AUTHOR : JENNY

DATE : 21-12-2023

High-risk payment service providers (PSPs) in India cater to a unique clientele facing specific challenges and opportunities within the financial landscape. Understanding the nuances and complexities of this sector is pivotal for stakeholders seeking to navigate its terrain effectively.

Understanding High-Risk PSPs

High-risk PSPs are entities that serve industries or businesses that typically encounter elevated levels of financial risk, often due to the nature of their operations or market dynamics. Commercial Clientele These entities are crucial for supporting transactions in sectors such as gaming, adult entertainment, or high-ticket item sales.

Factors Defining High-Risk Clients

The classification of high-risk clientele in India involves several elements, Commercial including industries with high chargeback rates, those prone to legal or regulatory changes, and businesses operating in emerging markets.

Importance of High-Risk PSPs in India

In a burgeoning economy like India ,High-Risk Merchant Account[1] play a pivotal role in fostering financial inclusion and supporting businesses that might otherwise struggle to access payment processing services.

Regulatory Hurdles

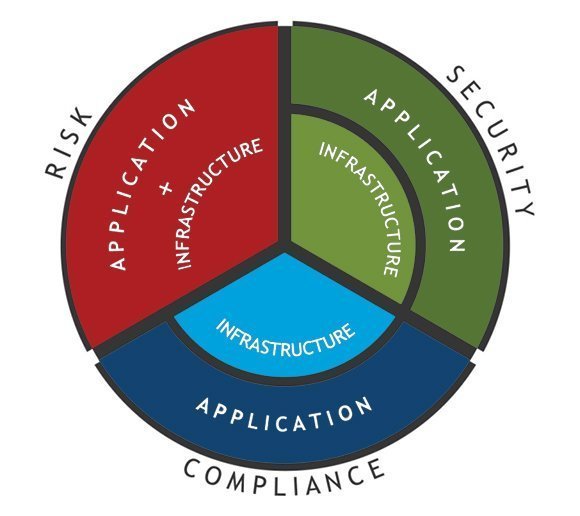

Navigating India’s regulatory framework poses significant challenges for high-risk PSPs. The stringent norms and Clientele In India evolving compliance standards require robust strategies to ensure adherence.

Compliance and Security Issues

Maintaining compliance and robust security measures are paramount for high-risk PSPs to safeguard transactions and Commercial bank[2] protect sensitive financial information. The notion of payment security involves all the comprehensive measures and protocols put in place to protect the integrity of financial transactions within your business.

Financial and Operational Challenges

high-Risk Business[3] Clientele In India Operational and financial hurdles are a constant concern, given the inherently volatile nature of high-risk commercial clientele payment security deserves your undivided attention, so let’s talk about what it is, why you should care, and how you can improve this area of your business operations.

Strategies for Managing High-Risk Commercial Clientele

Robust compliance measures, tailored Risk Mitigation Strategy[4] and leveraging technological innovations are pivotal strategies for managing high-risk clientele effectively It constitutes a true cornerstone of modern online operations involving any type of transfer of funds. Tightly safeguarding your financial transactions should be of utmost importance to you,.

Robust Compliance Measures

When you make a Digital payment solutions[5], your details, such as the credit card number or bank account information, are encrypted before being sent over the internet. Investing in compliance technology and processes is crucial for PSPs to remain with regulations.

Tailored Risk Mitigation Solutions

Customized risk assessment and strategies can help PSPs manage and also reduce potential financial risks associated with their clientele. To keep customer data safe from hackers, credit and debit card issuers require organizations to follow a set of policies and practices developed by the Payment Card Industry

Technology and Innovation in High-Risk PSPs

Adopting innovative technology can operations, enhance security, and also improve overall efficiency for PSPs in India. However, by implementing the appropriate solutions, organizations can foster a secure payment environment and gain a competitive edge in the market, strengthening consumer trust and enabling efficient compliance practices.

Growth Potential and Opportunities in the High-Risk PSP Sector in India

Despite challenges, the PSP sector in India holds immense growth potential. Security of payments is a complex challenge that necessitates a diverse and adaptable range of technologies.

