AUTHOR:HAZEL DSOUZA

DATE:26/12/2023

Introduction

In the dynamic landscape of the Indian financial sector, the term “High-risk PSP Credit risk” has gained prominence, sparking discussions about the challenges and potential threats faced by Payment Service Providers (PSPs).”Moreover, thoroughly understanding the Complexities of this phenomenon is not only crucial for industry Experts but also essential for consumers to make informed decisions.”

Understanding PSPs

Explanation of Payment Service Providers

Payment Service Providers play a pivotal role in facilitating financial transactions, ranging from simple fund transfers to complex online purchases. These entities have become indispensable in our increasingly digital world.

Role in the Financial Ecosystem

PSPs act as intermediaries, bridging the gap between consumers, merchants, and financial institutions. “Their remarkable efficiency and unparalleled convenience have significantly reshaped the financial ecosystem; however, this transformation has not come without its share of risks and challenges.” From traditional banks to innovative fintech startups, the spectrum of PSPs is vast. Understanding the diversity within this sector is vital for comprehending the nuanced challenges associated with high-risk credit.

Credit Risks Faced by PSPs

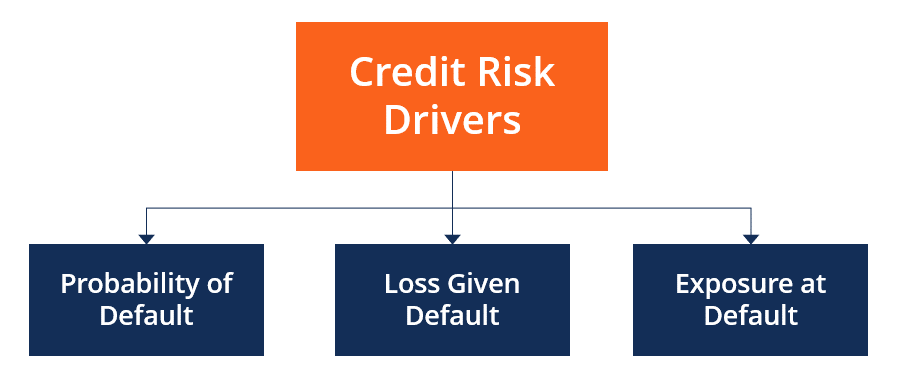

Overview of Credit Risks

Credit risks involve the potential for financial loss due to the failure of a borrower to meet their Payment Obligation[1]. In the context of PSPs, the intricacies of these risks become even more pronounced.

Factors Contributing to High-Risk PSP Credit

Several factors contribute to the elevated credit risks[2] faced by PSPs in India. These may include rapid technological advancements, market volatility, and evolving consumer behaviors. India has witnessed a surge in digital transactions, prompting regulatory bodies to establish frameworks for the functioning of PSPs. “However, despite the established framework, significant challenges still persist in effectively enforcing these regulations and ensuring compliance.”

Challenges in Implementing Effective Regulations

Navigating the evolving landscape of fintech regulations poses challenges for both Authorities and PSPs. Striking a balance between innovation and compliance is crucial for sustainable growth. Examining real-world examples provides valuable insights into the challenges faced by PSPs. Credit card payment processing[3] Case studies shed light on the impact of credit risks on the overall stability of the financial sector.

Impact on the Financial Sector

The repercussions of high-risk credit events[4] extend beyond individual PSPs, affecting the broader financial ecosystem. Understanding these ripple effects is essential for stakeholders in the industry. Proactive identification and assessment of credit risks are fundamental steps in mitigating potential financial losses. PSPs must employ robust risk management practices to safeguard their operations.

Implementing Risk Management Practices

Effective risk management involves the implementation of strategies to minimize the impact of credit risks. This may include diversification of portfolios, stress testing, and continuous monitoring. Collaborative efforts within the industry can enhance risk mitigation. Establishing partnerships and sharing best practices contribute to the collective resilience of PSPs against high-risk Credit Exposure[5].

Future Trends

Emerging Technologies in Credit Risk Management

Technological advancements, such as artificial intelligence and blockchain, hold the potential to revolutionize credit risk management. Exploring these innovations is crucial for the future resilience of PSPs Anticipating changes in the regulatory environment enables PSPs to adapt proactively. Staying informed about potential shifts in regulations is a key aspect of risk management.

Industry Insights

Expert Opinions on High-Risk PSP Credit in India

Insights from industry experts provide a deeper understanding of the challenges and opportunities associated with high-risk credit. Expert opinions guide stakeholders in making informed decisions. Forecasting the future trajectory of high-risk PSP credit in India is essential for strategic planning. Predictions based on industry trends and insights contribute to informed decision-making.

Balancing Innovation and Risk

The Delicate Balance in the Fintech Industry

Innovation drives the fintech industry forward, but it must be balanced with risk management. Striking the right equilibrium ensures sustainable growth without compromising financial stability. While advancements in technology offer unprecedented opportunities, they also present potential pitfalls. Recognizing and addressing these pitfalls is essential for the long-term success of PSPs. End-users, the ultimate beneficiaries of fintech services, are directly impacted by high-risk credit scenarios. Understanding the implications on consumers is crucial for implementing effective consumer protection measures.

Consumer Protection Measures

Implementing robust consumer protection measures is imperative for maintaining trust in PSPs. Transparent communication and proactive measures contribute to a safer financial environment for users. Analyzing high-risk credit scenarios globally provides valuable benchmarks for the Indian context. Comparative studies highlight unique challenges and potential solutions.

Lessons from International Experiences

Learning from the experiences of other regions enhances the adaptability of Indian PSPs. Implementing lessons learned from global counterparts strengthens the resilience of the industry. In the aftermath of high-risk credit events, rebuilding trust is a priority. PSPs must adopt transparent communication, ethical practices, and a commitment to addressing challenges head-on.

Conclusion

the landscape of high-risk PSP credit in India is complex and dynamic. Navigating this terrain requires a combination of regulatory adherence, technological innovation, and strategic risk management. Stakeholders in the industry must collaborate to ensure the long-term sustainability and resilience of PSPs.

FAQs

- What defines high-risk PSP credit in India?

- High-risk PSP credit in India refers to situations where Payment Service Providers face elevated levels of credit-related challenges, potentially leading to financial losses.

- How can consumers protect themselves from high-risk credit scenarios?

- Consumers can protect themselves by choosing reputable PSPs, staying informed about financial transactions, and promptly reporting any suspicious activities.

- What role does technology play in mitigating high-risk credit for PSPs?

- Technology, including artificial intelligence and blockchain, plays a crucial role in identifying, assessing, and mitigating high-risk credit scenarios for PSPs.

- Are there regulatory measures in place to address high-risk PSP credit in India?

- Yes, there are existing regulatory frameworks for PSPs in India. However, challenges persist in implementing and enforcing these regulations effectively.

- How can PSPs rebuild trust after a high-risk credit event?

- PSPs can rebuild trust through transparent communication, ethical practices, and a commitment to addressing challenges with proactive measures.