AUTHOR: SONIA ROY

India’s education[1] sector has seen a significant transformation in recent years, particularly with the rise of part-time students. These students often juggle their academic pursuits with work or other responsibilities, making access to financial aid a critical factor for their success. However, part-time students in India face unique challenges when seeking financial assistance[2]. One of the most pressing concerns is the availability of high-risk financial aid for part-time students in India.

High-risk financial aid[3] refers to funding options that target students in more precarious situations, such as those balancing multiple jobs, dealing with inconsistent incomes, or without traditional financial stability. These types of financial aids offer support where conventional loans or scholarships may fall short, ensuring that part-time students can continue their education without being weighed down by financial[4] constraints

This article delves into the concept of high-risk financial[5] aid for part-time students in India, exploring its importance, benefits, challenges, and available options.

Understanding High-Risk Financial Aid for Part-Time Students in India

Part-time students in India often face challenges that traditional full-time students do not encounter. These challenges can include balancing work and studies, financial instability, or lack of access to regular financial aid programs. High-risk financial aid for part-time students in India aims to address these issues by providing funding options that are more flexible and designed for students with higher financial uncertainty.

What Makes Financial Aid “High-Risk”?

Financial aid is often categorized as high-risk when it is offered to individuals who may not meet the typical criteria for traditional loans or grants, such as:

- Irregular income: Many part-time students work in jobs with fluctuating hours or salaries.

- Non-traditional credit history: Part-time students may not have the established credit history required for traditional financial aid programs.

- Lack of collateral: Students often do not have assets to offer as security for loans.

- Limited job stability: Part-time students might have seasonal or temporary employment, which reduces their financial security.

Despite these challenges, high-risk financial aid is crucial for ensuring that part-time students in India have access to the educational opportunities they deserve.

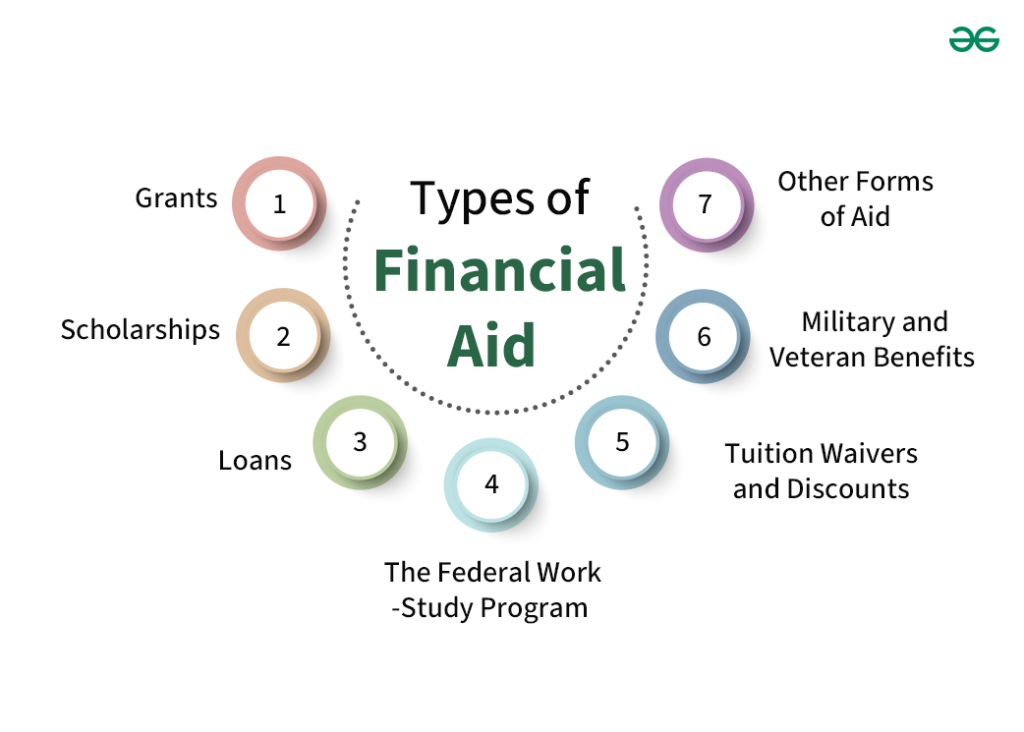

Types of High-Risk Financial Aid for Part-Time Students in India

1. Short-Term Loans with Flexible Repayment Options

One of the most common forms of high-risk financial aid for part-time students in India is short-term loans with flexible repayment plans. These loans typically feature lower interest rates and can be paid back over shorter periods, accommodating the unpredictable schedules of part-time students. Payment flexibility is key, with many lenders offering options such as income-based repayment plans that align with the student’s earnings.

2. Income-Share Agreements (ISAs)

Income-Share Agreements (ISAs) are an innovative financial aid option gaining popularity in India. With an ISA, students receive funding to cover their tuition and other educational expenses in exchange for agreeing to pay a percentage of their future income once they secure a job. This eliminates the need for upfront payments and ensures that part-time students can repay their financial aid only when they have stable income.

