AUTHOR:HAZEL DOSUZA

DATE:26/12/2023

The financial landscape in India has undergone a transformative journey, with Payment Service Providers (PSPs) playing a pivotal role. However, not all PSPs tread on stable ground, as some find themselves categorized as high risk entities. In this article, we delve into the nuances of unsafe PSP credit worthiness in India, exploring the challenges, impact, and potential mitigation strategies.

Introduction

Defining High Risk PSP

unsafe PSPs refer to financial entities facing elevated levels of uncertainty and potential financial instability. These organizations often grapple with regulatory challenges, market dynamics, and also operational hurdles that affect their credit worthiness.

Importance of Credit Worthiness in India

In a country driven by economic aspirations, credit worthiness holds immense significance. It not only influences an individual’s financial standing but also shapes the trajectory of businesses seeking financial support. As the financial ecosystem evolves, PSPs are witnessing transformative trends, including the rise of digital payments, contactless transactions, and blockchain integration. These advancements, while promising, also contribute to the complexity of evaluating credit worthiness.

Factors Contributing to High Risk PSPs in India

Several factors contribute to the classification of PSPs as high risk, ranging from regulatory uncertainties to market competition. Payment processor[1] worthiness in India Understanding these factors is crucial to navigating the challenges posed by unsafe categorization. Navigating the regulatory landscape is a daunting task for unsafe PSPs. Ambiguities in compliance requirements, frequent policy changes, and the lack of a standardized framework pose substantial challenges.

Market Competition and Dynamics

In a rapidly evolving market, unsafe PSPs face intense competition, making it challenging to establish a stable foothold. Understanding market dynamics and adapting to changes becomes imperative for survival. The credit worthiness of individuals associated with unsafe PSPs may suffer, impacting their ability to access loans, credit cards[2], or other financial instruments. This ripple effect underscores the interconnectedness of financial entities.

Ramifications for Businesses

Businesses relying on unsafe PSPs for financial transactions may face hurdles in Secured Credit Cards[3], hindering their growth potential. The symbiotic relationship between PSPs and businesses necessitates a holistic approach to credit evaluation.

Mitigation Strategies

Proactive Regulatory Compliance

unsafe PSPs can mitigate challenges by adopting a proactive approach to regulatory compliance. Engaging with regulatory bodies, staying informed about policy changes, and implementing robust compliance measures are essential steps. High Risk Population[4] Embracing technological innovations such as artificial intelligence and machine learning can enhance risk management capabilities. These tools enable unsafe PSPs to analyse data patterns, detect freak, and respond swiftly to emerging risks.

Case Studies

Successful Turnarounds

Exploring case studies of unsafe PSPs that successfully navigated challenges provides valuable insights. Learning from their strategies and adaptations can inspire others facing similar issue. inspect instances where unsafe PSPs faced setbacks offers valuable lessons. Identifying common pitfalls and understanding the factors contributing to failures can guide strategic decision-making.

The Role of Government Initiatives

Supportive Policies

Government initiatives aimed at supporting unsafe PSPs can significantly impact their Credit worthiness[5]. joint efforts between High risk PSP Credit worthiness in India the private sector and government bodies can create a conducive environment for growth. Fostering collaboration between regulatory authorities, industry stakeholders, and unsafe PSPs can lead to innovative solutions. Building a joint. ecosystem ensures collective responsibility for sustaining a healthy financial landscape.

Future Outlook

Anticipated Changes in PSP Landscape

Predicting the future trajectory of unsafe PSPs involves inspect market trends, technological advancements, and regulatory shifts. An informed perspective on the anticipated changes prepares stakeholders for proactive decision-making. Exploring avenues for credit rehabilitation opens up possibilities for unsafe PSPs. Identifying strategies for rebuilding credit worthiness contributes to long-term acceptable.

Expert Insights

Interviews with Industry Experts

Gaining insights from industry experts provides a nuanced understanding of the challenges and opportunities unsafe PSPs face. Expert perspectives guide strategic decision-making and offer valuable recommendations. Based on expert insights, formulating recommendations for partner.—both within unsafe PSPs and the broader financial ecosystem—creates a roadmap for joint. action.

