Author : Sweetie

Date : 26/12/2023

Introduction

In the dynamic landscape of digital transactions, businesses in India often find themselves grappling with the challenges posed by high-risk payment service providers (PSPs). These specialized entities play a crucial role in facilitating online payments but come with their own set of complexities. In this article, we will delve into the realm of high-risk PSP collection services in India, exploring the need for such services, key features to consider, top players in the market, regulatory nuances, and the future trends shaping this industry.

In the ever-evolving digital age, the demand for secure and efficient payment processing services has never been higher. Businesses across India, especially those dealing with high-risk transactions, seek reliable solutions to streamline their payment collections. High-risk PSP collection services emerge as the answer to this growing need, providing a specialized approach to handling payments that may be deemed riskier than traditional transactions.

Understanding High-Risk PSPs

High-Risk Payment Processors[1] are entities that specialize in handling transactions that are considered riskier due to various factors such as the nature of the business, high chargeback rates, or potential for fraud. Businesses classified as high-risk often face challenges when dealing with conventional payment processors, making the services of these specialized PSPs essential for their operations.

The Need for Collection Services in India

India has witnessed a rapid increase in online transactions, driven by factors like the widespread adoption of e-commerce and digital payment methods. With this surge comes the need for robust collection services that can navigate the complexities of risk[2] transactions, ensuring seamless and secure payments for businesses across various industries.

Key Features of Effective Collection Services

For businesses considering high-risk PSP collection services[3], certain key features should be at the forefront of their decision-making process. Security measures, High Risk PSP Collection Services in India flexibility in payment options, and quick, efficient processing are crucial elements that contribute to the effectiveness of these services.

Top High-Risk PSP Collection Services in India

Several high-risk PSPs operate in the Indian market, each offering unique features and benefits. A comparative analysis of these services can aid businesses in choosing the right partner for their payment collection[4] needs. From established players to emerging contenders, the market presents a diverse range of options for businesses to explore.

Case Studies

Real-world examples of businesses that have successfully utilized high-risk PSP collection services provide valuable insights. Examining these case studies allows businesses to understand the practical applications of such services and learn from the experiences of others.

Navigating Regulatory Challenges

As with any financial service, Payment service provider[5] operate within a regulatory framework. Understanding the regulatory landscape is crucial for businesses to ensure compliance and avoid potential legal pitfalls associated with payment processing.

Choosing the Right Service for Your Business

Selecting the most suitable high-risk PSP collection service involves considering various factors. From the specific needs of the business to customization options offered by the service provider, businesses should undertake a comprehensive evaluation before making a decision.

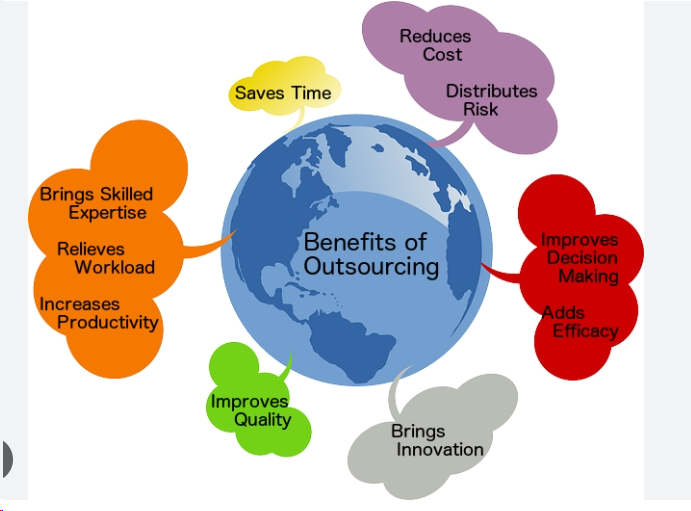

Benefits of Outsourcing Collection Services

Outsourcing collection services to high-risk PSPs can offer businesses cost-effectiveness and the ability to optimize resources. This section explores the advantages of outsourcing, allowing businesses to focus on their core activities while leaving the complexities of payment processing to the experts.

Risks and Mitigations

Identifying potential risks associated with high-risk PSP collection services is crucial for businesses to proactively implement strategies to mitigate these risks From fraud prevention to contingency planning, a well-thought-out risk management approach ensures smooth operations.

Future Trends in PSP Collection Services

The landscape of payment processing is constantly evolving, with technological advancements playing a pivotal role. This section explores the future trends shaping high-risk PSP collection services, providing businesses with insights into what to expect in the coming years.

Customer Testimonials

The experiences of businesses that have embraced high-risk PSP collection services are invaluable. Customer testimonials highlight the tangible benefits of these services, from increased revenue to enhanced customer satisfaction.

Industry Expert Insights

In-depth interviews with industry experts provide a deeper understanding of the challenges and opportunities in the high-risk PSP collection services sector. Expert recommendations and insights can guide businesses in making informed decisions.

Common Misconceptions About High-Risk PSPs

Addressing common myths and misconceptions surrounding high-risk PSPs is essential for businesses considering these services. By clarifying the benefits and drawbacks, businesses can make informed decisions aligned with their goals.

Conclusion

In conclusion, high-risk PSP collection services in India play a pivotal role in enabling businesses to navigate the complexities of online transactions. By understanding the unique challenges, exploring available options, and staying abreast of industry trends, businesses can make informed decisions that contribute to their success in the digital realm.

FAQs

- Are high-risk PSP collection services suitable for all businesses?

- The suitability of these services depends on the nature of the business and its risk profile. Consultation with experts is recommended.

- How do high-risk PSPs prevent fraud in transactions?

- High-risk PSPs employ advanced security measures, including encryption and fraud detection systems, to prevent fraudulent transactions.

- What regulatory compliance should businesses be aware of when using collection services?

- Businesses should be familiar with the regulatory requirements for payment service providers in India, ensuring compliance with relevant laws.

- Can businesses customize high-risk PSP collection services to their specific needs?

- Many service providers offer customization options to cater to the unique requirements of businesses.

- What are the emerging trends in high-risk PSP collection services?

- Emerging trends include the integration of artificial intelligence and blockchain technology for enhanced security and efficiency.