenses

One of the significant challenges in payment processing for software licenses in India revolves around regulatory hurdles. The dynamic nature of regulations demands constant vigilance to ensure compliance. Companies must proactively adapt their payment processing systems to align with evolving laws to avoid penalties or operational disruptions.

To mitigate transaction risks, implementing robust security measures is imperative. Encryption technologies, secure authentication protocols, and regular security audits can fortify payment gateways against potential threats, safeguarding sensitive customer data and transactional integrity

The Impact of Payment Processors on Scaling Software Businesses

The choice of a payment processor[1] extends beyond transaction facilitation; it plays a pivotal role in scaling software businesses. A streamlined payment process enhances customer trust and satisfaction, fostering repeat business and positive reviews. Moreover, efficient payment gateways position businesses to expand into new markets, seizing growth opportunities

Best Practices for Selecting a Payment Processor

Selecting a payment processor involves aligning it with business needs, reading user reviews, and considering integration and support. These practices streamline the decision-making process[2].

Future Trends in Payment Processing for Software Licenses

The landscape of payment processing continues to evolve with technological innovations and regulatory changes. Anticipating trends like advanced payment[3] technologies and regulatory adaptations is vital for businesses.

What Legal Aspects Should Businesses Consider When Choosing a Payment Processor in India?

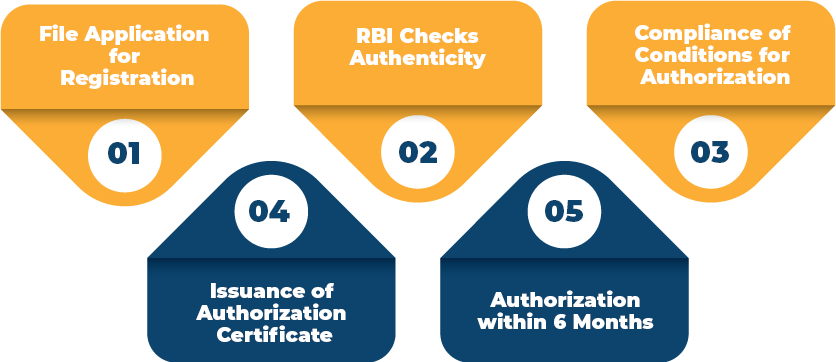

When selecting a payment processor in India for software licenses, adherence to legal requirements is fundamental. Ensure the chosen processor complies with the Reserve Bank of India’s guidelines for secure and legal transactions[4]. It’s crucial to verify if the processor meets the necessary data protection and privacy laws, such as the Information Technology Act and the Payment and Settlement Systems Act.

How Do Payment Processors Contribute to Enhancing the Customer Experience in Software Transactions?

Payment processors impact the user experience significantly. Smooth and secure payment gateways[5] streamline the checkout process, reducing cart abandonment rates. Moreover, processors offering multiple payment options cater to diverse customer preferences, enhancing convenience and satisfaction during transactions.

Are There Any Specific Challenges Unique to Payment Processing for Software Licenses in India?

Navigating regulatory complexities is a primary challenge. The ever-evolving legal landscape in India demands stringent compliance measures. Additionally, since software transactions often involve intellectual property rights, ensuring secure and authorized payments adds another layer of complexity.

What Role Does Currency Support Play in Selecting a Payment Processor for Software Transactions?

For software businesses operating globally, currency support is critical. Opt for a payment processor that accommodates various currencies to facilitate transactions with international customers. A processor offering multi-currency support minimizes currency conversion hassles and attracts a broader customer base [4].

Can small businesses benefit from the advanced payment technologies offered by these processors?

Absolutely! Advanced payment technologies provided by processors like Razorpay, PayU, or CCAvenue are not exclusive to large enterprises. Small businesses can leverage these technologies to enhance payment security, offer diverse payment options, and streamline transactions, thereby boosting their competitiveness in the market.

Conclusion

Choosing the right payment processor for software licenses in India is a critical decision for businesses. It not only impacts transactions but also influences customer satisfaction and growth opportunities. By choosing the right payment processor tailored to your needs, you can simplify complex transactions, accept payments from multiple channels, and even expand your reach to international markets. Whether you’re a small startup or a large enterprise, investing in the right payment processing system will enable you to focus on delivering quality software while leaving payment complexities to the experts.

FAQs

1. What are payment processors for software licenses?

Payment processors are platforms or systems that facilitate secure online transactions. They allow businesses to collect payments for software licenses via various payment methods, such as credit/debit cards, UPI, wallets, and net banking.

2. Why do I need a payment processor for my software business in India?

If you’re selling software licenses, a payment processor simplifies transactions for your customers, enhances security, supports multiple payment options, and ensures compliance with regulations like RBI guidelines for digital payments.

3. Are payment processors secure for handling software license payments?

Yes, most reputable payment processors use encryption, fraud detection, and secure payment gateways to ensure the safety of your transactions and protect sensitive data.

4. Are there specific payment processors for software businesses in India?

Yes, several payment processors cater to software businesses, including Razorpay, Instamojo, PayU, and CCAvenue. Each offers tailored solutions for handling software license payments effectively.

5. Can I accept international payments for my software licenses in India?

Yes, many payment processors provide international payment support, allowing you to accept payments in foreign currencies from global customers. Ensure that the processor complies with RBI’s cross-border transaction regulations.