AUTHOR : MICKEY JORDAN

DATE : 23/12/2023

Introduction

High-Risk PSP Corporate Procurement in India In the dynamic ,landscape of corporate procurement in India, the selection of Payment Service Providers (PSPs) comes with its own set of challenges. This article delves into the intricacies of high-risk PSP corporate procurement, exploring the nuances, risks, and strategies associated with this crucial aspect of business operations Procurement in India.

Definition of High-Risk PSP Corporate Procurement

In the realm of business transactions, high-risk PSP corporate procurement refers to the careful selection and engagement of Payment Service Providers with a higher-than-average risk profile. High-Risk PSP Corporate Procurement in India Understanding this concept is paramount for businesses seeking efficient and secure payment solutions.

Significance in the Indian Business Landscape

As the Indian business ecosystem evolves, the significance of choosing the right High-Risk PSP Procurement in India Procurement in India becomes increasingly vital. The article explores why high-risk PSPs play a crucial role in the success and security of transactions in India.

Understanding High-Risk PSPs

Characteristics of High-Risk Payment Service Providers

Identifying the key characteristics that classify a PSP as high-risk is essential for businesses. From transaction volumes to industry reputation, this section sheds light on the factors contributing to the Procurement Risk Management[1].

Examples of High-Risk PSPs

Concrete examples help illustrate the diversity of high-risk PSPs in the market. Procurement Service Provider[2] Real-life instances provide insights into the challenges and advantages associated with different providers Several procurement companies are emphasizing outsourcing everything from procurement to procure-to-pay.

Corporate Procurement Challenges in India

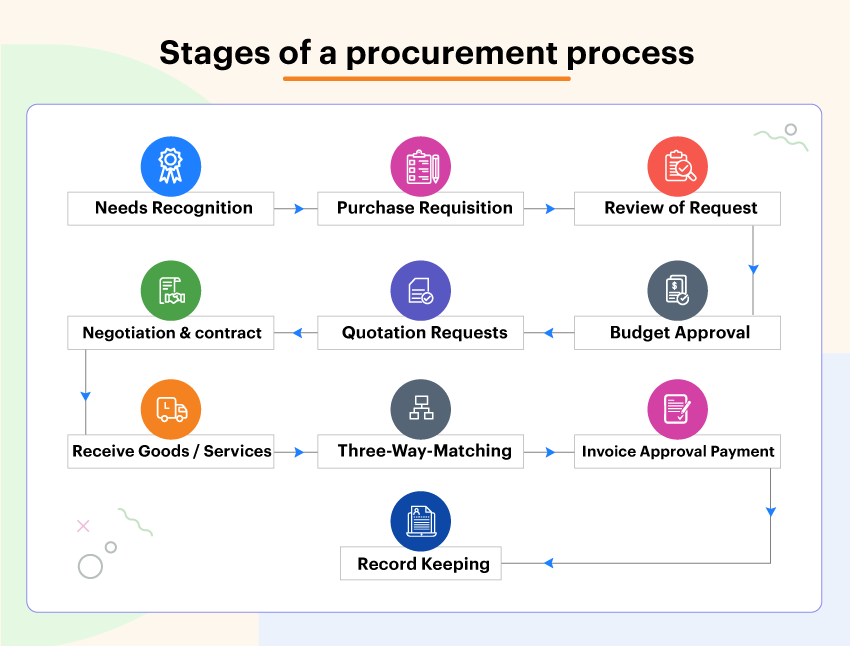

Overview of Corporate Procurement Practices

Before delving into challenges, a brief overview of practices in India sets the stage. Understanding the context allows readers to grasp the unique challenges posed by high-risk PSPs. the existing financial environment, small, medium, and large-sized firms are utilizing product-sourcing services to a substantial extent. The procurement service provider market has also undergone several changes.

Identified Challenges in High-Risk PSPs

This section details the specific challenges businesses face when opting for high-risk PSPs, ranging from regulatory compliance issues to potential financial risks. Several procurement companies are emphasizing outsourcing everything from procurement to procure-to-pay Supply Chain Risk[3]

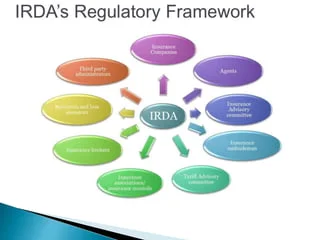

Regulatory Framework in India

Current Regulatory Landscape

A comprehensive examination of the current regulatory framework governing PSPs in India provides businesses with crucial insights into compliance requirements Supplier Risk Assessments[4].

Compliance Requirements for High-Risk PSPs

Navigating the regulatory landscape becomes even more critical when dealing with high-risk PSPs. This section outlines the specific compliance requirements that businesses must adhere to. Some technology agencies are also concentrating on outsourcing the procure-to-pay method across the indirect and direct total spending

Mitigating Risks in Corporate Procurement

Risk Management Strategies

Effective risk management is the cornerstone of successful corporate procurement. This section explores strategies to risk mitigation[5] the inherent risks associated with high-risk PSPs.

