AUTHOR NAME : JASMINE

DATE : 27/12/2023

Introduction

In the fast-paced financial landscape of India, the use of Payment Service Provider (PSP) credit cards has become increasingly prevalent. However, with the convenience of plastic money comes the potential for high-risk credit card debt, a concern that affects many individuals across the country.

In a world driven by plastic money, credit cards have become an indispensable part of our financial transactions. However, with the convenience they offer, there comes a darker side – the realm of high-risk PSP credit card debt. This article delves into the intricacies of this financial challenge in the Indian context, examining its causes, risks, and providing valuable insights on how individuals can navigate through this complex terrain.

Definition of High-risk PSP Credit Card Debt

High-risk PSP credit card debt refers to the situation where individuals find themselves unable to manage and repay their credit card balances, leading to financial instability. The prevalence of high-risk credit card debt is a pressing issue in India, impacting the financial well-being of individuals and contributing to economic challenges Credit Card Debt In India.

Understanding High-risk PSP Credit Card Debt

Explanation of PSP Credit Cards

PSP credit cards, often associated with seamless transactions, can pose risks due to their ease of use and accessibility. Several factors contribute to the strategies to pay off Credit card debt[1] faster, including high-interest rates, fees, and inadequate financial planning.

Common Pitfalls for Credit Card Users

Lack of awareness about hidden charges and the temptation of rewards programs are common pitfalls that trap users in high-risk debt situations. Individuals grappling with Understanding high-risk investments[2] heightened stress and anxiety due to the uncertainty of their financial future High risk PSP Credit card debt in india.

Credit Score Ramifications

High credit card debt can adversely affect credit scores, limiting future financial opportunities and loan approvals. Failure to manage credit card debt[2] may lead to legal consequences, emphasizing the urgency of addressing the issue promptly.

Common Causes of High-risk PSP Credit Card Debt

Unemployment and Income Fluctuations

Economic uncertainties, such as unemployment or income fluctuations, can contribute to individuals falling into high-risk debt. Lack of discipline in spending and succumbing to impulse purchases are major contributors to accumulating high levels of credit card debt.

Lack of Financial Literacy

A significant number of individuals find themselves in high-risk debt due to a lack of understanding of financial concepts and responsible credit card[3] usage. Implementing effective budgeting techniques can empower individuals to take control of their finances and manage their credit card debt responsibly.

Debt Consolidation Options

Exploring debt consolidation options provides an avenue for individuals to streamline their debt into manageable monthly High-risk Merchant Account[4] PSP Credit card debt in india. Open communication and negotiation with creditors can lead to favorable arrangements, making it easier for individuals to repay their debts.

Government Regulations and Initiatives

Current State of Credit Card Regulations in India

Understanding the existing regulations surrounding credit cards is crucial for consumers to protect themselves from unfair practices. Government initiatives and regulatory measures aim to safeguard consumers from falling into high-risk situations[5].

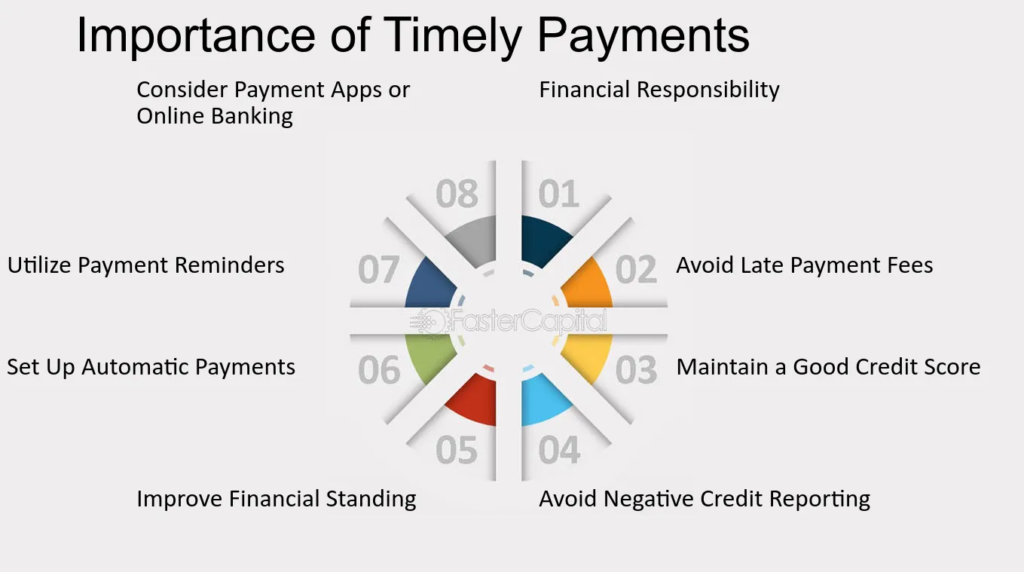

Tips for Responsible Credit Card Usage

Educating Consumers on Responsible Spending

Promoting financial literacy is essential to educate consumers on responsible credit card usage and the consequences of high-risk debt. Emphasizing the significance of timely credit card payments helps individuals avoid late fees and interest charges High risk PSP Credit card debt in india.

