Author : Sweetie

Date : 22/12/2023

Introduction

In the dynamic landscape of the Indian market, the collaboration between high-risk Payment Service Providers (PSPs) has become a strategic imperative. This article explores the nuances of such collaborations, delving into the challenges, benefits, and successful case studies that illuminate the path to success.

Definition of High-Risk PSP Business

High-risk PSP Collaboration business involves financial services that, due to regulatory scrutiny or market characteristics, carry a higher level of risk. This could include sectors like online gaming, adult entertainment, or cryptocurrency this approach values input from diverse perspectives in the risk management process..

Importance of Collaboration in the Indian Market

Collaborative Risk Management[1] nvolves employees identifying, assessing, and managing risks. It’s a joint effort where everyone is encouraged to contribute their unique insights and perspectives to achieve a common goal becomes crucial in a market as diverse and complex as India. The regulatory landscape and consumer behaviors a nuanced approach that efforts can provide Collaboration in India.

Regulatory Framework in India

Navigating the regulatory framework is. The Reserve Bank of India (RBI) and other regulatory bodies set the guidelines, making compliance a key factor in successful High Risk PSP Business ventures Understanding the players and their market strategies is essential for any collaboration..

Challenges in High-Risk PSP Business

Regulatory Compliance

Collaboration for High-Risk Stringent regulations require compliance efforts. Collaborators must align their strategies to ensure adherence to local laws and regulations

Security Concerns

Handling sensitive financial data in high-risk businesses demands robust security measures. Collaboration should prioritize data protection and cybersecurity to build trust.

Market Competition

Competition in the Indian market is fierce. Collaborators need to devise strategies that differentiate their services and capture niche markets. this approach values input from diverse perspectives in the risk management process.

Benefits of Collaboration

Risk Mitigation

Pooling resources and expertise helps in mitigating individual risks. High Risk Merchant Accounts[2] can share the burden of compliance and regulatory challenges Partnering with local entities provides invaluable insights into market dynamics, consumer behavior, and regulatory intricacies.

Enhanced Innovation

Collaboration fosters innovation by combining the strengths of different entities. This is crucial in high-risk PSP sectors where adaptability is key. Highlighting real-world examples showcases the feasibility and success of collaborative ventures in high-risk sectors.

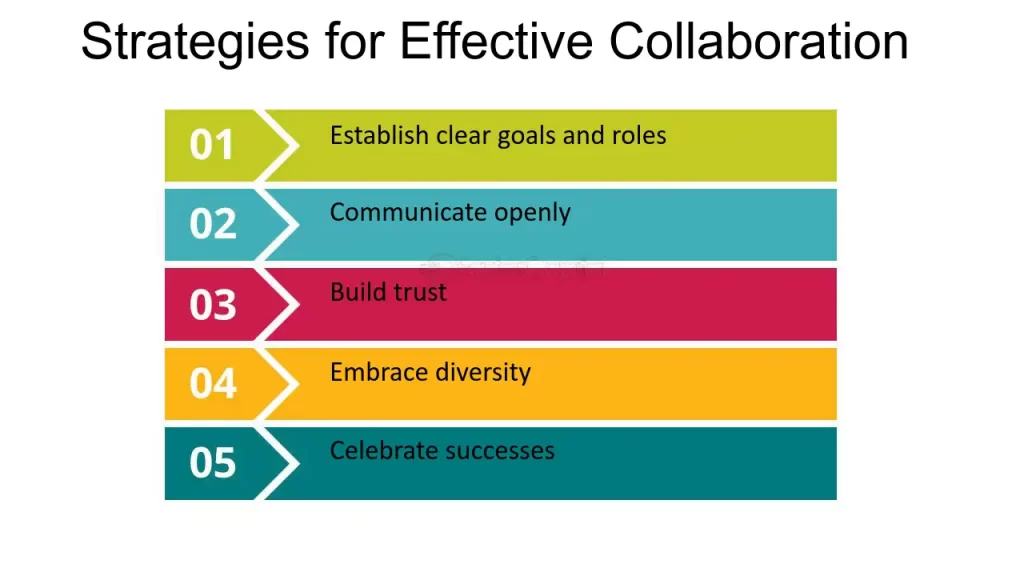

Strategies for Effective Collaboration

Choosing the Right Partner

Selecting a compatible partner is foundational. Shared values, strategic alignment, and complementary strengths contribute to successful collaborations Solutions for High-Risk Merchants[3].

Adapting to Local Market Dynamics

When employees from various roles, backgrounds, and departments are involved in risk management, they bring unique viewpoints Flexibility and adaptability are key to thriving in the Indian market. Collaborators must be attuned to local nuances for sustained success.

Mitigating Regulatory Risks

Understanding and Complying with Indian Regulations

A deep understanding of Indian regulations is essential. High-Risk Businesses[4] Establishing a robust compliance framework ensures a smooth regulatory journey There are always going to be risks associated with operating a business. But, some businesses and products are considered to be high-risk.

Security Measures in Collaborative Ventures

Cybersecurity Best Practices

Navigating the labyrinth of cybersecurity demands not just readiness but a proactive dance, anticipating threats before they cast their shadow, Risks of Strategic Alliances[5] a choreography of vigilance. Regular training, threat assessments, and rapid response mechanisms are crucial.

Navigating Market Competition

Identifying Niche Opportunities

There are always going to be risks associated with operating a business. But, some businesses and products are considered to be high-risk In a competitive landscape, identifying and capitalizing on niche opportunities can be a game-changer for collaborators.

Differentiating Products and Services

Innovation and differentiation are critical for standing out. Collaborators should continually evolve their offerings to meet market demands High-risk merchants could meet both conditions or just one. But they get used to addressing health and safety concerns and the profitability of your business..

Future Outlook for High-Risk PSP Business in India

Emerging Trends

High-risk merchants could meet both conditions or just one. But they get used to addressing health and safety concerns and the profitability of your business. Anticipating and adapting to emerging trends is vital for sustained success. From technological advancements to regulatory shifts, staying ahead is key.

Anticipated Changes in Regulatory Landscape

The regulatory landscape is dynamic. Collaborators must stay informed and agile to navigate upcoming changes effectively. One of the first things investors look for in a business is its ability to generate revenue and profitability.

Conclusion

In conclusion, high-risk PSP business collaboration in India is a challenging yet rewarding endeavor. By understanding and mitigating regulatory risks, prioritizing security, and adopting effective collaboration strategies, entities can thrive in this dynamic market.

FAQ

- Q: What makes a PSP business high-risk in India?

A: High-risk PSP businesses in India are typically those that involve sectors under stringent regulatory scrutiny, such as online gaming, adult entertainment, or cryptocurrency. - Q: How can collaboration mitigate the risks associated with high-risk PSP ventures?

A: Collaboration allows entities to pool resources, share compliance burdens, and benefit from each other’s expertise, thus mitigating individual risks. - Q: What role does regulatory compliance play in successful collaborations?

A: Regulatory compliance is paramount. Successful collaborations hinge on meticulous adherence to Indian regulations governing the financial sector. - Q: How can collaborators differentiate their services in a competitive market?

A: Identifying niche opportunities, innovating products and services, and staying attuned to market dynamics are key strategies for differentiation. - Q: What is the future outlook for high-risk PSP business in India?

A: The future holds opportunities and challenges, with trends like technological advancements and regulatory changes shaping the landscape.