AUTHOR: KHOKHO

DATE: 26/12/2023

Introduction to High-Risk PSP Consolidation Loans

In a financial landscape where challenges abound, high-risk borrowers in India often find themselves grappling with multiple debts and high interest rates. High-risk PSP Consolidation Loans emerge as a beacon of hope for individuals facing such predicaments. High-risk PSP Consolidation Loans in India offer a structured approach to managing debts[1] effectively.

Understanding the Indian Financial Landscape

India’s diverse economic landscape poses unique challenges for borrowers, especially those labeled as high-risk by financial institutions. High-Risk PSP Consolidation Loans in India These challenges range from fluctuating interest rates to stringent eligibility criteria.

The Need for PSP Consolidation in India

High-risk borrowers in India face an uphill battle when trying to secure favorable loan terms. PSP consolidation[2] becomes a necessity, providing a pathway to financial stability and simplified debt management.

Key Players in the High-Risk PSP Consolidation Market

Several financial institutions recognize the need for specialized consolidation services for high-risk[3] borrowers. Understanding the key players and their eligibility criteria is crucial for those seeking consolidation.

Navigating the Application Process

Applying for a high-risk PSP consolidation loan can be a daunting task. This section provides a step-by-step guide, offering insights into common pitfalls that applicants should avoid.

Interest Rates and Repayment Plans

One of the critical aspects of consolidation is understanding the interest rates applicable to high-risk borrowers. Tailored repayment plans that align with the borrower’s financial situation[4] play a pivotal role in ensuring successful consolidation.

Case Studies: Successful PSP Consolidation Stories

Real-life success stories highlight the tangible benefits of high-risk PSP consolidation. These case studies shed light on individuals who have successfully overcome financial challenges through consolidation.

Managing Debt After Consolidation

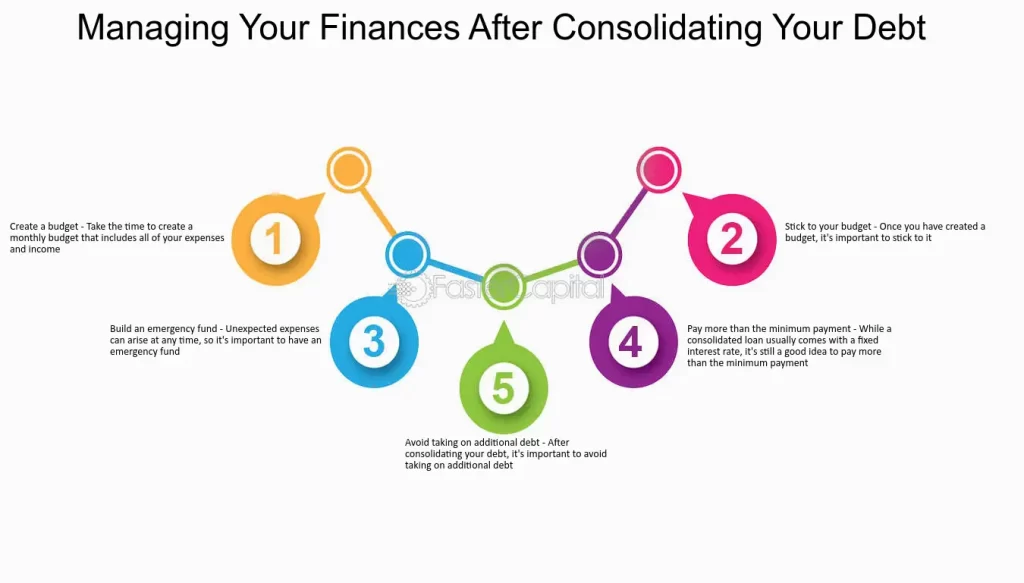

Consolidation is not the end but the beginning of a journey towards financial stability[5]. This section provides practical tips for managing debt responsibly post-consolidation and building a positive credit history.

Risks and Considerations

While mergers offer numerous advantages, it’s essential to be aware of potential risks and challenges. This section outlines considerations and precautions for borrowers contemplating consolidation.

Comparing Options: Traditional vs. Specialized PSP Consolidation

Borrowers must weigh the pros and cons of traditional merger programs against specialized ones tailored for high-risk individuals. Understanding the differences helps in making informed decisions.

Legal Implications and Consumer Protection

This section delves into the legal aspects of mergers, emphasizing consumer rights and protections. Awareness of legal frameworks ensures a secure and fair merger process.

The Role of Credit Counseling

Credit counseling is a valuable resource for individuals navigating the merger process. This section explores the importance of credit counseling and provides guidance on finding reputable services.

Building Financial Literacy

Empowering borrowers with financial education is crucial for their long-term financial well-being. This section discusses strategies for building financial literacy and making informed financial decisions.

Promoting Financial Literacy for Sustainable Debt Management

Beyond the immediate concerns of debt mergers, fostering financial literacy is a lasting solution. This section advocates for continuous education on budgeting, investing, and managing credit responsibly. Building financial literacy equips individuals with the tools to navigate the complexities of personal finance.

Addressing Common Misconceptions

Misinformation can deter individuals from exploring the benefits of mergers. By debunking common misconceptions, this section aims to provide clarity and encourage those in need to consider high-risk PSP merger as a viable solution

Conclusion

In a financial landscape where challenges persist, high-risk PSP merger loans stand as a viable strategy for individuals facing uphill battles with debt. This comprehensive guide has explored the intricacies of mergers, from understanding interest rates to navigating the application process. By embracing the benefits of mergers and taking proactive steps toward financial literacy, individuals can pave the way for a brighter, debt-free future.

FAQs

- Can I apply for a merger if my credit score is low?

- Yes, many specialized programs cater to individuals with low credit scores.

- How long does the merger process typically take?

- The duration varies but generally ranges from a few weeks to a couple of months.

- Are there any fees associated with the merger process?

- While some programs may have fees, it’s crucial to review the terms and conditions.

- Can I merge all types of debts, including credit cards and personal loans?

- Most merger programs cover a wide range of unsecured debts.

- What happens if I miss a payment after a merger?

- It’s essential to communicate with the lender; some flexibility may be available.