AUTHOR: NORA

DATE: 27-02-2024

Introduction

In today’s digital era, the demand for virtual software downloads in India has surged dramatically. With the advent of technology, software has become an integral part of our lives, aiding in various tasks from communication to productivity. To facilitate these downloads, reliable payment providers play a crucial role, ensuring seamless transactions and an enhanced user experience.

Overview of the Payment Provider Market

India has witnessed a significant shift towards digital payments in recent years. With initiatives like Digital India and demonetization, the adoption of digital payment methods has skyrocketed. This trend has fueled the growth of the payment provider market in the country, with several players competing to offer innovative solutions.

Advantages of Using Payment Providers for Software Downloads

Convenience

Payment providers offer a convenient way for users to purchase and download software instantly. With just a few clicks, users can complete transactions without the hassle of handling physical cash or cards.

Security

Security is paramount when it comes to online transactions Payment providers employ robust encryption technologies to safeguard sensitive information, ensuring that user data remains protected throughout the payment process.

Accessibility

By partnering with multiple banks and financial institutions, payment providers offer a wide range of payment options to users. Whether it’s credit/debit cards, net banking, or mobile wallets, customers can choose the most convenient payment method.

Popular Payment Providers in India

India boasts a diverse ecosystem of payment providers[1], each offering unique features and services. Some of the most popular payment providers for virtual software downloads include:

- Paytm: Known for its mobile wallet and payment gateway services, Paytm is one of the leading payment providers in India.

- PhonePe: Backed by Flipkart, PhonePe has gained widespread popularity for its seamless payment experience and innovative features.

- Google Pay: Formerly known as Tez, Google Pay offers a simple and secure way to make payments using UPI (Unified Payments Interface).

- Amazon Pay: Integrated with the e-commerce giant Amazon, Amazon Pay allows users to pay for software downloads using their Amazon account.

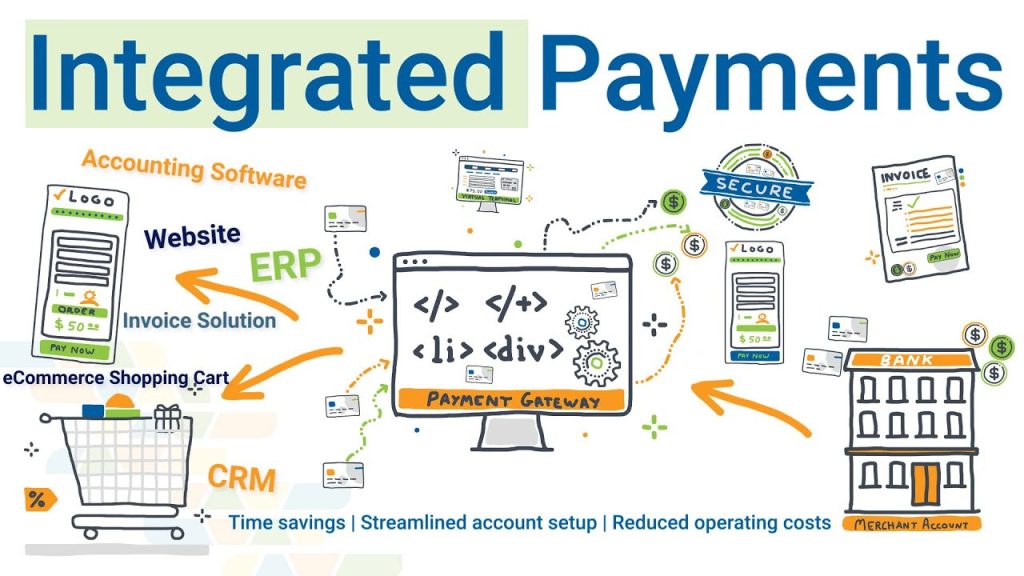

How to Set Up Payment Integration for Virtual Software Downloads

Setting up payment integration for virtual software downloads involves several steps:

- Choosing the Right Payment Provider: Conduct thorough research to identify the payment provider that best suits your requirements in terms of pricing, features, and security[2].

- Integrating Payment Gateway with the Software Platform: Once you’ve selected a payment provider, integrate their payment gateway with your software platform. This process may require assistance from developers or technical experts.

Challenges and Solutions

Security Concerns

Security remains a top concern for both users and businesses[3] when it comes to online payments. To address this issue, payment providers implement stringent security measures such as encryption, tokenization, and multi-factor authentication.

User Experience

A seamless user experience is essential for driving conversions and retaining customers. Payment providers continually strive to enhance their interfaces and streamline the checkout process to minimize friction and maximize user satisfaction.

Transaction Fees

While payment providers offer convenience and security, they also charge transaction fees for their services. To mitigate this cost, businesses can explore alternative pricing models or negotiate lower fees based on transaction[4] volume.

Future Trends in Virtual Software Downloads and Payment Providers

Emerging Technologies

The future of virtual software downloads and payment providers is intertwined with emerging technologies such as blockchain, artificial intelligence, and machine learning. These technologies hold the potential to revolutionize the way transactions are conducted, offering greater efficiency and transparency.

Regulatory Changes

The regulatory frameworks governing digital payments[5] are constantly evolving to keep pace with technological advancements and address emerging challenges. As such, businesses and payment providers must stay abreast of regulatory changes and ensure compliance to avoid any legal repercussions.

Conclusion

In conclusion, payment providers play a pivotal role in facilitating virtual software downloads in India. With their convenient, secure, and accessible payment solutions, they empower users to purchase and download software with ease. As the digital landscape continues to evolve, payment providers will continue to innovate and adapt to meet the changing needs of consumers and businesses alike

FAQs

- Are virtual software downloads secure?

- Yes, payment providers employ advanced security measures to ensure that virtual software downloads are secure and protected against unauthorized access.

- Can I use multiple payment methods for software downloads?

- Most payment providers offer multiple payment options, allowing users to choose the method that best suits their preferences.

- How long does it take to set up payment integration for software downloads?

- The time required to set up payment integration depends on various factors, such as the complexity of your software platform and the chosen payment provider. It may range from a few days to several weeks.

- Are there any hidden fees associated with using payment providers?

- While payment providers may charge transaction fees for their services, these fees are typically transparent and disclosed upfront. Be sure to review the pricing structure of your chosen provider to avoid any surprises.

- What should I do if I encounter any issues with payment processing?

- If you encounter any issues with payment processing, reach out to the customer support team of your chosen payment provider for assistance. They will be able to help troubleshoot the issue and ensure that your transactions are processed smoothly.