AUTHOR : JENNY

DATE : FEBRUARY 24, 2024

Introduction

In the dynamic landscape of the financial industry, acquiring high-risk customers in India has become both a challenge and an opportunity for Payment Service Providers (PSPs). This article delves into the nuances of high-risk PSP Customer Acquisition In India Customer Acquisition In India Customer Acquisition , exploring the strategies, technologies, and considerations essential for success.

Understanding High Risk PSP Customer Acquisition

High Risk PSP Customer Acquisition In India customers, in the context of Payment Service Providers, refer to individuals or businesses with a higher likelihood of default or fraudulent activities. Recognizing these customers is crucial for PSPs to tailor their services and also mitigate potential risks. Acquiring such customers involves navigating challenges and also capitalizing on the unique opportunities they present.

Key Factors in High Risk PSP Customer Acquisition

Compliance and Regulatory Considerations

Compliance with regulations is the cornerstone of acquiring high-risk customers. Financial institutions must adhere to stringent regulatory frameworks to ensure the legality and legitimacy of their operations. This section explores the compliance landscape and strategies for maintaining regulatory alignment.

Risk Assessment and Management Strategies

Effective risk assessment is imperative for PSPs to safeguard their interests and those of their clients. Developing robust risk management strategies involves a combination of predictive analytics, machine learning, and also human expertise to identify and mitigate potential threats.

Customized Marketing Approaches

Traditional marketing approaches may not resonate with high-risk customers Tailoring marketing strategies to address the unique needs and concerns of this demographic is essential. This includes personalized communication, targeted campaigns, and value propositions that resonate with the specific challenges faced by high-risk clients.

Technology and Innovation

Role of Technology

Technology plays a pivotal role in identifying and targeting high-risk[1] customers Advaed data analytics, artificial intelligence, and machine learning enable PSPs to analyze patterns, detect anomalies, and make data-driven decisions. The article explores the technological landscape and also its impact on customer acquisition.

Innovative Solutions

Secure onboarding and transaction processing are paramount in the high-risk environment. Innovative solutions, such as biometric authentication, blockchain technology, and multi-layered security protocols, contribute to creating a trustworthy and secure ecosystem for both PSPs and also their customers.

Building Trust and Credibility

Transparent Communication

Building trust is a delicate yet crucial aspect of high-risk customer acquisition. Transparent communication regarding terms, conditions, and potential risks fosters a sense of trust among customers. Case studies and also real-world examples illustrate successful instances of transparent communication leading to positive outcomes.

Successful High-Risk Customer Acquisition in India

- Bank’s Tailored Approach

- Innovative Risk[2] Mitigation at Payments

Lessons Learned and Best Practices

Drawing insights from successful case studies, this section outlines lessons learned and best practices in high-risk customer acquisition. From understanding local nuances to leveraging cultural insights, financial institutions can adapt and also optimize their strategies.

Future Trends

Emerging Trends in the High Risk PSP Landscape

The financial industry is ever-evolving, and staying ahead of emerging trends is crucial. This section explores the future landscape of high-risk PSP customer acquisition[3], including advancements in technology, regulatory shifts, and also evolving customer expectations.

Predictions for the Future

Predicting the trajectory of customer acquisition in the financial sector, the article presents informed predictions based on current industry trends and expert analyses. Insights into the future help PSPs prepare for potential challenges and also capitalize on upcoming opportunities.

Importance of SEO in Financial Industry Content

Role of SEO in Reaching the Target Audience

In an era dominated by digital presence, Search Engine Optimization (SEO) is instrumental in reaching the target audience. This section discusses the importance of SEO for financial institutions looking to expand their reach and also connect with high-risk investment[4]

Best SEO Practices for Financial Content

Effective SEO practices go beyond keyword optimization. This subsection provides actionable insights into crafting SEO-optimized content, including metadata optimization, backlink strategies, and also mobile responsiveness.

Crafting Compelling Content

Writing Techniques to Engage High-Risk Prospects

Engaging high-risk[5] prospects requires a nuanced approach to content creation. This section explores writing techniques that resonate with the target audience, emphasizing clarity, empathy, and also relevance in crafting compelling content.

Leveraging Storytelling for Effective Communication

Storytelling is a powerful tool in communicating complex concepts and establishing an emotional connection. The article discusses how financial institutions can leverage storytelling to convey their brand narrative and also connect with high-risk customers.

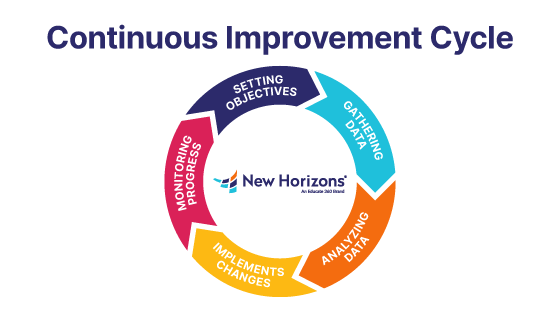

Analytics and Continuous Improvement

Importance of Data Analytics

Data analytics is not only about understanding the past but also about predicting and shaping the future. This section delves into the significance of data analytics in refining customer acquisition strategies, emphasizing the role of actionable insights in decision-making.

Continuous Improvement Mindset

Adopting a continuous improvement mindset is crucial for sustained success in high-risk PSP customer acquisition. The article explores how financial institutions can embrace an iterative approach, learning from data, customer feedback, and market dynamics to refine and also optimize their strategies over time.

Conclusion

High Risk PSP Customer Acquisition in India is a multifaceted challenge that demands a comprehensive and strategic approach. By understanding the unique characteristics of high-risk customers, complying with regulations, embracing innovative technologies, and building trust through transparent communication, financial institutions can navigate this landscape successfully.

FAQs

- What defines a high-risk PSP customer?

- A high-risk PSP customer is one with a higher likelihood of default or engaging in fraudulent activities, requiring specialized attention and also risk management.

- How can financial institutions build trust with high-risk customers?

- Transparent communication, case studies, and personalized approaches are key to building trust with high-risk customers.

- What role does technology play in high-risk customer acquisition?

- Technology, including data analytics and innovative solutions, plays a crucial role in identifying, targeting, and also securing high-risk customers.

- Why is SEO important for financial content targeting high-risk prospects?

- SEO enhances the visibility of financial content, ensuring it reaches and also resonates with the target audience, including high-risk prospects.

- How can financial institutions adapt to future trends in high-risk PSP customer acquisition?

- Continuous learning, staying updated on emerging trends, and being agile in adopting new technologies are essential for adapting to future trends.