AUTHOR : SAYYED NUZAT

DATE : MAY 31, 2024

Establishing a gambling merchant account in India involves a multifaceted process due to the stringent regulations surrounding the gambling industry in the country. Below are key points and steps that outline how to set up such an account:

Understanding Legal Framework

- Regulatory Environment: Gambling Merchant Account in India are heavily regulated. Most forms of gambling are illegal, except for lotteries and horse racing, which are permitted under specific conditions. Online gambling laws vary by state.

- State Jurisdiction: Each state in India has the authority to formulate its own laws related to gambling. States like Sikkim and Goa have more liberal laws allowing certain types of gambling, including online gambling.

- Legal Compliance: Ensure that your gambling operations comply with both central and state laws. Consult with legal professionals to effectively manage the intricate regulatory framework.

Choosing the Right Banking and Payment Solutions

- Banks and Payment Gateways: Not all banks and payment processors in India support gambling transactions due to the high-risk nature of the business. It is crucial to identify those who do.

- Merchant Account Providers: Look for merchant account providers that specialize in high-risk industries, including gambling. These providers are more likely to understand the specific needs and risks associated with gambling transactions.

Documentation and Application Process

- Business Registration: Ensure your business is legally registered in India and complies with all relevant business regulations.

- Necessary Paperwork: Gather the essential documents [1], which might include:

- Business license

- Tax Identification Number (TIN)

- Personal identification of business owners (e.g., Aadhaar Card, PAN Card)

- Detailed business plan

- Bank statements

- Proof of compliance with gambling laws

- Application Submission: Submit your application along with the required documents to the chosen merchant account [2] provider. Be prepared for a thorough review process.

Risk Management and Compliance

- Anti-Money Laundering (AML) Measures: Establish strong AML policies and protocols.is crucial to preventing money laundering activities within your gambling platform.

- Know Your Customer (KYC): Establish stringent KYC protocols to verify the identity of your customers and ensure compliance with legal requirements.

- Ongoing Monitoring: Continuously monitor transactions and activities to detect and prevent fraudulent activities.

Technical and Security Measures

- Secure Payment Gateway: Use a reliable and secure payment gateway that supports high-risk transactions and ensures the safety of customer data

- Data Protection: Implement strong data protection measures to safeguard sensitive information. This includes compliance with data protection laws such as the Personal Data Protection Bill in India.

Customer Support and Dispute Resolution

- 24/7 Customer Support: Provide round-the-clock customer support to address any issues or concerns your customers may have.

- Dispute Resolution Mechanism: Establish a clear and fair dispute resolution mechanism to handle customer complaints and disputes efficiently.

Marketing and Promotion

- Advertising Regulations: Adhere to advertising regulations specific to gambling. Misleading advertisements or promotions can lead to legal complications.

- Responsible Gambling: Promote responsible gambling practices and Gambling Merchant Account in India provide resources for customers to seek help if they have gambling problems.

Setting Up a Secure Website

- SSL Certificates: Ensure your website is SSL-certified to encrypt data transfers and build customer trust.

- PCI Compliance: Make sure your payment processing systems comply with the Payment Card Industry[4]Data Security Standard (PCI DSS) to protect cardholder data.

- Firewall and Security Protocols: Implement robust firewall protection and other security protocols to prevent cyber-attacks and data breaches.

Financial Management and Reporting

- Transparent Financial Records: Maintain transparent and accurate financial records. This includes transaction logs, customer balances, and compliance reports.

- Regular Audits: Conduct regular financial and compliance audits to ensure that your business operations align with regulatory requirements and to identify potential risks.

