AUTHOR NAME : JASMINE

DATE : 27/12/2023

Introduction

In the fast-paced world of financial services, Payment Service Providers (PSPs) in India face a unique set of challenges when it comes to collections. The process of recovering funds from high-risk accounts requires a strategic and well-thought-out approach. In this article, we will delve into the intricacies of the high-risk PSP collections process in India, exploring the challenges, strategies for mitigation, legal considerations, technological solutions, and industry best practices.

High-risk PSP collections involve the recovery of funds from accounts deemed more likely to default. These accounts may exhibit signs of financial instability, non-compliance, or a history of payment issues.

Importance of a Robust Collections Process

A robust collections process is crucial for the financial health of PSPs. It ensures the timely recovery of funds, minimizes losses, and maintains the overall stability of the financial ecosystem.

Understanding the Challenges

Identifying High-risk Accounts

One of the primary challenges is accurately identifying high-risk accounts. Implementing effective risk assessment tools and methodologies is essential. Collections process[1] PSPs often face challenges such as changing economic conditions, market uncertainties, and evolving customer behaviors. These factors contribute to the complexity of collections.

Regulatory Hurdles in India

Navigating the intricate regulatory landscape in India adds another layer of complexity to high-risk collections. Complying with diverse regulations requires a thorough understanding of legal frameworks. Proactive risk assessment is the cornerstone of successful risk collections[2]. PSPs need to employ advanced analytics to identify potential risks before they escalate High risk PSP Collections process in india.

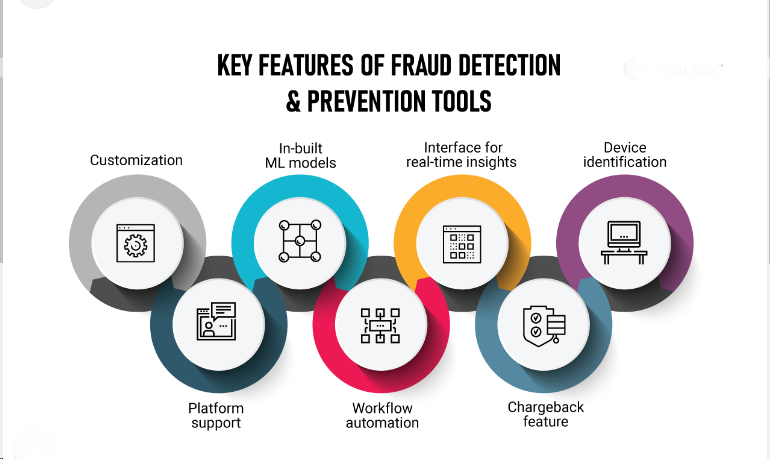

Utilizing Advanced Fraud Detection Tools

Incorporating cutting-edge fraud detection tools enhances the ability to identify and mitigate risks associated with high-risk Customers[3]. Maintaining open and transparent communication with customers is crucial. Proactive engagement can prevent potential issues from escalating.

Legal Framework

Overview of Legal Aspects Related to Collections

Understanding the legal framework surrounding is The Essential Collection[4] . This includes knowledge of debt recovery laws, consumer protection laws, and other relevant regulations. PSPs must navigate the legal landscape in India carefully. Compliance with local regulations is not just a legal requirement but also essential for building trust with customers.

