AUTHOR : JAYOKI

DATE : 21/12/2023

Introduction

In the dynamic landscape of commercial transactions in India, the concept of high-risk PSP (Payment Service Provider) transactions has garnered significant attention. This article delves into the intricacies of such transactions, exploring their definition, regulatory challenges, and the impact on businesses Commercial Transactions

Regulatory Landscape

Navigating the regulatory landscape is crucial in understanding the dynamics of high-risk PSP commercial Transactions in India. The article provides an overview of the existing framework and sheds light on the compliance challenges faced by businesses operating in this space.

Identifying High-Risk Transactions

Understanding the characteristics and indicators of High-Risk PSP Commercial Transactions in India high-risk transactions is essential for businesses to stay vigilant. This section explores the telltale signs and common indicators that mark a transaction as high risk.

Impact on Businesses

High-risk transactions pose operational and financial challenges for businesses. This section outlines the specific challenges and explores the potential financial implications, emphasizing the need for proactive risk management.

Mitigation Strategies

To counter the challenges posed by high-risk transactions, businesses must adopt robust mitigation strategies. The article discusses due diligence measures and the implementation of advanced security protocols as effective strategies.

Emerging Technologies

The role of technology in mitigating risks cannot be overstated. The article explores the impact of emerging technologies on risk management, offering a glimpse into future trends in the industry High-Risk Business[1].

Collaborative Approaches

Addressing high-risk transactions requires collaborative efforts. This section discusses the importance of industry cooperation and collaboration between the government and businesses in developing effective risk mitigation strategies High Risk Merchant Accounts[2]

Educating Stakeholders

Creating awareness and imparting knowledge to stakeholders is crucial for building a resilient ecosystem. The article explores training programs and awareness initiatives aimed at educating businesses and consumers about high-risk transactions.

Expert Insights

Interviews with industry experts provide a deeper understanding of the challenges and opportunities in managing high-risk transactions. Perspectives from experts shed light on effective risk management[3] practices.

Balancing Innovation and Security

Encouraging innovation while maintaining robust security protocols is a delicate balance. This section explores ways to foster innovation in the payment industry while against potential risks Financial Risk Management Strategies[4] are a plan of action or policies that are designed to deal with various forms of financial risk.

Future Outlook

Anticipating changes in the landscape is essential for businesses to stay ahead. The article provides insights into the expected shifts in the industry and offers recommendations for preparedness.

Blockchain and Distributed Ledger Technology

The decentralized nature of blockchain technology makes it secure. By storing transaction data across a distributed network, the risk of a single point of failure is . This section delves into how blockchain and distributed ledger technology offer transparency and immutability, the security of high-risk transactions[5].

Biometric Authentication

One notable innovation in the payment industry is the widespread adoption of biometric authentication. Fingerprint scanning, facial recognition, and even voice recognition are becoming common methods of ensuring the identity of individuals involved in transactions. This section explores how biometric authentication adds an extra layer of security without user convenience.

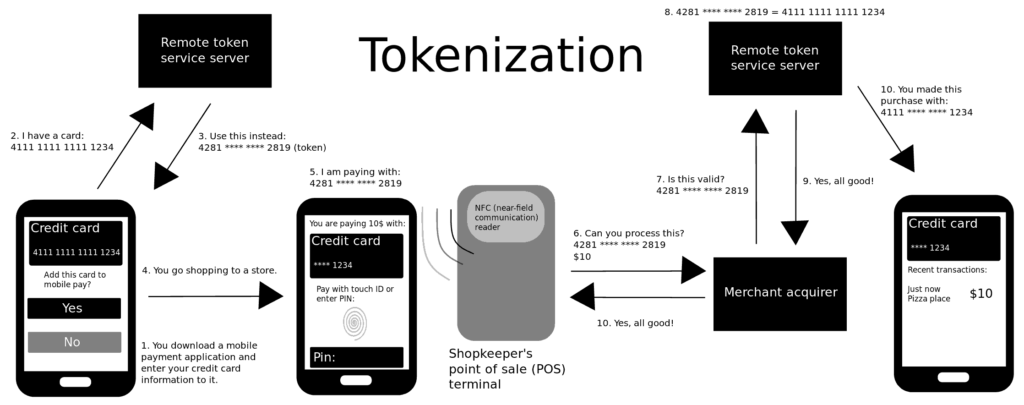

Tokenization

Tokenization is another groundbreaking technology that enhances transaction security. By replacing sensitive information with a unique token, businesses can significantly reduce the risk of data breaches.

Conclusion

In conclusion, high-risk PSP commercial transactions present both challenges and opportunities. This article has explored the nuances of these transactions, from regulatory hurdles to mitigation strategies, with the aim of fostering a secure and innovative payment ecosystem.

FAQs

1 Q: What defines a high-risk PSP commercial transaction? A: High-risk transactions typically involve factors such as large sums, international elements, or suspicious patterns, making them prone to potential fraud or regulatory scrutiny.

2 Q: How can businesses navigate compliance challenges? A: Businesses can variety compliance challenges by staying informed about regulatory changes, conducting thorough due , and implementing advanced security measures.

3 Q: Are there specific industries more prone to high transactions? A: Industries dealing with high volumes of online transactions, such as e-commerce and fintech, are often more to transactions.

4 Q: What role does technology play in risk ? A: Technology plays a pivotal role in risk , offering solutions such as advanced fraud systems and secure payment .

5 Q: How can stakeholders stay informed about regulatory changes? A: Stakeholders can stay informed by regularly monitoring regulatory updates, participating in industry forums, and engaging with regulatory bodies to understand evolving compliance requirements.