DATE : 24 DEC , 2024

HIMARI JONSON

Introduction

In India, education[1] has become a pivotal aspect of personal and societal growth. With the rising cost of education, especially for higher studies, families are increasingly looking for ways to save efficiently for their children’s future. One of the key methods of ensuring a secure educational journey is through education savings plans. However, with fluctuating market conditions and various investment options, the need for high-risk financial[2] aid consulting becomes critical.

High-Risk Financial Aid Consulting

High-risk financial aid consulting refers to the professional advice provided by experts[3] who specialize in guiding individuals or families to navigate high-risk investment avenues that yield potentially high returns. These investments are typically volatile and can fluctuate significantly in the short term, but they offer the potential for substantial gains over the long term.

For education savings plans, high-risk strategies often involve investing[4] in assets such as stocks, mutual funds, and other market-linked financial instruments. Financial aid consultants help families manage these risks by offering tailored advice, identifying the right products, and aligning them with the long-term education goals[5] of the family.

High Risk Financial Aid Consulting For Education Savings Plans In India

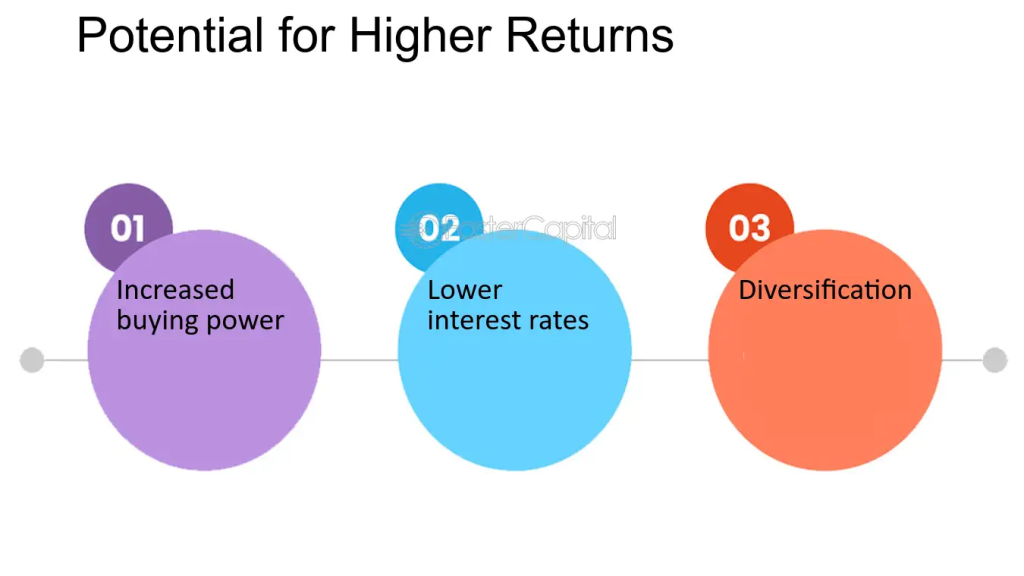

Higher Return Potential

Education savings plans often require long-term commitment. By choosing high-risk investments, families can tap into the potential of higher returns over time. For instance, investing in equities or mutual funds may involve significant fluctuations, but the long-term growth trajectory is generally more favorable than low-risk options like fixed deposits or bonds.

Inflation Hedge

Education costs tend to outpace inflation, making it essential to invest in high-risk instruments that have the potential to deliver returns that beat inflation. A conservative investment approach might not yield enough returns to match the rising cost of education, making high-risk strategies attractive for long-term savings.

Diversification

A key benefit of high-risk financial aid consulting is the ability to diversify your investments. Diversifying across different asset classes and sectors can help manage risk and boost returns, especially in volatile markets. High-risk consultants help you construct a portfolio that aligns with your risk tolerance while achieving the necessary growth for educational expenses.

Key High-Risk Investment Options for Education Savings Plans

Equities (Stocks)

Investing in the stock market is one of the most popular high-risk strategies. Stocks offer the potential for significant capital appreciation, especially in growing sectors such as technology, healthcare, and infrastructure. However, stock markets are volatile, and prices can fluctuate rapidly.

financial consultant specializing in high-risk investments will assess your risk appetite and suggest stocks that have a strong growth potential while balancing volatility. They may also guide you on the timing of purchases and sales to optimize returns.

