AUTHOR : RIVA BLACKLEY

DATE : 07/12/2023

Introduction

Payment Gateway Financial Aid Consulting is a specialized service designed to assist businesses in selecting and implementing the most suitable payment gateway solutions. In India, where the digital economy is flourishing, the need for secure and smooth financial transactions is more critical than ever.

The Landscape of Payment Gateways in India

India has witnessed a remarkable growth in the payment gateway industry, fueled by the rise of e-commerce and digital transactions. However, this growth comes with its own set of challenges, including security concerns and the need for constant innovation.

Financial Aid in Business

Financial aid plays a pivotal role in the success of businesses, especially in the context of payment gateways. Choosing the right payment gateway can significantly impact a business’s cash flow, customer satisfaction, and overall efficiency in handling transactions.

The Need for Consulting Services

Selecting an appropriate payment[1] gateway can be a daunting task for businesses. The market is flooded with options, each offering unique features and also pricing structures. This complexity underscores the need for professional consulting services to guide businesses through the decision-making process.

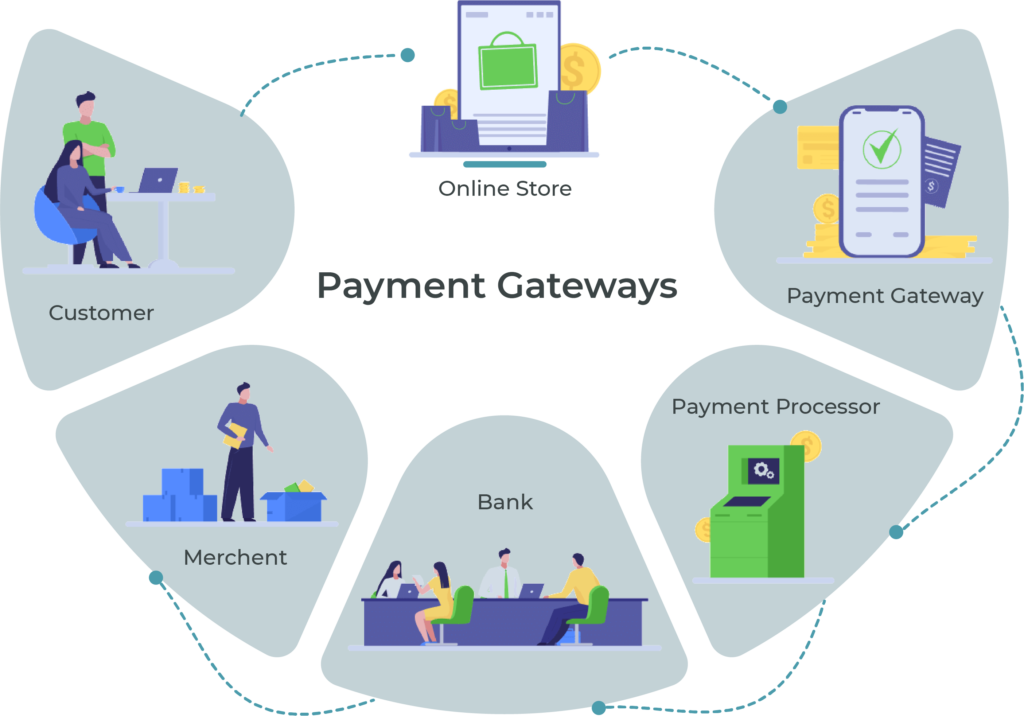

How Payment Gateway Financial Aid Consulting Works

Payment Gateway Financial Aid Consulting involves a comprehensive assessment of a business’s requirements, financial capabilities, and long-term goals. Consultants work closely with businesses to identify the most suitable payment gateway solutions tailored to their specific needs.

Advantages of Professional Guidance

Engaging with payment gateway consultants[2] provides businesses with several advantages. These include expert advice, cost-effective solutions, and streamlined integration processes. Real-life examples abound where businesses have witnessed significant improvements in their financial transactions after seeking professional guidance.

Trends in Payment Gateway Financial Aid Consulting

The consulting industry is not immune to technological advancements. Emerging trends include the integration of artificial intelligence[3], blockchain, and enhanced security measures to ensure the robustness of payment gateway solutions.

Key Considerations for Businesses

Businesses must consider various factors when selecting payment gateways, such as transaction fees, security protocols, and compatibility with existing systems. Consulting services offer insights into customization options, ensuring businesses make informed decisions.

Case Studies

Examining successful case studies provides valuable insights into how businesses, regardless of size or industry, have benefited from payment gateway financial aid consulting. These case studies serve as testimonials to the efficacy of professional guidance.

Regulatory Compliance

Navigating the regulatory landscape is crucial for businesses and consultants alike. A comprehensive understanding of the regulatory framework ensures that payment gateway solutions adhere to legal requirements, safeguarding businesses from potential pitfalls.

Future Prospects

As technology[4] continues to evolve, the future of payment gateway financial aid consulting holds promise. Anticipated innovations include enhanced security measures, seamless integrations, and a broader range of payment options.

Trends in Payment Gateway Financial Aid Consulting

The trends shaping the payment gateway[5] consulting industry are not only indicative of its dynamism but also of its adaptability to technological innovations. In 2023 and beyond, we foresee a continued integration of artificial intelligence (AI) into the process. AI algorithms can analyze vast datasets to provide more accurate and personalized recommendations for businesses seeking payment solutions.

Additionally, the exploration of blockchain technology in payment gateways is gaining momentum. Blockchain offers enhanced security and transparency, reducing the risk of fraud and ensuring the integrity of financial transactions. Businesses can expect to witness more robust and secure payment systems through the incorporation of blockchain into consulting practices.

Key Considerations for Businesses

Choosing the right payment gateway involves navigating a myriad of factors. Understanding transaction fees, security protocols, and also compatibility with existing systems are paramount. Payment gateway consultants play a pivotal role in guiding businesses through these considerations, ensuring that the chosen solution aligns seamlessly with their unique requirements.

Conclusion

In conclusion, the landscape of payment gateway financial aid consulting in India is a dynamic and vital aspect of the business ecosystem. Businesses that prioritize professional guidance in selecting payment gateways are better positioned for success in the ever-evolving digital economy.

FAQS

- What is the role of a payment gateway consultant?

- Payment gateway consultants assist businesses in selecting and also implementing the most suitable payment solutions based on their unique needs.

- How does consulting benefit small businesses?

- Consulting services cater to businesses of all sizes, providing tailored solutions that enhance efficiency and also financial stability.

- Are there specific trends in payment gateway consulting for 2023?

- Yes, trends include the integration of advanced technologies like AI and blockchain for more secure and efficient transactions.

- What challenges do businesses commonly face in selecting payment gateways?

- Common challenges include navigating a crowded market, understanding complex fee structures, and ensuring regulatory compliance.

- How can businesses access payment gateway financial aid consulting services?

- Accessing consulting services can be initiated by reaching out to reputable consulting firms or utilizing online platforms offering such services.