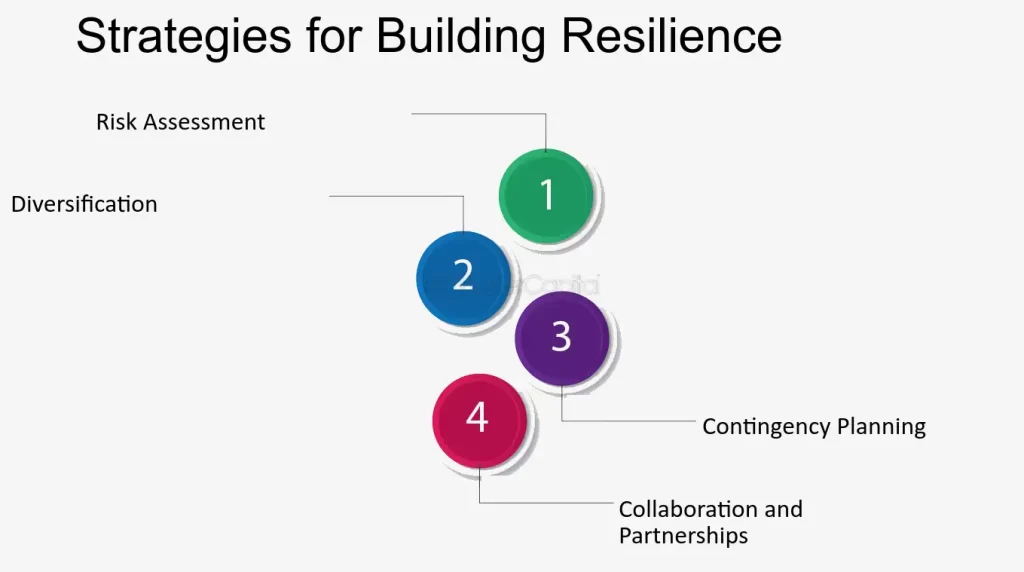

Building Resilience in High Risk PSPs

Strengthening Internal Mechanisms

unsafe PSPs can build resilience by fortifying internal mechanisms. Robust risk management frameworks, transparent communication, and a focus on customer satisfaction contribute to organizational strength. Prioritizing a customer-centric approach fosters trust and loyalty, mitigating the impact of unsafe categorization. Aligning business strategies with customer needs enhances the overall resilience of PSPs.

Adapting to Technological Disruptions

The Role of Fintech in Credit Evaluation

The integration of fintech solutions offers new avenues for credit evaluation. unsafe PSPs can leverage technological disruptions to enhance their credit worthiness assessment processes. Blockchain technology provides transparency in financial transactions. Exploring blockchain solutions enhances credit transparency, instilling confidence in stakeholders and regulatory bodies.

Conclusion

Navigating the unsafe PSP landscape in India requires a multi-faceted approach. Understanding challenges, adopting innovative solutions, and fostering collaboration are key to sustaining a resilient financial ecosystem.

FAQs

- What defines a unsafe PSP in India?

- unsafe PSPs are characterized by elevated uncertainty and potential financial instability, often stemming from regulatory challenges and market dynamics.

- How can unsafe PSPs navigate regulatory challenges?

- unsafe PSPs can adopt a proactive approach to regulatory compliance, engaging

- with authorities and implementing robust compliance measures.

- What role does credit worthiness play for individuals associated with unsafe PSPs?

- Individuals may face challenges in accessing loans and credit instruments, highlighting the interconnectedness of financial entities.

- How can technological innovations aid in risk management for unsafe PSPs?

- Technologies like artificial intelligence and machine learning enhance risk management capabilities, enabling swift response to emerging risks.

- What is the future outlook for unsafe PSPs in India?

- Anticipated changes in the PSP landscape and prospects for credit rehabilitation shape the future outlook for unsafe PSPs in India.