AUTHOR : ZOYA SHAH

DATE : 26-12-2023

In the fast-paced world of financial challenges, many individuals find themselves grappling with high-risk PSP (Payment Service Provider) debt in India. This article aims to shed light on the complexities of such debt, the importance of debt consolidation, and how assistance programs in India can provide a lifeline to those in need.

Introduction

In a country as diverse and economically dynamic as India, high-risk PSP debt has become a prevalent issue. Understanding the nuances of this financial challenge is crucial for individuals seeking a way out. This article delves into the intricacies of high-risk PSP debt and explores the significance of debt consolidation assistance in the Indian context.

Understanding High Risk PSP Debt

High-risk PSP refers to debt incurred through payment service providers[1] with elevated risk factors. Individuals facing high-risk PSP debt often encounter various challenges, including exorbitant interest rates and aggressive debt collection practices. These issues can lead to financial distress and a negative impact on credit scores.

Importance of Debt Consolidation

Debt consolidation emerges as a beacon of hope for those drowning in multiple high-risk PSP debts. By consolidating debts, individuals can streamline their payments, often at lower interest rates, making the repayment process more manageable. The importance of debt consolidation lies in its ability to provide a structured and realistic path to financial recovery[2].

Steps to Take for Debt Consolidation

Before diving into debt consolidation, individuals must assess their current debt situation. Researching available options and choosing a reliable debt consolidation[3] assistance program are pivotal steps in this journey. This section guides readers through the necessary steps to embark on a successful debt consolidation strategy.

Debt Consolidation Assistance in India

India offers various debt consolidation services tailored to the unique needs of its citizens. Understanding the criteria for availing assistance and exploring popular debt consolidation agencies are essential for those seeking relief. This section provides an overview of the landscape of debt consolidation assistance in the country. High Risk PSP Debt Consolidation Assistance In India

Perplexity of High Risk PSP Debt

The perplexity of high-risk PSP debt lies in its intricate legal and financial aspects. Navigating through complex agreements and understanding the implications of debt can be challenging. This section addresses the perplexities associated with high-risk PSP debt and offers insights into managing these complexities effectively.

Burstiness in Debt Consolidation Strategies

Debt consolidation strategies need to be dynamic and adaptable. Financial circumstances change, and individuals must be prepared to adjust their approach. This section explores burstiness in debt consolidation, emphasizing the need for flexible strategies to achieve successful outcomes.High Risk PSP Debt Consolidation Assistance In India

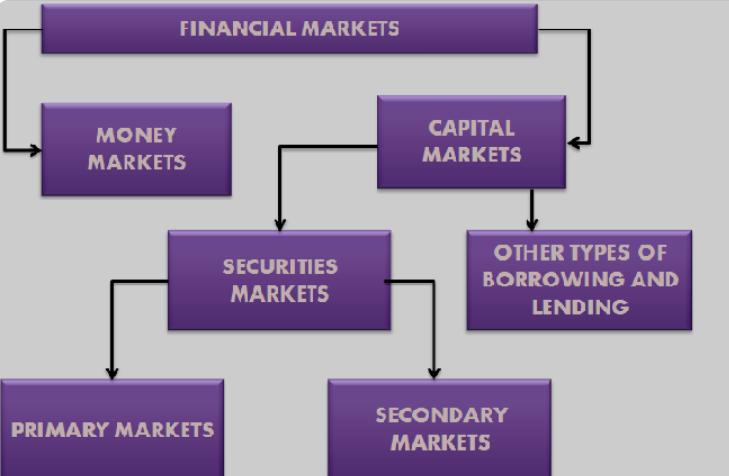

Specifics of Indian Financial Market

Factors influencing high-risk PSP debt in India are unique to the country’s financial landscape. Understanding these specifics is crucial for tailoring debt solutions effectively. This section delves into the nuances of the Indian financial market[4] and how debt consolidation strategies can align with local contexts.

Success Stories

Real-life success stories serve as motivation for individuals struggling with high-risk PSP debt. This section shares experiences of individuals who have overcome their financial challenges through debt consolidation assistance. These stories inspire hope and provide practical insights for those on a similar journey.

Common Misconceptions

Debunking myths surrounding debt consolidation is essential for informed decision-making. This section addresses common misconceptions and clarifies expectations, ensuring that individuals approaching debt consolidation have a realistic understanding of the process.

Proactive Debt Management Tips

Preventing serious PSP debt is as crucial as finding solutions for those already facing it. This section provides proactive tips for managing debt, building financial resilience[5], and avoiding the pitfalls that lead to high-risk PSP debt.

Expert Insights

Interviews with financial advisors offer valuable insights into effectively managing serious PSP debt. This section features expert recommendation and strategies for individuals seeking professional guidance on their debt consolidation journey.

User Testimonials

Feedback from individuals who have utilized debt consolidation assistance adds a human touch to the article. This section showcases the impact of debt consolidation on their lives, providing prospective readers with a glimpse into the potential positive outcomes of seeking assistance.

Conclusion

In conclusion, serious PSP debt consolidation assistance in India is a viable and effective solution for individuals facing financial challenges. By understanding the complexities, embracing dynamic strategies, and leveraging the support available, individuals can regain control of their financial well-being.

FAQs

- While debt consolidation is generally effective for unsecured debts like credit card balances and medical bills, it might not be the optimal solution for secured debts such as mortgages or car loans. It’s essential to carefully assess the nature of your debts and consult with financial experts to determine the most suitable approach?

- Debt consolidation is generally for unsecured debts, such as credit card debt and medical bills. However, secured debts, like mortgages, may require a different approach.

- How long does the debt consolidation process take?

- The duration varies based on individual circumstances. On average, the process can take anywhere from a few months to a couple of years.

- Can debt consolidation improve my credit score?

- Yes, consolidating debts and making timely payments can positively impact your credit score over time.

- What criteria do debt consolidation agencies consider for assistance?

- Agencies typically consider factors such as income, credit score, and the types of debts you have.

- Are there risks associated with debt consolidation?

- While debt consolidation can be