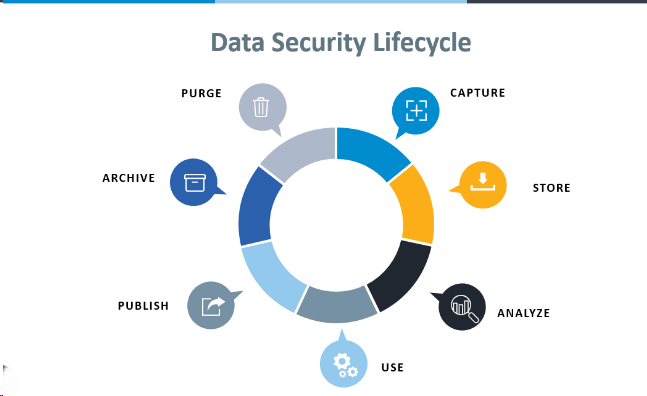

Implementing AI and Machine Learning in Collections

Artificial Intelligence (AI) and Machine Learning (ML) can analyze vast datasets to identify patterns and predict potential risks, enhancing the effectiveness of High risk Payment Processing[5] evolves, ensuring the security of customer data becomes paramount. Implementing robust data security measures is non-negotiable High risk PSP Collections process in india.

Successful Legal Strategies

Examining successful case studies provides insights into effective legal strategies employed by PSPs in India. Technology plays a pivotal role in mitigating risks associated with high-risk collections. Implementing advanced technologies ensures efficiency and accuracy in the process.

Case Studies

Successful Stories of High-risk Collections in India

Examining success stories from the industry provides valuable insights into effective strategies. Learning from peers can guide PSPs in their collections journey. Industry leaders often set benchmarks in high-risk collections. Analyzing their approaches can inspire innovation and improvement in existing processes.

Customer Communication

Importance of Transparent Communication

Transparent communication fosters trust between PSPs and customers. Keeping customers informed about the collections process reduces friction and improves cooperation. Building trust is an ongoing process. PSPs must demonstrate empathy and understanding, especially when dealing with high-risk accounts.

Handling Sensitive Situations Effectively

High-risk collections often involve sensitive situations. Empathetic leaders are more successful. Learn why empathy in the workplace matters and how leaders can show and foster more empathy. Specialized training equips collections teams to navigate high-risk scenarios effectively. Continuous skill development ensures teams stay ahead of emerging challenges.

Developing Specialized Skills

High-risk collections require a unique skill set. Developing specialized skills among team members enhances their ability to navigate complex situations High risk PSP Collections process in india. Embracing a culture of continuous improvement ensures that collections teams evolve with the dynamic nature of high-risk scenarios.

Industry Best Practices

Learning from Global Best Practices

Drawing inspiration from global best practices enables PSPs to adopt proven strategies. Adapting these practices to the Indian context is crucial for success. Collaboration with industry experts provides valuable insights and guidance. Building networks within the industry fosters a culture of knowledge-sharing.

Staying Updated on Emerging Trends

Staying abreast of emerging trends in high-risk collections ensures that PSPs remain proactive and adaptable. Anticipating changes is key to mitigating future risks. The collections landscape is dynamic, with constant changes. PSPs must anticipate and prepare for these changes to stay ahead of the curve.

Preparing for Evolving Risks

Evolving risks require proactive strategies. PSPs should be prepared to adapt their collections processes to address new challenges. Innovation is the cornerstone of sustainability. PSPs should embrace technological and process innovations to ensure long-term success.

Conclusion

In conclusion, the high-risk PSP collections process in India demands a comprehensive and strategic approach. By understanding the challenges, implementing effective strategies, navigating the legal landscape, leveraging technology, and learning from industry best practices, PSPs can build a resilient collections process that adapts to the dynamic Indian market.

FAQs

- What defines a high-risk account in the collections process?

- High-risk accounts exhibit signs of financial instability, non-compliance, or a history of payment issues.

- How can technology assist in mitigating collection risks?

- Technology, including AI and ML, can analyze data to identify patterns and predict potential risks, enhancing the efficiency of collections.

- Are there specific regulations that PSPs must adhere to in India?

- Yes, PSPs must comply with local regulations, including debt recovery laws and consumer protection laws.

- What role does customer communication play in high-risk collections?

- Transparent and proactive communication with customers is crucial for building trust and reducing friction in the collections process.

- How can collections teams stay updated on industry best practices?

- Continuous training, collaboration with industry experts, and staying informed about emerging trends are key to staying updated on best practices.