3. Crowdfunding for Education

Crowdfunding platforms are increasingly used by part-time students to raise money for their education. High-risk financial aid platforms often feature crowdfunding options specifically targeted at individuals who may not have access to traditional loan options. Students can create campaigns to raise funds from friends, family, and even strangers who are willing to support their education. Payment processors make it easy for donations to be transferred securely and quickly.

4. Government-Sponsored Schemes for Non-Traditional Students

The Indian government offers various scholarship schemes, but many are designed for full-time students. However, there are some government initiatives aimed at non-traditional learners, such as the Pradhan Mantri Vaya Vandana Yojana and the National Scholarship Portal, which provide funding for adult learners, part-time students, and individuals from marginalized groups. Although these schemes often involve stricter criteria, they are still accessible and provide valuable support for part-time learners.

5. Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms provide an alternative source of high-risk financial aid for part-time students. These platforms allow individuals to lend money directly to students in need, bypassing traditional financial institutions. The advantage of P2P lending is that it provides more flexible terms, and lenders may be more willing to take on the risk of supporting students who may not have a strong credit history.

6. Educational Sponsorships from Private Sector Companies

Some private companies and corporate organizations offer sponsorship programs or bursaries for part-time students, particularly those pursuing courses related to their field of business. These sponsorships can provide financial aid in exchange for a commitment to work with the company after graduation, which is often beneficial for students looking to gain work experience and reduce financial stress.

Benefits of High-Risk Financial Aid for Part-Time Students in India

High-risk financial aid plays a crucial role in supporting part-time students in India by providing flexible, accessible funding options. Some of the main benefits of this type of aid include:

1. Greater Accessibility

One of the main advantages of high-risk financial aid is that it is more accessible to students who might not otherwise qualify for traditional loans or scholarships. Part-time students often face barriers to conventional financial aid due to their irregular incomes or lack of a traditional credit history. High-risk financial aid opens up opportunities for them to continue their studies without being hindered by financial limitations.

2. Flexible Repayment Terms

Traditional loans can often be a burden, especially for part-time students who may not have consistent income streams. High-risk financial aid typically offers more flexible repayment terms, allowing students to pay back their loans or financial aid based on their earning capacity. This flexibility can make a significant difference in helping students maintain their academic and professional balance.

3. Encouragement for Adult Learners

High-risk financial aid for part-time students encourages adult learners to return to education and upgrade their skills. With more accessible financial options, these students can balance work, family, and their studies without worrying about financial constraints.

Challenges of High-Risk Financial Aid for Part-Time Students

Despite the benefits, there are challenges associated with high-risk financial aid for part-time students in India, including:

1. Higher Interest Rates

High-risk financial aid programs often come with higher interest rates compared to conventional loans, as lenders perceive these students to be a higher risk. This can be a significant disadvantage for students already struggling financially.

2. Limited Awareness

Many part-time students in India are unaware of the high-risk financial aid options available to them. Lack of awareness can prevent students from accessing the funding they need to pursue their studies.

3. Eligibility Criteria

Though high-risk financial aid aims to assist part-time students, many programs still have eligibility requirements that can be challenging to meet. For example, some government schemes may require part-time students to meet certain income or academic criteria.

The Future of High-Risk Financial Aid for Part-Time Students in India

The demand for high-risk financial aid for part-time students in India is likely to increase in the coming years as more students pursue flexible learning options. With the rise of online education and the growing need for adult learners to upskill, innovative financial solutions such as Income-Share Agreements, peer-to-peer lending, and government-backed schemes will continue to evolve and provide much-needed support.

1. Greater Digital Integration

As India moves towards digitalization, more financial aid programs for part-time students will be managed and disbursed through digital platforms, making the process more accessible and efficient. Payment processors will play a pivotal role in streamlining this process.

2. Increased Private Sector Support

Increased collaboration between educational institutions, financial bodies, and private companies could lead to the development of more targeted financial aid programs designed specifically for part-time students, reducing barriers to education.

Conclusion

High-risk financial aid for part-time students in India is essential for ensuring that students from diverse backgrounds can access education without being hindered by financial difficulties. By providing flexible, accessible funding solutions, these programs empower students to balance work, studies, and other responsibilities. As the demand for part-time education continues to grow, these financial aid options will play a crucial role in shaping the future of higher education in India.

FAQ’s

1. What is high-risk financial aid for part-time students?

High-risk financial aid refers to financial support provided to part-time students who may not meet traditional eligibility criteria, such as stable income or credit history. These options are more flexible and accessible to students with irregular financial situations.

2. What types of financial aid are available for part-time students in India?

Part-time students in India can access short-term loans, income-share agreements, crowdfunding, government schemes, and peer-to-peer lending platforms as part of high-risk financial aid options.

3. How can part-time students apply for financial aid?

Part-time students can apply for financial aid through various online platforms, including crowdfunding websites, government portals, and peer-to-peer lending services.

4. What are the risks of high-risk financial aid?

High-risk financial aid often comes with higher interest rates and stricter repayment terms. Additionally, students may face difficulties in meeting eligibility criteria for certain programs.

5. How can I find financial aid for part-time studies?

Students can explore options through government websites, educational institutions, or online crowdfunding platforms that offer financial aid tailored to nontraditional learners.