Author : Sweetie

Date : 22/12/2023

Introduction

In the dynamic landscape of e-commerce and payment services in India, the concept of High-Risk Payment Service Providers (PSPs) has gained prominence. Businesses engaging in bulk purchasing through these PSPs face unique challenges and opportunities. Let’s delve into the intricacies of high-risk PSP bulk purchasing in India, understanding the risks involved, regulatory frameworks, and also strategies for success.

In recent years, the surge in online transactions has led to an increased demand for payment services, with businesses opting for bulk purchasing through High-Risk PSP Bulk . This article aims to shed light on the nuances of navigating this intricate landscape, emphasizing the importance of understanding and also mitigating risks.

Understanding High-Risk PSPs

High-Risk Purchasing in India are entities that cater to businesses with elevated transaction risks. These risks may arise from various factors, including the nature of the products or services being sold, the geographical locations involved, or the Customers served. It’s crucial to identify and categorize these risks before delving into bulk purchasing strategies.

The Indian Market Landscape

India’s e-commerce and payment industry has Seen unprecedented growth, Purchasing in India offering immense opportunities for businesses. The increasing trend of bulk purchasing adds another layer of complexity. Understanding the market dynamics is essential for making informed decisions and mitigating potential risks bulk payment processing[1].

Identifying Risks in Bulk Purchasing

Before Starting on bulk purchasing, businesses must conduct a comprehensive analysis of potential risks. Market Changes, Misleading activities, Bulk Payment System[2] and Unexpected challenges can impact transactions. Recent incidents in the Indian market serve as cautionary tales, underlining the importance of due Persistence.

Regulatory Framework

Navigating the regulatory landscape is crucial for businesses engaging in high-risk PSP transactions. This section provides an overview of the existing regulatory framework in India and highlights compliance requirements for bulk purchasing. Adhering to these regulations is Essential for Continued success E-Commerce High-Risk Merchant Services[3].

Mitigating Risks

Successful navigation of High Risk Payment Processors[4] requires a Anticipatory approach to risk Reduction. Best practices, such as thorough due diligence in selecting a PSP and employing robust security measures, can significantly reduce risks. Businesses must be vigilant in adopting these strategies to ensure the integrity of their transactions.

Case Studies

Examining real-world examples provides valuable insights into successful bulk purchasing strategies[5]. By learning from both successes and failures in the Indian market, businesses can Adjust their approaches and make informed decisions.

Technological Solutions

Technology plays a pivotal role in minimizing risks associated with high-risk PSP transactions. This section explores the latest technological Improvements, including fraud detection tools and secure payment gateways. Staying abreast of these innovations is essential for businesses seeking a competitive edge.

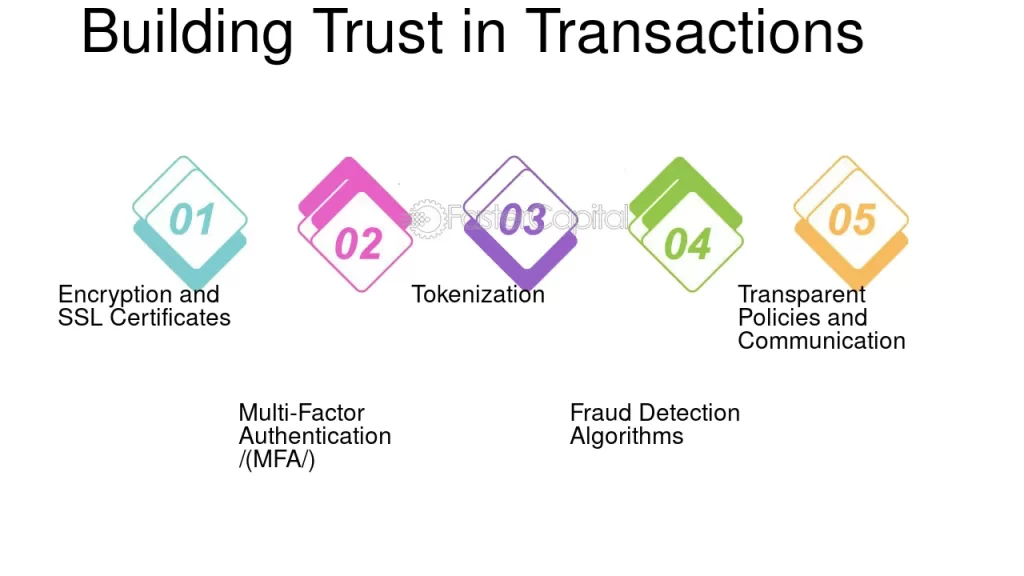

Building Trust in Transactions

Establishing trust with customers is Vital in high-risk transactions. Transparent communication, clear policies, and Interactive customer service contribute to building a positive reputation. Businesses must prioritize customer trust to ensure long-term success in bulk purchasing.

Cost-Benefit Analysis

An Complete analysis of the costs and benefits associated with high-risk PSP bulk purchasing is crucial for Selecting. While the potential rewards can be substantial, understanding the long-term implications and evaluating the overall impact on business operations is essential.

Future Outlook

The landscape of high-risk PSPs is dynamic, with anticipated changes in regulations and technology. This section explores predictions for the future, providing businesses with insights to adapt and thrive in this evolving ecosystem.

Expert Opinions

Industry experts share valuable insights on Managing risky situations PSP transactions. Their recommendations offer a strategic perspective, guiding businesses towards informed Selecting and successful bulk Buying efforts.

Common Pitfalls to Avoid

Mistakes in high-risk bulk purchasing can have severe consequences. This section outlines common pitfalls to avoid, ensuring businesses are Well-prepared to Guide challenges and minimize risks effectively.

Success Stories

Profiles of businesses that successfully Managed challenging situations bulk Buying highlights actionable strategies. Examining these success stories provides inspiration and key Highlights for businesses embarking on similar journeys.

Conclusion

In conclusion, the landscape of high-risk PSP bulk purchasing in India is multifaceted. Businesses must approach it with a combination of caution, innovation, and strategic planning. By understanding the risks, complying with regulations, and adopting best practices, businesses can thrive in this challenging yet rewarding environment.

FAQ

- What defines a High-Risk Payment Service Provider?

- A High-Risk PSP is an entity that caters to businesses with elevated transaction risks, often due to the nature of products or services, geographical locations, or client demographics.

- How can businesses build trust in high-risk transactions?

- Building trust involves transparent communication, clear policies, and responsive customer service.

- What technological solutions are recommended for minimizing risks?

- The latest advancements in fraud detection tools and secure payment gateways play a crucial role in minimizing risks associated with high-risk PSP transactions.

- What are the common pitfalls to avoid in high-risk bulk purchasing?

- Common pitfalls include inadequate due diligence, lack of transparent communication, and neglecting compliance requirements. Businesses should be vigilant to avoid these pitfalls.

- How can businesses prepare for the future of high-risk PSPs in India?

- Adapting to anticipated changes in regulations and technology, staying informed, and learning from industry experts are essential steps in preparing for the future of high-risk PSP transactions.