Author : Sweetie

Date : 26/12/2023

Introduction

In the dynamic landscape of India’s financial sector, the term “High-Risk PSP Credit Counseling” has gained prominence, raising crucial questions about its implications and the strategies needed to address associated challenges.

In simple terms, high-risk PSP credit counseling involves assisting individuals associated with Payment Service Providers (PSPs) facing elevated financial risks. These risks often stem from a variety of factors, including economic fluctuations, regulatory challenges, and technological vulnerabilities. Understanding the significance of high-risk credit counseling is vital in navigating the complexities of the Indian financial ecosystem.

Understanding High-Risk PSPs

Identifying PSPs

Payment Service Providers, or PSPs, play a pivotal role in facilitating transactions. However, not all PSPs operate in a risk-free environment. Some face higher levels of uncertainty due to their business models, client base, or market conditions. High-Risk PSP Credit Counseling in India. Various factors contribute to the heightened risk associated with certain PSPs. These may include market volatility, reliance on specific industries, or inadequate risk management practices within the PSP.

Impact on Credit Counseling

The risks faced by PSPs can directly impact individuals associated with them. Credit counseling[1] in such scenarios becomes a crucial tool for mitigating financial challenges and ensuring sustainable economic practices. One of the primary challenges in the Indian context is the evolving regulatory framework for financial services. The lack of clear guidelines can create uncertainties, making it challenging for credit counseling agencies to navigate the legal landscape.

Economic Factors

India’s economic diversity poses both opportunities and challenges. Credit Counselling High-risk PSPs may find it challenging to adapt to the varied Economic Condition[2] across different states and regions. The rapid advancement of technology is a double-edged sword. While it enhances financial services, it also exposes PSPs to new risks, especially if they lack the infrastructure to withstand cyber threats.

Importance of Quality Credit Counseling

Role in Financial Stability

Quality credit counseling plays a pivotal role in maintaining the stability of the financial system. By addressing risks at their roots, counseling helps prevent widespread financial crises. High-Risk Merchant[3] Individuals associated with high-risk PSPs benefit from counseling by receiving personalized advice on managing their finances in uncertain times. This can include debt management, investment strategies, and contingency planning.

Building Trust in the Financial System

Effective credit counseling contributes to building trust among consumers. When individuals witness successful outcomes through counseling, they are more likely to trust the broader financial system. Recognizing the unique challenges faced by each high-risk PSP, Credit Counseling[4] must be tailored to address specific issues, High Risk PSP Credit Counseling in India ensuring a personalized approach.

Educational Initiatives

Promoting financial literacy is a cornerstone of effective credit counseling. Educating individuals on prudent financial practices empowers them to make informed decisions. Credit card debt[5] Successful credit counseling often involves collaboration between various stakeholders, including government bodies, financial institutions, and non-profit organizations.

The Role of Technology

Fintech Solutions

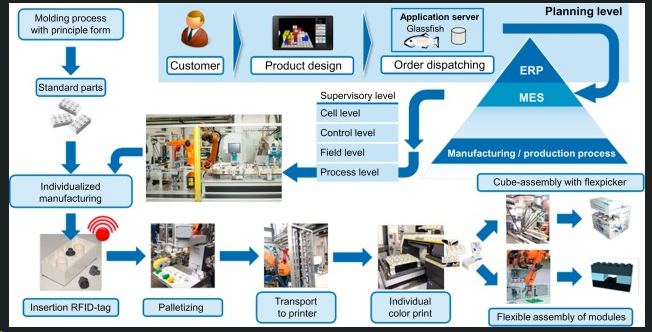

Fintech innovations offer new avenues for addressing challenges in high-risk credit counseling. Credit Environment India Leveraging technology can streamline processes and enhance the effectiveness of counseling programs. The integration of artificial intelligence and machine learning enables credit counselors to analyze vast amounts of data, providing more accurate predictions and personalized advice.

Professional Organizations in the Field

Accredited Counseling Agencies

Highlighting the role of accredited counseling agencies is crucial in establishing trust among individuals seeking assistance. Accreditation ensures a standard of quality and ethical practices. Professional organizations contribute significantly to risk mitigation by employing experienced counselors and adhering to established ethical guidelines.

Government Initiatives

Policies Supporting Credit Counseling

Governments play a vital role in fostering a conducive environment for credit counseling. Supportive policies can incentivize individuals and PSPs to engage in counseling programs. Collaborations between government bodies and non-governmental organizations (NGOs) amplify the reach of credit counseling initiatives, ensuring a broader impact.

Future Trends

Emerging Technologies

Anticipating future trends in technology and finance is crucial for staying ahead of challenges. High-risk credit counseling must evolve alongside technological advancements. Adapting to changes in the regulatory landscape is essential for credit counseling agencies. Staying informed and proactive ensures continued relevance and effectiveness.

Real-World Applications

Implementing Counseling Strategies

Exploring how counseling strategies are implemented in real-world scenarios sheds light on the practical aspects of high-risk PSP credit counseling. Establishing metrics to measure the success of credit counseling programs provides a quantitative understanding of their impact on individuals and the broader financial ecosystem.

Expert Insights

Interviews with Industry Experts

Gaining insights from industry experts provides a nuanced understanding of the challenges and opportunities in high-risk PSP credit counseling. Experts can offer valuable perspectives on the evolving nature of high-risk credit counseling and the strategies needed for success.

Common Misconceptions

Debunking Myths Surrounding High-Risk PSPs

Addressing common misconceptions about high-risk PSPs is essential for fostering an accurate understanding among the general public. Dispelling misconceptions about credit counseling ensures that individuals recognize its value and actively seek assistance when needed.

Building Financial Resilience

Individual Responsibilities

Empowering individuals to take responsibility for their financial well-being is a core aspect of credit counseling. Encouraging proactive financial planning enhances overall resilience. Promoting long-term financial planning ensures that individuals are prepared for uncertainties, reducing the overall impact of high-risk situations.

Conclusion

In conclusion, high-risk PSP credit counseling in India is a dynamic field that requires adaptive strategies, collaboration, and a forward-looking approach. By addressing challenges at their roots and promoting financial literacy, the impact of credit counseling extends beyond individuals to the broader financial system.

FAQs

- Is credit counseling only for individuals facing financial challenges? Credit counseling is beneficial for individuals at various stages of their financial journey. It provides guidance on budgeting, debt management, and long-term financial planning.

- How can technology contribute to effective credit counseling? Technology, including AI and machine learning, can enhance the accuracy of predictions, personalize advice, and streamline counseling processes for better outcomes.

- What role do government initiatives play in high-risk credit counseling? Government initiatives create a supportive environment, offering policies and incentives that encourage individuals and PSPs to engage in credit counseling programs.

- Are all PSPs considered high-risk, or are there specific criteria? Not all PSPs are high-risk. Criteria may include market volatility, reliance on specific industries, or inadequate risk management practices.

- How can individuals contribute to building financial resilience? Individuals can contribute by actively participating in credit counseling programs, practicing financial literacy, and engaging in long-term financial planning.