Monitoring Credit Card Statements

Regularly monitoring credit card statements enables users to detect any unauthorized transactions and address potential issues promptly. Financial institutions play a crucial role in ensuring responsible lending practices, emphasizing the need for thorough assessments before issuing credit cards.

Customer Support and Financial Counseling

Offering robust customer support and financial counseling services can assist[4] individuals in managing and overcoming high-risk credit card debt. As digital transactions become the norm, it is essential to be aware of the risks associated with online payments and take appropriate precautions. Implementing secure practices, such as using trusted platforms and regularly updating passwords, enhances the security of digital transactions.

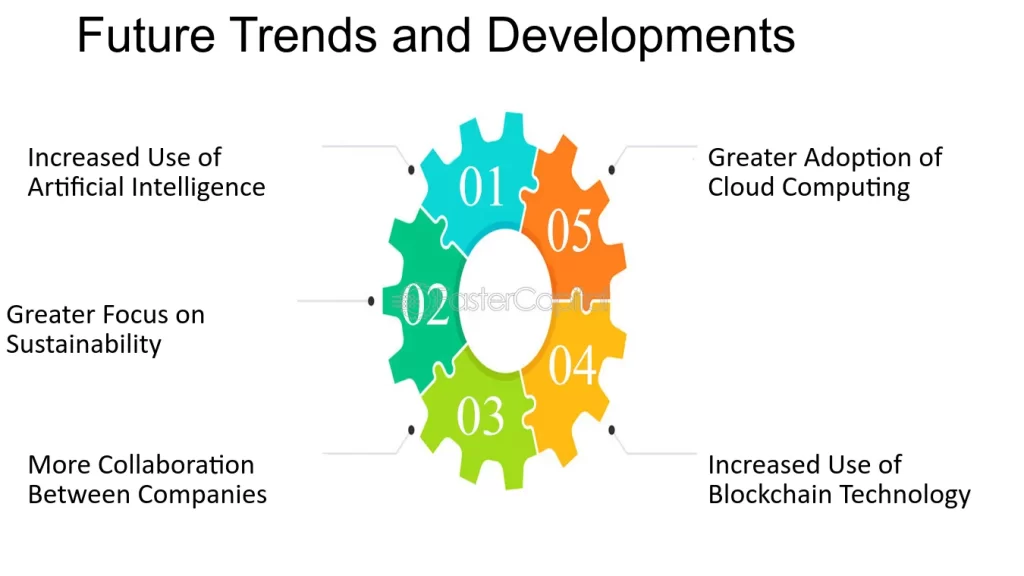

Future Trends and Developments

Technological Innovations in Credit Card Security

Advancements in technology continue to shape credit card security, with biometrics and other innovations playing a crucial role in preventing fraud. The evolving preferences[5] and behaviors of consumers influence the changing dynamics of credit card usage in the Indian market.

Conclusion

In conclusion, high-risk PSP credit card debt demands our attention and proactive measures. By understanding the factors contributing to debt, learning from past cases, and implementing responsible financial practices, individuals can navigate the financial landscape successfully.

FAQs

- Is it possible to negotiate interest rates with credit card companies to reduce high-risk debt?

- Yes, negotiating interest rates is a common practice. Contact your credit card company to discuss possible arrangements.

- How can individuals protect themselves from unauthorized transactions in the digital age?

- Implementing two-factor authentication and regularly monitoring your digital transactions are effective ways to prevent unauthorized activities.

- What role does financial literacy play in avoiding high-risk credit card debt?

- Financial literacy is crucial in making informed financial decisions, helping individuals avoid common pitfalls that lead to high-risk debt.

- Are there government programs to assist individuals in managing high-risk credit card debt?

- Some countries may have debt relief or financial counseling programs. Research available government initiatives and support in your region.

- Can consolidating credit card debt negatively impact credit scores?

- While debt consolidation can initially affect credit scores, it often provides a long-term benefit by making repayments more manageable and improving credit over time.