Mutual Funds

Mutual funds pool money from multiple investors to invest in stocks, bonds, and other securities. There are various types of mutual funds available—equity funds, hybrid funds, and sectoral funds, among others. Equity mutual funds are particularly high-risk, as they invest predominantly in the stock market.

High-risk consultants can help you select mutual funds with high-growth potential while ensuring proper risk management. They often recommend a mix of active and passive mutual funds to suit different goals within the education savings plan.

Real Estate

While not as liquid as stocks or mutual funds, real estate investments can yield substantial returns over the long term. Investing in high-growth cities or emerging areas can help families grow their education savings, although the market can be volatile.

High-risk consultants may provide insight into the real estate market dynamics, helping clients make informed choices on property investments.

Commodities

Investing in commodities like gold, silver, and oil can be considered a high-risk, high-reward strategy for education savings. Commodity prices can experience drastic swings, offering opportunities for significant profits. Gold, for example, has traditionally been a hedge against inflation and can add substantial value to your savings.

Foreign Investments

For those looking to invest outside the Indian market, foreign investments can offer lucrative returns, particularly in developed markets. High-risk consultants expertise in international investments can guide families on the benefits and risks of such investments, considering currency fluctuations, geopolitical events, and market dynamics.

Advantages of High-Risk Financial Aid Consulting for Education Savings Plans

Risk Assessment

The primary role of a high-risk financial aid consultant is to assess the financial situation of the family and determine the suitable risk level. While some families may be willing to take on higher risk for potentially greater returns, others may prefer a more balanced approach. Financial consultants analyze your risk tolerance and customize education savings plans accordingly.

Portfolio Construction

Once the risk level is determined, consultants create a well-diversified portfolio that includes a mix of high-risk instruments such as stocks, mutual funds, and real estate. The goal is to balance the potential for high returns with risk management techniques, ensuring that the education savings plan is aligned with your financial goals.

Regular Monitoring and Adjustments

Market conditions change frequently, and investments need to be constantly monitored. High-risk consultants regularly review your portfolio, make adjustments when necessary, and suggest new investment avenues based on current market trends.

Education and Awareness

One of the most significant advantages of high-risk financial aid consulting is the education provided to clients. Consultants help families understand complex financial instruments and strategies, providing them with the knowledge needed to make informed decisions about their education savings plans.

Advantages of High-Risk Financial Aid Consulting for Education Savings Plans

Expert Guidance

High-risk financial aid consultants bring in-depth market knowledge and expertise. They help families make educated investment decisions by analyzing market trends, assessing risk levels, and developing customized strategies that maximize returns.

Long-Term Growth

By taking on calculated risks, families can benefit from long-term growth, ensuring that they have sufficient funds to meet future educational expenses.

Personalized Plans

Financial consultants tailor plans to individual needs, taking into account factors such as income, risk tolerance, time horizon, and educational goals. This personalization makes education savings plans more efficient and achievable.

Financial Discipline

Engaging with a consultant instills financial discipline, as families are encouraged to stay invested for the long term, avoiding knee-jerk reactions to market volatility.

Conclusion

In a country like India, where the cost of education continues to rise, planning for future educational expenses is crucial. High-risk financial aid consulting offers families the opportunity to build substantial education savings by investing in volatile but rewarding assets. While such investments come with their challenges, the expertise of a qualified consultant can provide the necessary guidance to navigate the complexities and create a successful education savings plan.

FAQ

high-risk financial aid consultants help me with my education savings plan.

Consultants assess your financial goals, risk tolerance, and timeline, then recommend suitable high-risk investment options. They help you construct a diversified portfolio, guide you through market fluctuations.

role of diversification in high-risk education savings plans.

Diversification is essential in high-risk investment strategies as it helps spread the risk across different asset classes and markets. By diversifying investments—such as stocks, mutual funds, and real estate.

risks associated with high-risk investment strategies.

While high-risk investments can offer higher returns, they also come with the possibility of significant losses. The value of stocks, mutual funds, or real estate can fluctuate based on market conditions, economic factors, and investor sentiment.

know if high-risk financial aid consulting is right for me.

High-risk financial aid consulting may be suitable for families who are comfortable with market volatility and have a long-term horizon for their education savings. If you are looking for substantial growth in your education.

invest in high-risk instruments for my child’s education.

The amount to invest depends on various factors, such as your financial goals, current savings, and how soon you expect to need the funds for education. A financial consultant will assess these factors and help you determine an appropriate investment strategy.