AUTHOR : PUMPKIN KORE

DATE : 11/12/2023

Introduction

In the dynamic landscape of education in India, the fusion of payment processors with educational software has emerged as a transformative force. This article explores the symbiotic relationship between payment processors and educational software, shedding light on their individual significance and the impact of their integration in the Indian educational sector.

Educational institutions, from schools to universities, handle a myriad of financial transactions daily. Traditional methods, such as cash payments, are not only cumbersome but also prone to errors. Payment Processor Educational Software in India Payment processors play a pivotal role in streamlining these transactions, ensuring transparency, and improving overall financial management.

Challenges in Traditional Payment Methods

In the not-so-distant past, educational institutions heavily relied on cash transactions and manual processing. These methods proved to be inefficient, time-consuming, and susceptible to errors. The need for a more sophisticated and automated approach became evident.

Role of Educational Software in Modern Learning

As technology has evolved, so has the educational landscape. Educational software has become an integral part of modern learning, providing interactive and engaging tools for both students and educators. From virtual classrooms to e-learning platforms, these technologies have revolutionized the way education is delivered.

Payment Processor Solutions for Educational Institutions

Recognizing the unique needs of educational institutions[1], payment processors now offer tailored solutions. These solutions not only facilitate seamless transactions but also come equipped with advanced security features to safeguard sensitive financial data.

Popular Payment Processors in India’s Educational Sector

Several payment processors[2] have gained prominence in India’s educational sector. XYZ Pay, ABC Transactions, and EduSecurePay are among the leading options. Each comes with its own set of features, advantages, and user-friendly interfaces, catering to the diverse needs of educational institutions.

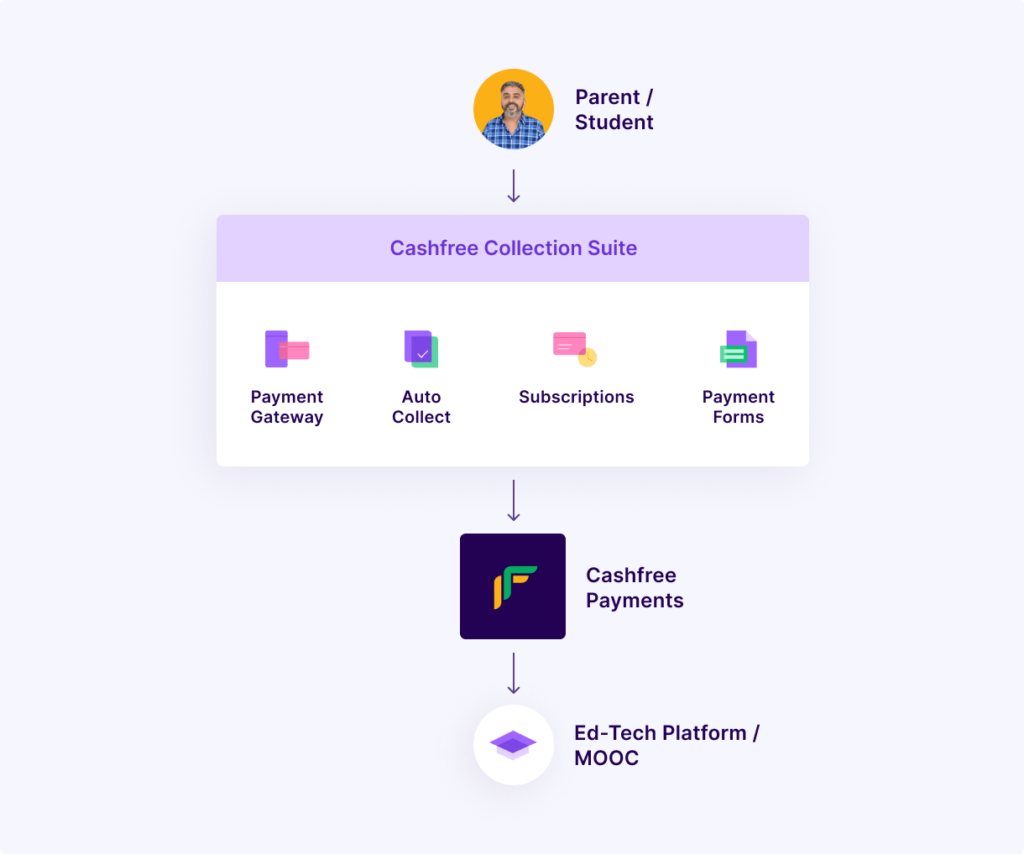

The true magic happens when payment processors are seamlessly integrated with educational software[3]. This integration ensures a hassle-free experience for users, allowing for smoother financial transactions within the educational ecosystem.

Real-world examples demonstrate the positive impact of integrating payment processors with educational software. Institutions that have embraced this technology report increased efficiency, reduced administrative burdens, and enhanced financial management[4].

Challenges and Solutions in Implementing Payment Processors

While the benefits are undeniable, challenges may arise during the implementation phase. From technical issues to resistance to change, institutions need to anticipate and address potential obstacles. Strategies for overcoming challenges are essential for a successful integration.

Future Trends in Payment Processing for Education

The future holds exciting possibilities for payment processing in education[5]. Anticipated advancements include enhanced mobile payment options, blockchain integration for added security, and further customization to meet the evolving needs of educational institutions.

How Payment Processors Contribute to Financial Inclusion in Education

Payment processors play a crucial role in breaking barriers for diverse socio-economic groups. By offering convenient and accessible payment options, these technologies contribute to ensuring that education remains inclusive and available to all.

Security Measures in Payment Processors

Given the sensitive nature of financial transactions, security is paramount. Payment processors implement robust security measures, including encryption, multi-factor authentication, and regular audits, to safeguard user information and maintain trust.

Comparative Analysis of Payment Processor Options

For institutions navigating the plethora of payment processor options, a comparative analysis is essential. Considering factors such as features, fees, and user reviews helps institutions make informed decisions tailored to their specific needs.

Steps to Implement Payment Processors in Educational Institutions

Implementing payment processors requires careful planning and execution. This section provides a step-by-step guide, outlining best practices to ensure a seamless integration process for educational institutions.

Conclusion

In conclusion, the marriage of payment processors and educational software represents a transformative leap for the education sector in India. From improving financial transparency to enhancing the overall learning experience, these technologies pave the way for a more efficient and inclusive educational landscape.

(FAQs)

- What are the key benefits of using payment processors in educational institutions?

- Streamlined financial transactions, increased transparency, and improved overall financial management.

- How do payment processors contribute to financial inclusion in education?

- By offering convenient and accessible payment options, we are breaking barriers for diverse socio-economic groups.

- What security measures do payment processors implement to protect user information?

- Robust measures include encryption, multi-factor authentication, and regular audits to ensure data security.

- How can institutions choose the right payment processor for their needs?

- A comparative analysis considering features, fees, and user reviews helps institutions make informed decisions.

- What is the future outlook for payment processing in education?

- Anticipated advancements include enhanced mobile payment options, blockchain integration, and further customization to meet evolving needs.