AUTHOR: LUCKY MARTINS

DATE: 22/12/2024

Understanding the Options and Importance

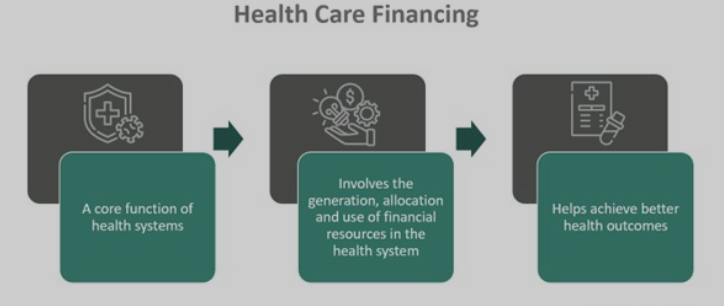

Healthcare professionals[1] in India play a pivotal role in the nation’s well-being. From doctors and nurses to medical researchers and paramedics, their contribution is immeasurable. However, these professionals often face unique financial risks[2] due to the demanding nature of their jobs. To address this, several financial[3] aid options have emerged specifically designed for healthcare workers. This article will explore high-risk financial aid programs available for healthcare professionals in India, highlighting the importance of these programs and answering common queries[4].

Understanding the Need for High-Risk Financial Aid

Healthcare professionals in India, especially those working in critical areas like emergency care, surgery, and infectious disease management, face significant financial risks[5]. These risks may arise from various factors, including:

- Occupational hazards: Exposure to life-threatening diseases, physical strain, and emotional stress are inherent in the healthcare profession.

- Long Work Hours: Many healthcare professionals work long shifts, increasing the risk of accidents, burnout, and physical health problems.

- Financial Insecurity: Healthcare workers in government hospitals, private clinics, or rural areas may face job insecurity, irregular payments, or insufficient insurance coverage.

To mitigate these risks, various financial aid options have been introduced to support healthcare professionals in their careers and safeguard their financial future.

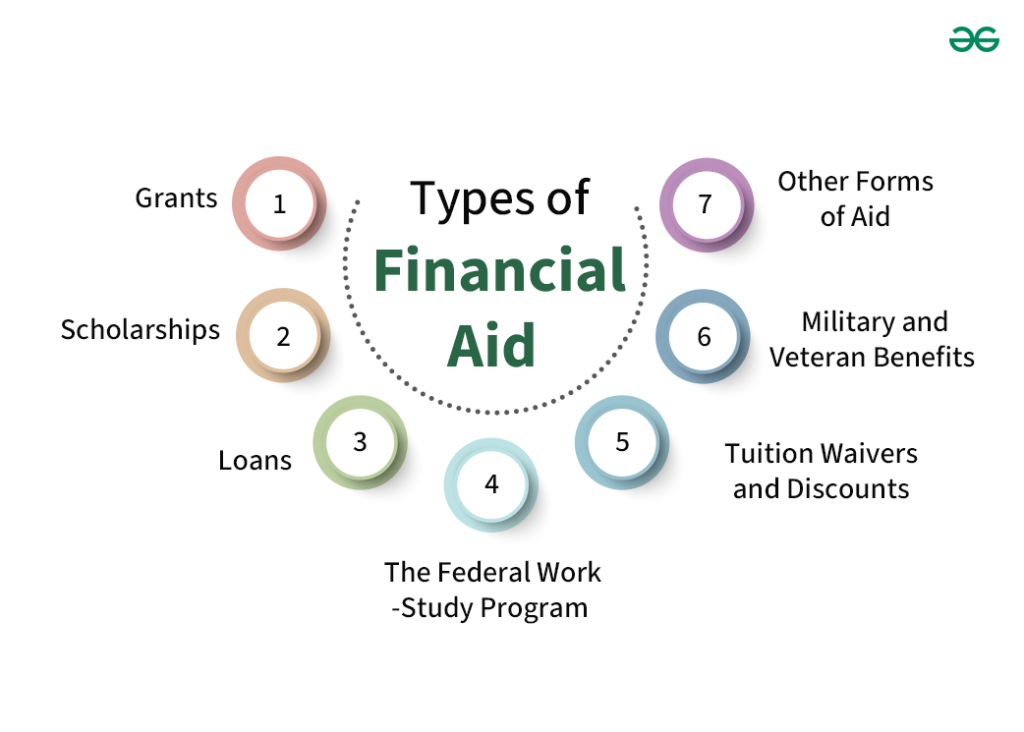

Types of High-Risk Financial Aid for Healthcare Professionals

Several financial aid programs cater to healthcare professionals in India. These programs aim to provide a safety net against financial instability, ensure the well-being of medical personnel, and encourage their continued service in the healthcare sector.

