AUTHOR :MICKEY JORDAN

DATE : 21/12/2023

Introduction

High-Risk PSP Corporate Synergy involves strategic collaboration between Synergy in India payment service providers operating in high-risk sectors and various corporate entities. This synergy aims to enhance operational efficiency, manage risks effectively, and explore new avenues for market expansion.

Significance in the Indian Business Landscape

With the rapid evolution of the payment industry and the growing complexity of regulatory frameworks, businesses in India are increasingly PSP Corporate Synergy recognizing the need for collaborative approaches. High-risk PSP corporate synergy emerges as a strategic solution to tackle challenges unique to high-risk sectors.

Understanding High-Risk PSPs

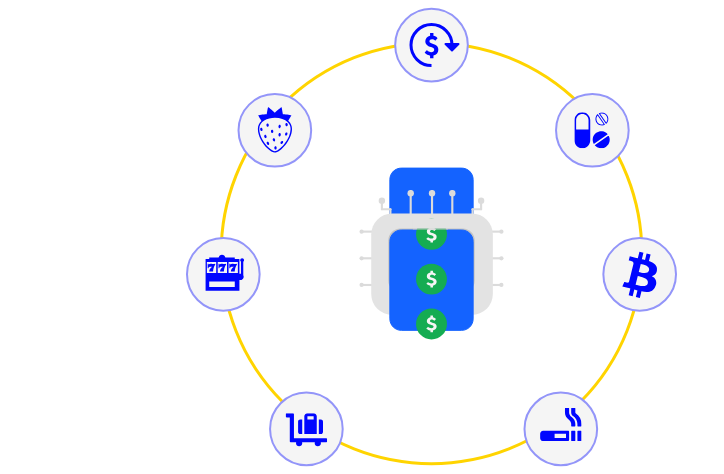

The World of High-Risk Payment Service Providers

High Risk Synergy in India cater to industries that face elevated levels of risk, such as online gaming, adult entertainment, and e-commerce with high chargeback rates. Understanding the dynamics and regulatory environment surrounding high-risk PSPs is crucial for effective collaboration.

Regulatory Framework in India

Navigating the regulatory landscape is a critical aspect of operating in India. High Risk PSP Corporate Synergy in India must comply with stringent regulations, making it essential to stay abreast of legal requirements and adapt business strategies accordingly.

Corporate Synergy: A Key Business Strategy

Defining Corporate Synergy

Corporate synergy involves the combined efforts of two or more entities to achieve a result that is greater than what each entity could achieve . In the context of High Risk Payment Processor[1], corporate synergy becomes a key strategy for overcoming industry challenges and growth.

Benefits of High-Risk PSP Corporate Synergy

Improved Risk Management

Collaborative efforts enable businesses to pool resources and expertise, High-Risk Transaction[2] Corporate Synergy in India enhancing the ability to manage and mitigate risks associated with high-risk payment services[3].

Enhanced Operational Efficiency

Synergies between High-Risk Payment Processor and corporate entities operations, reduce redundancies, and improve overall efficiency, resulting in cost savings and better service delivery.

Market Expansion Opportunities

Corporate synergy opens doors to new market segments, High-risk Business [4]Corporate Synergy in India providing PSPs with opportunities for growth and diversification beyond their traditional customer base.

Navigating Regulatory Compliance

Overview of Regulatory Framework for PSPs

A comprehensive understanding of the regulatory framework payment service providers is crucial. This includes compliance with data protection laws, anti-money laundering regulations, and other industry-specific mandates.

Compliance Strategies for High-Risk Entities

Implementing effective compliance strategies involves continuous monitoring, staff training, and collaboration with regulatory bodies. High-risk PSPs must stay proactive in to evolving regulatory requirements.

Technological Innovations in Payment Services

Emerging Technologies in the Payment Industry

The payment industry is witnessing rapid technological advancements, including blockchain, artificial intelligence, High Risk Merchant Accounts[5] and biometric authentication. High-risk PSPs must stay abreast of these innovations to remain competitive.

Integration Challenges and Solutions

Integrating technologies with existing payment systems can be challenging. Collaborative efforts between high-risk PSPs and technology experts are essential for successful integration and optimal performance.