Due Diligence in PSP Selection

Thorough due diligence is paramount in selecting a high-risk PSP. Readers gain actionable insights into the steps involved in conducting comprehensive due diligence When common risk instances occur, circumstances can make them detrimental to an organization. .

Emerging Trends in PSP Procurement

Technological Innovations

As technology continues to advance, this section explores emerging trends in PSP procurement, including innovations that can revolutionize the landscape. If an organization isn’t equipped to deal with the problem, the minor issue might turn into something catastrophic,

Future Prospects in High-Risk PSPs

Anticipating the future helps businesses stay ahead. Insights into the future prospects of high-risk PSPs The best way to prevent this from happening is having a risk mitigation plan in place. If an event occurs, enable corporations to make informed decisions.

Impact on Business Operations

Effects on Operational Efficiency

High-risk PSPs can impact operational efficiency. This section delves into the potential effects on day-to-day business operations. the organization has contingency plans to mitigate the damage that the organization sustains. Risk mitigation focuses on the inevitability of some disasters and is most often used where a threat is unavoidable.

Financial Implications of Choosing High-Risk PSPs

The purpose of the risk mitigation plan is to prepare for the worst and come to terms with the fact that one or some disasters that are listed can occur. Once that realization has been made, it’s the responsibility Understanding the financial implications of engaging high-risk PSPs is crucial for businesses. This section explores the economic considerations involved.

Building a Robust Corporate Procurement Strategy

Steps to Develop a Strategic Procurement Plan

Crafting a robust procurement strategy is essential for mitigating risks. This section provides actionable steps to develop a strategic plan tailored to high-risk PSPs. At the broadest level, risk mitigation requires a team of people, processes and technology

Integrating Risk Mitigation in Procurement Processes

Embedding risk mitigation measures within the processes ensures a proactive approach to dealing with high-risk PSPs. A project management team would be the best business strategy to evaluate risks The risk mitigation process is not one-size-fits-all and will not be the same from one organization to the next..

Importance of Thorough PSP Assessment

Highlighting the critical role of due diligence, this section emphasizes why businesses cannot afford to overlook the importance of assessing high-risk PSPs thoroughly. However, there are several steps that are relatively standard when making a thorough risk mitigation plan.

Factors to Consider in Due Diligence

Detailing the specific factors businesses should consider during due diligence helps streamline the process and make informed decisions Risk evaluation compares the severity of each possible risk and ranks them according to prominence and consequence. .

Stakeholder Perspectives

Insights from Corporations

This is a vital step as organizations must decide which risks have the most damning effect on the organization and its workforce. Gaining insights from corporations that have navigated provides readers with valuable perspectives and lessons learned.

Views from Payment Service Providers

Understanding the viewpoints of high-risk PSPs adds depth to the narrative, offering a holistic view of the challenges and opportunities in the industry.

Navigating Legal Challenges

Legal Considerations in High-Risk PSP Agreements

Also, in this step, an organization establishes an acceptable level of risk for different areas. Legal challenges are inherent in high-risk PSP agreements. This section provides an overview of legal considerations businesses should keep in mind.

Addressing Contractual Disputes

In the event of disputes, having a clear understanding of how to address contractual issues is crucial. This section offers guidance on navigating disputes effectively. This will then create a reference point for the business and better prepare the resources that are needed for business continuity.

Adapting to Dynamic Market Conditions

Flexibility in Corporate Procurement Strategies

Flexibility is key in adapting to market changes. This section explores how businesses can remain agile in their procurement strategies amid dynamic market conditions.

Agility in Response to Market Changes

Highlighting the importance of agility, this section provides practical tips on how businesses can swiftly respond to market changes affecting high-risk PSP procurement. Risks can change and so can risk levels depending on several different factors. The monitoring phase in the risk mitigation plan

Conclusion

Summarizing the key points reinforces the essential insights covered throughout the article, providing readers with a concise overview. The conclusion emphasizes the critical importance of informed decision-making in procurement, leaving readers with a clear understanding of the topic.

FAQs

- What makes a Payment Service Provider high-risk? High-risk PSPs often exhibit characteristics such as elevated transaction volumes, a history of disputes, or involvement in industries prone to fraudulent activities.

- How can businesses navigate regulatory challenges in PSP procurement? Businesses can navigate regulatory challenges by staying informed about the current regulatory landscape, ensuring compliance, and actively engaging in due diligence.

- What role do technological innovations play in high-risk PSP procurement? Technological innovations can significantly impact high-risk PSP procurement by introducing more secure and efficient payment solutions, enhancing overall procurement processes.

- Why is due diligence crucial in selecting a high-risk PSP? Due diligence is crucial as it helps businesses assess the risk associated with a PSP, understand their operational practices, and make informed decisions to protect their interests.

- How can corporations build resilience in their procurement strategies? Corporations can build resilience by developing flexible procurement plans, integrating risk mitigation measures, and staying agile to adapt to changing market conditions.