AUTHOR: KHOKHO

DATE: 27/12/2023

In today’s fast-paced world, financial challenges are ubiquitous, and for many in India, high-risk PSP debt has become a pressing concern. This article aims to guide individuals through the complex landscape of debt consolidation, specifically focusing on high-risk PSP debt consolidation companies in India[1]. By the end of this comprehensive guide, readers will be equipped with the knowledge to make informed decisions about their financial future.

Introduction

Debt consolidation is a financial strategy[2] that involves combining multiple debts into a single, manageable payment. In India, the prevalence of high-risk PSP debt has led to the emergence of various debt consolidation companies. However, not all companies are created equal, and choosing the right one is crucial for a successful debt consolidation journey

Understanding High-Risk PSP Debt

High-risk PSP debt refers to debts associated with payment service providers (PSPs) that carry an elevated level of risk. This could include outstanding credit card balances, personal loans, or other financial obligations with high interest rates. Individuals facing high-risk debt[3] often experience challenges such as mounting interest payments and the risk of financial instability.

The Need for Debt Consolidation in India

India’s economic landscape has witnessed a surge in high-risk debt situations, with individuals grappling to manage their financial obligations. The need for effective debt consolidation solutions is more pronounced than ever, and understanding the intricacies of the process is crucial for those seeking financial relief.[4]

Identifying Reliable Debt Consolidation Companies

Choosing a debt consolidation company requires careful consideration. Researching the market, reading reviews, and assessing the company’s reputation are essential steps to avoid falling victim to unscrupulous practices. Factors such as interest rates, repayment terms, and customer support should be evaluated before making a decision.

Risks Associated with High-Risk PSP Debt Consolidation

Debt consolidation can provide relief for individuals overwhelmed by high-risk debt, but it also carries its own potential drawbacks.

. This section will explore potential pitfalls, ensuring that individuals are fully aware of the challenges and can make informed decisions.

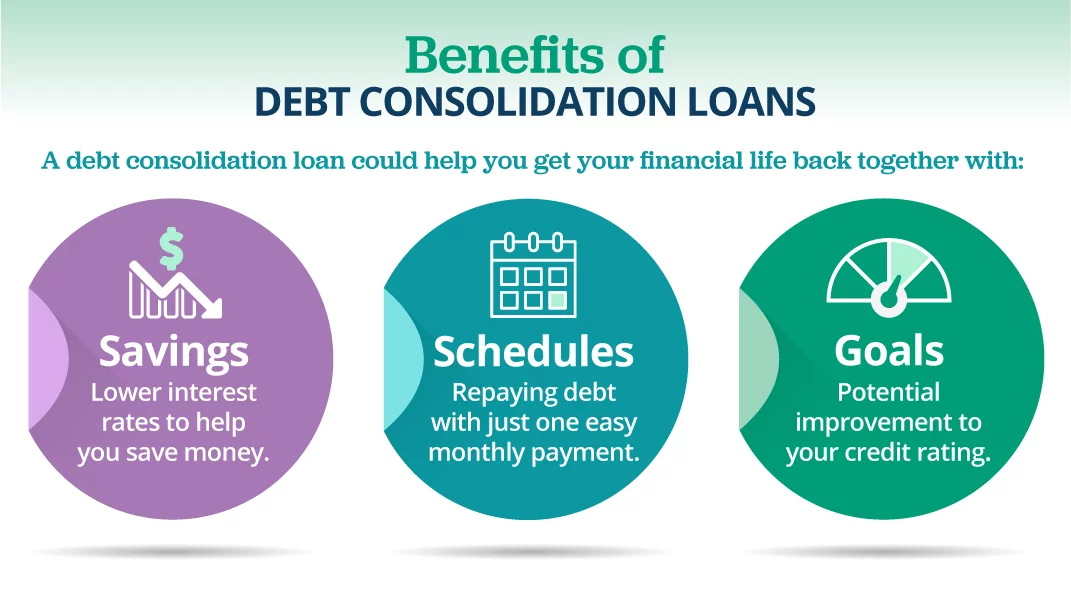

Benefits of Choosing Reputable Companies

Reputable debt consolidation companies offer a range of benefits, including lower interest rates, flexible repayment plans, and personalized solutions. Success stories and also testimonials from individuals who have successfully consolidated their high-risk PSP debt highlight the positive outcomes achievable through reliable services.

The Role of Credit Counseling

Credit counseling plays a pivotal role in the debt consolidation process. It helps individuals understand their financial situation, provides guidance on managing debt[5], and ensures informed decision-making throughout the consolidation journey.

Tailored Debt Solutions

Recognizing the unique challenges posed by high-risk PSP debt, reputable companies offer tailored solutions. These customized plans address the specific needs of individuals, providing a roadmap to financial recovery.

Legal Aspects and Regulations

Navigating the legal landscape of debt consolidation is essential for consumer protection. This section will shed light on the legal aspects and regulations governing debt consolidation in India, empowering individuals to make choices within a secure framework.

Case Studies: Successful Debt Consolidation

Real-life examples of individuals who successfully consolidated their high-risk PSP debt offer inspiration and practical insights. These case studies demonstrate that financial recovery is possible with the right debt consolidation strategy.

Navigating Debt Consolidation Process

A step-by-step guide will break down the debt consolidation process, simplifying what might seem like a daunting task. From gathering information to selecting a reputable company, readers will gain actionable insights into navigating the consolidation journey.

Alternatives to Debt Consolidation

While debt consolidation is a viable option, it may not be suitable for everyone. This section will explore alternative strategies for managing high-risk debt, providing a comprehensive overview of available options.

Tips for Maintaining Financial Health Post-Consolidation

Consolidating debt is just the first step toward financial recovery. This section offers practical tips for maintaining financial health post-consolidation, ensuring that individuals build a sustainable and secure financial future.

Common Misconceptions about Debt Consolidation

Dispelling myths and misconceptions surrounding debt consolidation is crucial for informed decision-making. By addressing common misunderstandings, this section aims to clarify the realities of the debt consolidation process.

Conclusion

In conclusion, navigating high-risk PSP debt consolidation in India requires a thoughtful and informed approach. By understanding the challenges, exploring reputable companies, and considering alternatives, individuals can take control of their financial future. Debt consolidation is not a one-size-fits-all solution, but with the right knowledge, it can be a powerful tool for financial recovery.

Frequently Asked Questions (FAQs)

- Is debt consolidation the right choice for everyone facing high-risk PSP debt?

- Debt consolidation may be suitable for some, but not for all. It’s essential to assess individual circumstances and consider alternative options.

- How can I identify a reliable debt consolidation company in India?

- Research extensively, read reviews, and look for companies with a solid reputation. Consider factors such as interest rates, terms, and customer feedback.

- What risks should I be aware of when consolidating high-risk PSP debt?

- Risks include potential hidden fees, extended repayment terms, and the need for disciplined financial management post-consolidation.

- Can debt consolidation impact my credit score?

- While debt consolidation itself may not harm your credit score, it’s crucial to manage your post-consolidation finances responsibly to maintain or improve your credit standing.

- Are there government regulations overseeing debt consolidation in India?

- Yes, understanding the legal aspects and also regulations governing debt consolidation is crucial. Ensure the company you choose adheres to these regulations for consumer protection.