Strategies for Market Penetration

Targeting Niche Markets

Identifying and targeting niche markets allows high-risk PSPs and corporate entities to capitalize on specific consumer needs, fostering a mutually beneficial relationship.

Building Trust and Credibility

Establishing trust is crucial in high-risk sectors. Corporate synergy can enhance credibility by the reputation and resources of established entities.

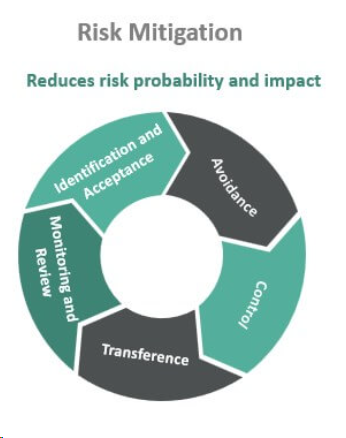

Risks and Mitigation Strategies

Identifying Potential Risks

Thorough risk assessments are essential to identify potential in collaborative efforts. Anticipating challenges enables proactive mitigation strategies.

Developing Effective Mitigation Plans

Creating robust mitigation plans involves implementing safeguards, contingency measures, and continuous monitoring to address risks promptly and effectively.

Future Trends in High-Risk PSP Corporate Synergy

Predictions and Projections

As the payment industry evolves, future trends in high-risk PSP corporate synergy are likely to include increased use of blockchain, enhanced cybersecurity measures, and further integration of artificial intelligence.

Opportunities for Growth

Identifying and capitalizing on emerging opportunities ensures growth for businesses engaged in high-risk PSP corporate synergy.

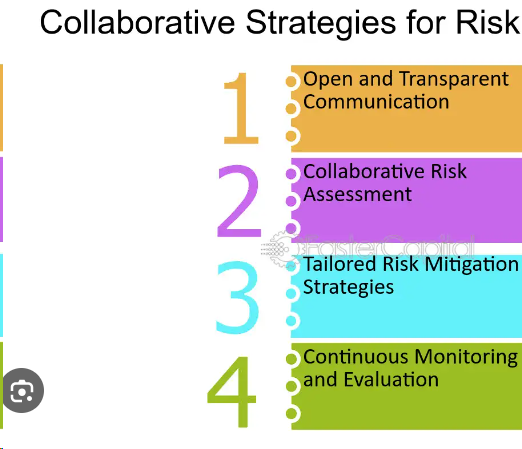

Importance of Collaboration

Building Partnerships for Success

Collaborative partnerships create a synergy that goes beyond individual capabilities, fostering an environment conducive to innovation, growth, and sustained success.

Collaborative Strategies in High-Risk Environments

Developing specific strategies to high-risk environments ensures that collaborative efforts address unique challenges and leverage opportunities effectively.

Conclusion

In conclusion, high-risk PSP corporate synergy in India presents a unique and promising avenue for businesses to navigate challenges and on growth opportunities. By understanding the regulatory landscape, embracing technological innovations, and partnerships, businesses can create a resilient foundation for success in high-risk sectors.

FAQs

- What defines a high-risk payment service provider?

- A high-risk PSP is a payment service provider catering to industries with elevated risk factors, such as online gaming and adult entertainment, often characterized by high chargeback rates.

- How can businesses ensure regulatory compliance in high-risk sectors?

- Businesses can ensure compliance by staying informed about regulatory changes, implementing robust compliance strategies, and collaborating with regulatory bodies.

- What role does technology play in high-risk PSP corporate synergy?

- Technology is crucial for seamless integration and operational efficiency. It enables high-risk PSPs to stay competitive and innovative in the rapidly evolving payment industry.

- Can small businesses benefit from high-risk PSP corporate synergy?

- Yes, small businesses can benefit by leveraging the resources and expertise of high-risk PSPs through strategic collaborations, enabling them to compete in challenging markets.

- What are the future trends in high-risk PSP corporate synergy?

- Future trends include increased use of blockchain, enhanced cybersecurity measures, and further integration of artificial intelligence to address evolving challenges in the industry.