Author : Sweetie

Date : 27/12/2023

Introduction

In the dynamic landscape of financial transactions, Payment Service Providers (PSPs) play a crucial role in facilitating seamless payments. However, the realm of credit inquiries associated with PSPs in India has recently witnessed a surge in high-risk scenarios, creating concerns for both borrowers and lenders.

Definition of High-Risk PSP Credit Inquiry

High-risk PSP credit inquiries refer to instances where the associated credit inquiry poses an elevated level of risk, often leading to potential negative consequences for the involved parties.

Significance in the Indian Financial Landscape

Understanding the impact of high-risk PSP credit inquiries is vital as it directly influences the creditworthiness of individuals and the risk exposure of financial institutions. High Risk Payment card industry[1] Inquiry in India Payment Service Providers serve as intermediaries, facilitating electronic transactions between consumers and merchants, and are integral to the Indian financial ecosystem.

Role in Credit Inquiries

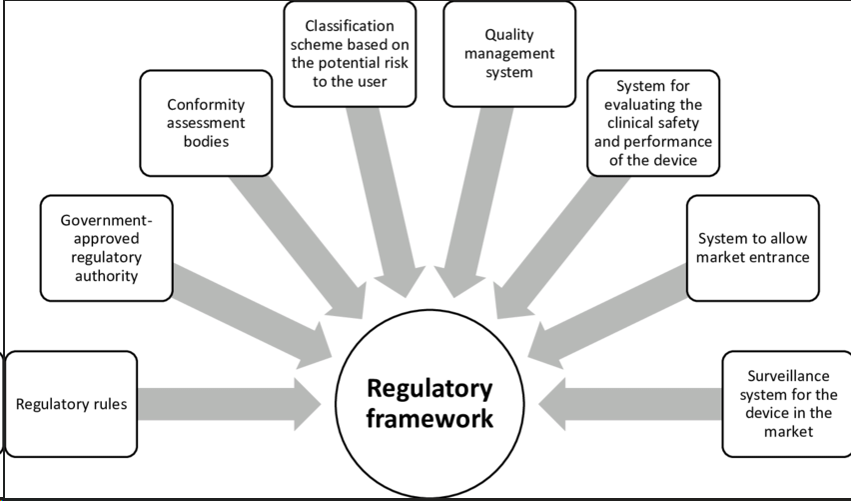

PSPs contribute to credit inquiries by providing valuable transaction data that financial institutions use to assess the creditworthiness[2] of individuals. The absence of a comprehensive regulatory framework has created a breeding ground for credit inquiries, leading to potential misuse of financial data.

Increased Vulnerability to Fraud

The Developing nature of financial fraud poses a significant threat, making credit inquiries Vulnerable to and misuse. High-risk CPP Investments[3] can Negatively impact credit scores, affecting an One’sability to secure loans or credit. Navigating the complexities of high-risk credit inquiries requires a deep understanding of the factors Adding to Increased risk levels.

Addressing Perplexing Scenarios

“Implementing effective strategies, especially when navigating perplexing scenarios, is not only essential for both debtors and lenders but also crucial to ensuring and securing their financial interests.” Understanding burstiness in Credit Inquiries Impact[4] involves analyzing sudden spikes in activity, which may indicate potential risks. Leveraging technology and proactive measures can help manage burstiness in credit inquiries, ensuring a more stable financial environment.

Impact on Borrowers and Lenders

Borrower’s Perspective

From a borrower’s standpoint, navigating high-risk PSP credit inquiries necessitates awareness and proactive measures to protect personal financial data. Financial institutions must employ robust risk mitigation strategies to Secure against the adverse effects of high-risk credit inquiries.

Navigating High-Risk Situations

Proactive Measures for Borrowers

“Borrowers can, therefore, take proactive steps, such as diligently monitoring transactions, carefully securing personal information, and consistently staying informed about credit activities to safeguard their financial well-being.” Lenders must adopt advanced risk management practices, leveraging technology and data analytics to identify and mitigate high-risk credit inquiries.

The Role of Technology

Technological Solutions for Risk Mitigation

Incorporating advanced technology, such as machine learning and AI, can enhance the efficiency of risk mitigation credit risk management strategies[5] inquiries. The continual evolution of technology offers promising prospects for further improving the accuracy and reliability of credit inquiry processes. Exploring real-life case studies provides valuable insights into the varied scenarios and challenges associated with high-risk credit inquiries.

Lessons Learned

Drawing lessons from past cases enables stakeholders to implement proactive measures and refine existing risk mitigation strategies. Striking a balance between detailed analysis and contextual understanding is crucial for providing comprehensive yet accessible information. “Ensuring that content is not only detailed enough to be informative but also carefully maintains context is, therefore, key to effectively engaging a broad and diverse audience.”

Crafting Compelling Narratives

Engaging the reader involves weaving compelling narratives that make the subject matter relatable and interesting. Encouraging reader involvement through interactive elements and relatable examples enhances the overall reading experience.

Active Voice in Content Creation

Importance of Active Voice

The active voice adds Enthusiasm and clarity to content, making it more engaging and accessible to a wider audience. Incorporating practical examples that use active voice helps readers connect with the content on a personal level. Effective communication involves Providing information Succinctly without sacrificing depth, keeping the reader’s interest intact.

Information Retention Strategies

Implementing strategies to aid information retention ensures that readers grasp and remember key concepts in a brief yet impactful manner. Using rhetorical questions captivates the reader’s attention, prompting them to think and reflect on the content. Analogies provide relatable comparisons that enhance understanding, making complex concepts more accessible.

Conclusion

“In conclusion, effectively navigating high-risk PSP credit inquiries in India not only requires a holistic approach but also demands proactive measures, continuous technological advancements, and, most importantly, collaborative efforts between borrowers and lenders.” As the financial landscape continues to evolve, staying informed and proactive is essential. “Continue to explore and stay abreast of developments, thus ensuring you can effectively adapt and safeguard your financial well-being.”

FAQs

- What defines a high-risk PSP credit inquiry?

- A high-risk PSP credit inquiry involves elevated levels of risk, often leading to potential negative consequences for the involved parties.

- How can borrowers protect themselves from high-risk credit inquiries?

- Borrowers can take proactive steps, such as monitoring transactions, securing personal information, and staying informed about credit activities.

- What role does technology play in mitigating high-risk credit inquiries?

- Technology, including machine learning and AI, plays a crucial role in enhancing the efficiency of risk mitigation strategies in credit inquiries.

- Why is the active voice important in content creation?

- The active voice adds dynamism and clarity to content, making it more engaging and accessible to a wider audience.

- How can lenders effectively manage burstiness in credit inquiries?

- Lenders can leverage technology and proactive measures to manage burstiness in credit inquiries, ensuring a more stable financial environment.