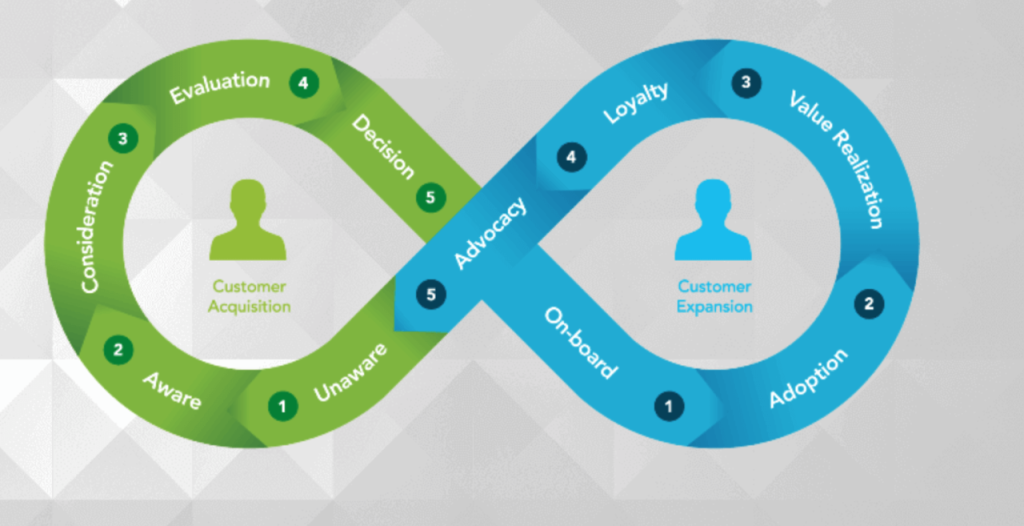

Customer Experience and Retention

- User-Friendly Interface: Design an intuitive and user-friendly interface for your gambling platform to enhance customer experience.

- Loyalty Programs: Implement loyalty programs and promotions to retain customers and encourage repeat business.

- Feedback Mechanism: Establish a feedback mechanism[5] to gather customer input and continually improve your services.

Legal and Regulatory Updates

- Stay Informed: Regularly monitor updates and changes in gambling laws and regulations both at the state and central levels. This is critical as gambling laws in India can evolve.

- Legal Counsel: Maintain ongoing relationships with legal counsel who specialize in gambling laws to ensure your business remains compliant.

Ethical Considerations and Social Responsibility

- Responsible Gambling Initiatives: Promote responsible gambling practices by providing tools for self-exclusion, setting deposit limits, and offering support for problem gamblers.

- Community Engagement: Engage with the community and contribute to social causes, which can enhance your business’s reputation and demonstrate corporate social responsibility.

Contingency Planning

- Risk Management Plan: Develop a comprehensive risk management plan to address potential issues such as payment disputes, fraud, and technical failures.

- Crisis Management: Prepare a crisis management strategy to handle any unforeseen events that could impact your operations or reputation.

International Expansion Considerations

- Market Research: Conduct thorough market research to identify potential opportunities and regulatory environments in other countries.

- Localization: Adapt your platform and services to meet the cultural and legal requirements of each target market.

Conclusion

Setting up a gambling merchant account in India is a complex process that requires careful attention to legal, financial, and operational details. By following these steps and seeking expert guidance, you can navigate the regulatory landscape and establish a secure and compliant gambling business.

(FAQ)

What is a gambling merchant account?

A gambling merchant account is a type of bank account specifically designed for businesses in the gambling industry. It allows these businesses to process payments, including credit card transactions, from their customers.

Is gambling legal in India?

The legality of gambling in India varies by state. While most forms of gambling are generally prohibited, certain types like lotteries, horse racing, and online gambling are permitted in some states under specific regulations. It’s crucial to understand and comply with the laws in the state where you intend to operate.

Which states in India allow gambling?

States such as Goa, Sikkim, and Nagaland have more liberal gambling laws that allow casinos and certain forms of online gambling. However, each state has its own regulatory framework, so it’s essential to consult legal experts to navigate the specific requirements.

How do I apply for a gambling merchant account?

To apply for a gambling merchant account, you need to:

- Register your business legally in India.

- Compile necessary documentation such as your business license, tax identification number, personal identification of business owners, and detailed business plans.

- Submit an application to a merchant account provider that supports gambling transactions.

What documents are required to open a gambling merchant account?

Typically, you will need:

- A valid business license.

- Tax Identification Number (TIN).

- Personal identification documents (e.g., Aadhaar Card, PAN Card) of business owners.

- Detailed business plan.

- Bank statements.

- Proof of compliance with gambling regulations.