AUTHOR : ZOYA SHAH

DATE : 26-12-2023

Introduction

In today’s fast-paced financial landscape the term “high-risk PSP” has gained prominence, especially concerning credit card debt consolidation in India. This article aims to guide individuals through the process of consolidating credit card debt with high-risk payment service providers (PSPs). Let’s delve into the intricacies of these services and explore the steps to achieve financial freedom[1].

Understanding High-Risk PSPs

High-risk PSPs, or payment service providers[2], cater to businesses or individuals categorized as high-risk due to various factors such as credit history, industry type, or transaction volume. These providers offer unique solutions to those facing challenges in traditional financial settings. However, it’s essential to comprehend the associated risks before diving into debt consolidation[3].

Challenges of Credit Card Debt in India

India has witnessed a surge in credit card[4] usage, accompanied by the challenges of mounting debt. Understanding the landscape is crucial, as many individuals grapple with issues like high-interest rates, multiple due dates, and varying payment structures.

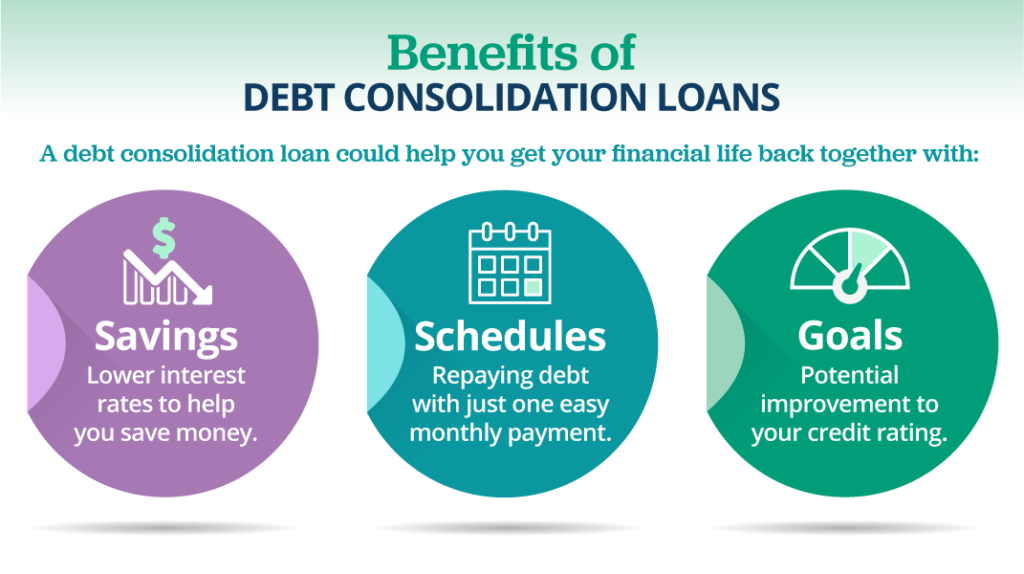

Benefits of Debt Consolidation

Consolidating credit card debt through high-risk PSPs comes with several advantages. Lower interest rates, simplified repayment structures, and the potential improvement of credit scores make this a viable option for those seeking financial relief.

Choosing the Right High-Risk PSP for Consolidation

Selecting the right high-risk PSP requires careful consideration. Factors such as interest rates, reputation, and customer reviews should be weighed to ensure a seamless and beneficial consolidation process. High Risk PSP Consolidate Credit Card Debt In India.

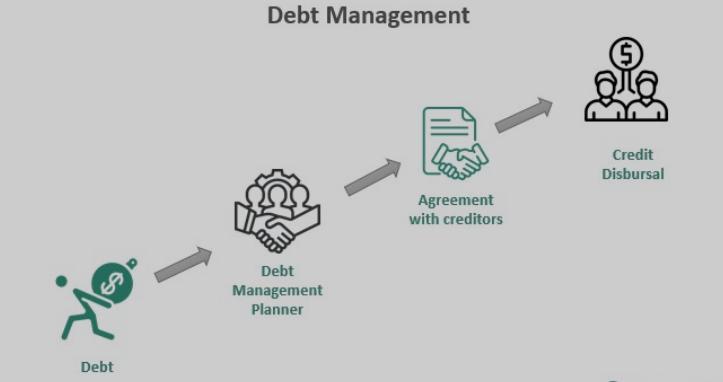

Application Process

Embarking on the debt consolidation journey involves a straightforward application process. This section provides a step-by-step guide and outlines the necessary documentation for a successful consolidation.

Managing Debt Consolidation Effectively

Once the consolidation is in place, effective management becomes paramount. Creating a budget and adopting smart financial planning practices are key components in maintaining a healthy financial status.

Impact on Credit Score

Understanding how debt consolidation affects credit scores is essential. Contrary to common misconceptions, the long-term impact can be positive, contributing to improved credit health.

Success Stories

Real-life success stories serve as inspiration for those contemplating debt consolidation. Personal accounts of individuals who successfully navigated the process shed light on the potential benefits .High Risk PSP Consolidate Credit Card Debt In India.

Common Misconceptions

Addressing misconceptions surrounding debt consolidation is crucial. Dispelling myths and clarifying doubts about high-risk PSPs provide a clearer perspective for individuals considering this financial strategy.

Future Financial Planning

The article provides valuable insights into future financial planning[5], offering tips to prevent future debt accumulation and maintain financial discipline.

Customer Testimonials

Positive customer testimonials highlight the success stories of individuals who chose to consolidate their credit card debt with high-risk PSPs, emphasizing the positive outcomes of their decisions.

Risks and Precautions

Acknowledging potential risks and taking precautionary measures is essential for a successful debt consolidation journey. This section outlines common challenges and suggests proactive measures.

Comparative Analysis

A comparative analysis of different high-risk PSPs provides readers with a comprehensive understanding of available options. Highlighting the strengths and weaknesses of each helps individuals make informed decisions.

Conclusion

In conclusion, debt consolidation through high-risk PSPs provides a strategic approach to managing credit card debt in India. Understanding the process, benefits, and potential challenges is key to making informed decisions for a secure financial future

Summarizing the key points discussed throughout the article, the conclusion emphasizes the importance of responsible financial decisions and encourages readers to take control of their credit card debt through informed choices.

FAQs

- Is debt consolidation suitable for everyone?

- Debt consolidation is a viable option for many, but individual circumstances vary. It’s advisable to assess personal financial situations before making a decision.

- How long does the debt consolidation process take?

- The duration depends on factors such as the chosen high-risk PSP, the complexity of the debt, and the efficiency of document submission. On average, it can take a few weeks to a couple of months.

- Will debt consolidation affect my credit score negatively?

- Initially, there may be a slight impact, but in the long run, responsible debt consolidation can contribute to an improved credit score.

- Can I consolidate other types of debt besides credit card debt?

- Yes, high-risk PSPs often offer solutions for various types of debt, including personal loans and business-related debts.

- What happens if I miss a payment after consolidating my debt?

- Missing payments can have adverse effects. It’s crucial to adhere to the agreed-upon repayment plan to avoid complications.