1. Health Insurance for Healthcare Workers

Specialized health insurance plans are designed to protect healthcare professionals from the financial strain of medical expenses, especially in case of job-related injuries or illnesses. Some of the prominent insurers offer tailor-made health insurance schemes for healthcare workers, covering risks such as exposure to infectious diseases, workplace accidents, and chronic conditions arising from long working hours.

2. Disability and Life Insurance

Life and disability insurance policies provide financial security to healthcare professionals in the event of an accident or health condition that renders them unable to work. Given the high-risk nature of the profession, insurers in India offer specialized coverage that accounts for risks like physical injuries, infections, or accidents during surgeries. These policies often come with higher premiums but provide more comprehensive coverage

3. Financial Assistance for Medical Education and Training

Financial aid programs are available for healthcare professionals who wish to pursue advanced degrees or specializations. These programs are particularly helpful for young doctors or nurses looking to enhance their skills but lacking the financial resources. Many universities and institutions offer scholarships and low-interest loans specifically for healthcare professionals. These aid packages ensure that professionals can advance their education without bearing a heavy financial burden.

4. Government Schemes and Subsidies

The Government of India offers various welfare schemes aimed at supporting healthcare professionals in high-risk sectors. Programs such as the “Ayushman Bharat Scheme” may provide financial assistance for workers involved in healthcare delivery, including funding for personal protective equipment (PPE), treatment of occupational injuries, and life insurance schemes for healthcare staff during national emergencies such as the COVID-19 pandemic.

5. Retirement and Pension Plans

Healthcare professionals often work in high-stress environments that may cause them to retire early or face burnout. Pension schemes and retirement funds, such as the Employees’ Provident Fund (EPF) and the National Pension Scheme (NPS), ensure long-term financial security. These plans help healthcare professionals accumulate savings over time, which can support them after retirement or in times of need.

6. Loan Programs for Healthcare Workers

Many financial institutions offer specialized loan programs with lower interest rates to healthcare professionals. These loans can be used for personal use, purchasing medical equipment, or starting new clinics. The advantage of these loan programs is that they take into account the profession’s unique requirements, offering more flexible repayment terms and higher loan amounts.

The Importance of Financial Aid for Healthcare Professionals

1. Ensuring Personal and Family Security

Healthcare professionals, especially those in high-risk specialties, face an increased risk of exposure to diseases and accidents. Financial aid, such as life insurance and disability cover, helps to protect their families in case of unfortunate events.

2. Reducing Financial Stress

The long hours and emotional toll on healthcare professionals can lead to financial stress. Financial aid programs ensure that professionals have access to resources that reduce the burden of everyday financial concerns, allowing them to focus on providing quality care to patients.

3. Promoting Mental Health and Well-Being

With the increasing incidence of burnout among healthcare professionals, having access to financial aid can reduce job-related stress. This, in turn, helps in maintaining better mental health and work-life balance.

4. Encouraging Retention in the Healthcare Sector

Adequate financial assistance encourages healthcare workers to remain in the field despite the challenges. These programs help retain skilled professionals in both urban and rural areas, ensuring that healthcare services are continuously available.

Conclusion

High-risk financial aid for healthcare professionals in India plays a vital role in ensuring their security and well-being. Given the nature of the profession, these professionals require specialized financial protection to manage the risks they face daily. With a combination of insurance plans, government schemes, and financial assistance programs, healthcare workers are better equipped to face the challenges of their profession while securing their future. It is essential that healthcare professionals explore these options to make informed decisions about their financial health and long-term stability.

FAQ:

1. What is high-risk financial aid for healthcare professionals in India?

High-risk financial aid includes specialized insurance plans, pension schemes, subsidies, loans, and other forms of financial assistance aimed at protecting healthcare professionals from financial strain due to the high-risk nature of their work.

2. What types of financial risks do healthcare professionals face?

Healthcare professionals face risks such as exposure to diseases, workplace accidents, burnout, job insecurity, and financial instability from irregular payments, especially in rural or underresourced settings.

3. How can healthcare professionals access financial aid?

Healthcare professionals can access financial aid through government schemes, insurance providers, financial institutions offering loans, and specialized training funds. Many hospitals also have tie-ups with financial aid programs for their employees.

4. Are there any government schemes for healthcare professionals?

Yes, the Government of India offers various schemes like Ayushman Bharat, which provides healthcare insurance for workers, and other welfare programs specifically for healthcare workers during times of national crises.

5. What role do pension plans play in financial aid for healthcare professionals?

Pension plans provide long-term financial security for healthcare professionals after retirement, ensuring that they have a stable income after a career in a high-risk job. This can be particularly beneficial in reducing financial strain as healthcare workers age.