Emerging Market Trends

High Risk PSP Commercial Clientele In India Trends indicate an increasing need for PSP services, providing an opportunity for growth and also diversification heir role is to guard against potential threats and vulnerabilities your money-related operations are exposed to every day..

Investment Prospects

Investors keen on the fintech landscape in India are eyeing PSPs for their potential returns and unique within the market. complying with relevant regulations and standards, and minimizing financial losses. Payment security solutions aim to maintain the payment data’s integrity,

Expansion Possibilities

Payment security needs to be a priority for all organizations that process, store, or transmit payment information, including payment card data. With the right strategies, PSPs can expand their services, tapping into new markets and their offerings to attract diverse clientele.

Challenges Faced by High-Risk PSPs in India

Regulatory Hurdles

India’s financial landscape is by regulations. High-risk PSPs must these complex frameworks, often legal expertise to ensure compliance. Payment security solutions are the technology, processes, and measures put in place to protect payment transactions and sensitive customer information from unauthorized access

Compliance and Security Issues

Maintaining compliance with ever-evolving standards while sensitive financial data poses continuous challenges. High-risk PSPs need to invest in robust security measures to protect against cyber threats and also data breaches.

Financial and Operational Challenges

Operating within industries prone to market fluctuations or legal ambiguities introduces financial uncertainties. Balancing operational stability while managing financial risks remains an ongoing challenge.

Strategies for Managing High-Risk Commercial Clientele

Robust Compliance Measures

Deploying sophisticated compliance tools and employing experts capable of interpreting and implementing regulatory changes effectively is crucial. Regular audits and also updates ensure to evolving norms.

Tailored Risk Mitigation Solutions

High-risk PSPs must offer customized risk assessment tools and also solutions, providing their clientele with options to mitigate potential financial risks associated with their operations Encryption is the lock mechanism protecting this chest, making sure that even if it falls into the wrong hands, its contents remain inaccessible..

Technology and Innovation

Innovative technology solutions, like AI-driven fraud detection systems and also blockchain-based security protocols, play pivotal roles in ensuring secure transactions while efficiency. payment processing security, encryption is the process of converting sensitive data into an unreadable format.

Growth Potential and Opportunities

Emerging Market Trends

The Indian market is witnessing a surge in demand for specialized payment services, creating opportunities for high-risk PSPs to cater to niche industries. Payment data can be thought of as a treasure chest full of valuable information, ready to be transported across the digital seas.

Investment Prospects

Investors eye the potential returns from the dynamic PSP sector in India. These entities are becoming increasingly attractive due to their specialized positioning. Payment security is a bulwark you put up to fend off the inevitable threats, ensuring trust and financial stability.

Expansion Possibilities

High-risk PSPs can explore avenues to expand their services by their offerings, tapping into new markets, and partnerships to reach a broader clientele. There are several essential ways of safeguarding your business operations you need to know about. Let’s discuss how you can bolster your defense systems, thus protecting your assets and fortifying your reputation.

Conclusion

Navigating the complexities of high-risk commercial clientele in India requires a delicate balance between regulatory compliance, technological innovation, and tailored risk management strategies. Despite challenges, the sector holds immense potential for growth and also diversification, making it an enticing prospect for both investors and also stakeholders.

FAQs

- What defines a high-risk PSP client in India? High-risk PSP clients often operate in industries with financial volatility, legal uncertainties, or high chargeback rates, necessitating specialized payment services.

- How do high-risk PSPs manage regulatory challenges in India? By investing in compliance technology, staying abreast of regulatory changes, and tailoring strategies to meet evolving norms.

- Why is technology crucial for managing high-risk clientele? Technology helps streamline operations, fortify security measures, and provide customized solutions to mitigate financial risks.

- Are there growth opportunities for high-risk PSPs in India? Absolutely. Emerging market trends and increasing demand for specialized payment services present growth prospects.

- What role do high-risk PSPs play in India’s financial landscape? They facilitate financial inclusion by supporting businesses that struggle to access mainstream payment processing services, contributing to economic growth.