AUTHOR : LISA WEBB

DATE : FEBRUARY 26, 2024

Introduction

The financial landscape in India is evolving rapidly, and one term that has gained prominence is “high-risk PSP cross-selling.” But what does it entail, and why is it relevant? In this article, we will delve into the intricacies of high-risk payment service providers (PSPs) and explore the challenges and opportunities associated with cross-selling in the Indian market.

Understanding High-Risk Payment Service Providers (PSPs)

High-risk PSPs are entities that, due to the nature of their business, face elevated levels of risk. These businesses often operate in industries prone to chargebacks, fraud, or regulatory scrutiny. Examples include online gaming platforms, adult entertainment services, and cryptocurrency exchanges.

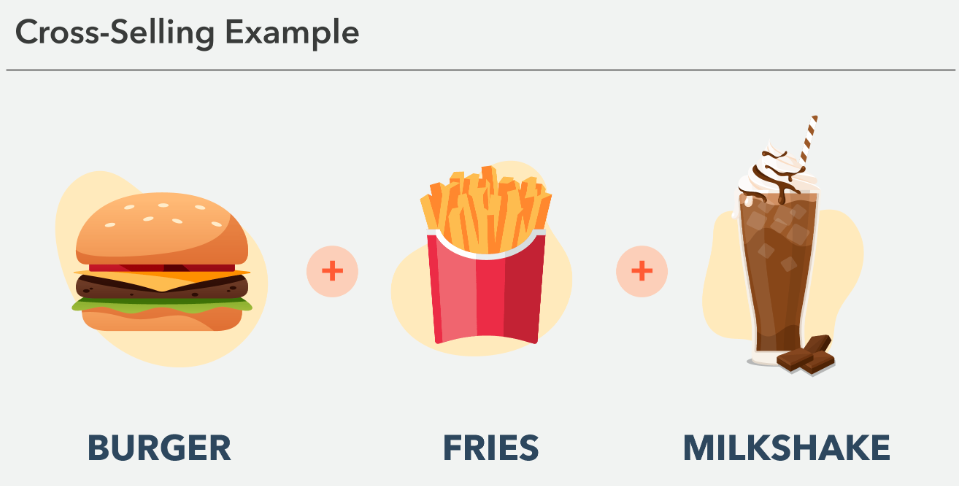

The Cross-Selling Concept

Cross-selling involves offering additional products or services to existing customers. In the financial sector, this practice can be a game-changer for PSPs, providing avenues for increased revenue and customer engagement. Understanding the dynamics of cross-selling is crucial for navigating the competitive Indian market.

Challenges in High-Risk PSP Cross-Selling

While the potential benefits are substantial, high-risk PSPs face unique challenges. Stringent regulations and customer trust issues can pose significant roadblocks. Navigating these hurdles requires a strategic approach and a commitment to compliance.

Benefits of High-Risk PSP Cross-Selling

Despite the challenges, successful, high-risk PSP cross-selling can result in substantial rewards. From revenue generation to the diversification of services, the benefits can be transformative for businesses willing to take on the associated risks.

Successful Strategies for Implementation

To successfully implement high-risk cross-selling strategies, businesses must prioritize compliance and transparency. Aligning practices with regulatory requirements and building trust with customers are foundational elements for success.

Case Studies

Examining real-world examples of high-risk PSP cross-selling in India provides valuable insights. Learning from both successes and failures can inform strategies and help businesses make informed decisions.

The regulatory landscape in India

Understanding the regulatory framework is paramount for high-risk PSPs. A detailed overview of payment regulations in India, along with specific considerations for high-risk businesses, can guide compliance efforts.

Building Customer Trust

Trust is a currency that high-risk PSPs cannot afford to lose. This section explores the importance of transparency in operations and outlines initiatives for educating customers about the benefits and risks associated with high-risk products.

Marketing High-Risk Products

Effectively marketing high-risk products[1] requires a nuanced approach. Tailoring strategies to address customer concerns proactively and transparently communicating the value proposition can set businesses apart in a crowded market.

Technological Innovations

Technology plays a pivotal role in mitigating risks and enhancing the overall user experience. From robust security measures to user-friendly interfaces, high-risk PSPs can leverage technology to build credibility and trust.

Future Trends in High-Risk PSP Cross-Selling

What does the future hold for high-risk PSP cross-selling in India[2]? This section explores industry predictions, emerging opportunities, and potential challenges, providing businesses with the foresight to stay ahead of the curve.

Expert Opinions

Insights from industry experts shed light on the nuances of high-risk PSP cross-selling. Recommendations and best practices from those well-versed in the field offer valuable guidance for businesses entering this dynamic market.

Data Security and Compliance

Data security is a top concern in high-risk industries[3]. Compliance with data protection regulations is non-negotiable. This part of the article delves into the importance of robust security measures, regulatory compliance, and the role they play in fostering customer trust.

Navigating the Trust Deficit

High-risk industries often face a trust deficit among consumers. Acknowledging this challenge and actively working to overcome it is vital. Strategies to bridge the trust gap, such as transparent communication, customer testimonials, and industry partnerships, are discussed here.

Leveraging Analytics for Informed Decision-Making

In the age of data, analytics has become a powerful tool for high-risk PSPs. This section explores how businesses can leverage analytics to gain insights into customer behavior, market trends, and potential risks[4], enabling informed decision-making.

Building a Resilient Risk Management Framework

Risk management is at the core of high-risk PSP operations. Developing a resilient risk management framework involves a combination of technology, expertise, and adaptability. This part of the article outlines key components and best practices for effective risk management[5].

Conclusion

High-risk PSP cross-selling presents both challenges and opportunities in the Indian financial landscape. Navigating this terrain requires a combination of compliance, transparency, and customer-centric strategies. As businesses explore these avenues, responsible and informed decisions are key to long-term success.

FAQs

Q1. How can businesses optimize the customer journey in high-risk PSP cross-selling?

Providing actionable strategies for enhancing each stage of the customer journey.

Q2. What role does data security play in high-risk industries, and how can businesses ensure compliance?Delving into the importance of data security and practical steps for ensuring compliance.

Q3. How can high-risk PSPs effectively manage and mitigate risks in their operations?

Offering insights into developing a resilient risk management framework.

Q4. What are the key considerations in building strategic partnerships for high-risk PSPs?

Exploring the benefits and best practices of collaboration in high-risk industries.

Q5. How can high-risk PSPs stay updated on regulatory changes and adapt their operations accordingly?Providing strategies for staying informed and agile in response to regulatory shifts.