Author : Sweetie

Date : 26/12/2023

Introduction

In the dynamic financial landscape of India, addressing high-risk Payment Service Provider (PSP) debt is crucial for both businesses and individuals. This article delves into the complexities of high-risk PSP debt settlement, offering insights into the challenges faced and strategies to navigate these financial hurdles effectively.

Definition of High-Risk PSP Debt Settlement

High-risk PSP debt settlement involves resolving financial obligations with payment service providers[1] in situations where the risk of non-payment is elevated. Understanding and addressing these scenarios are pivotal for maintaining financial health[2].

Significance of Addressing High-Risk PSP Debt in India

With the growing reliance on digital payments, high-risk debt situations can adversely impact businesses and individuals. Proactive measures are essential to mitigate financial risks and foster economic stability.

Understanding High-Risk PSP Debt

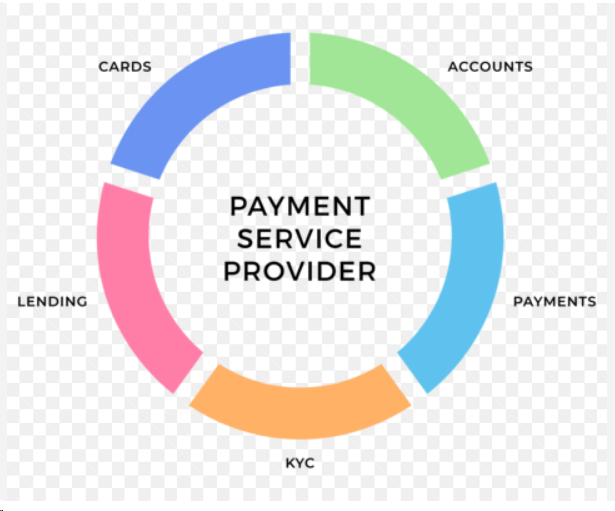

Explanation of PSP (Payment Service Provider)

Payment Service Providers play a vital role in facilitating transactions. Recognizing the nuances of these entities is fundamental to understanding high-risk debt scenarios.

Identifying High-Risk Debt Scenarios

Factors contributing to high-risk situations

Multiple factors, including economic downturns and unforeseen circumstances, contribute to elevated risk levels in debt settlement[3] scenarios.

Impact on businesses and individuals

High-risk debt situations can lead to financial strain, affecting both businesses and individuals. Addressing these challenges promptly is imperative.

The Legal Landscape

Indian Regulations on Debt Settlement

Navigating the legal framework surrounding debt settlement is essential. An overview of relevant laws provides clarity, but compliance challenges may complicate the process.

Overview of relevant laws

Understanding the legal framework governing debt settlement in India is vital for effective resolution.

Compliance challenges

Meeting the legal requirements poses challenges that must be addressed to ensure a fair and lawful settlement process.

Challenges in Debt Settlement

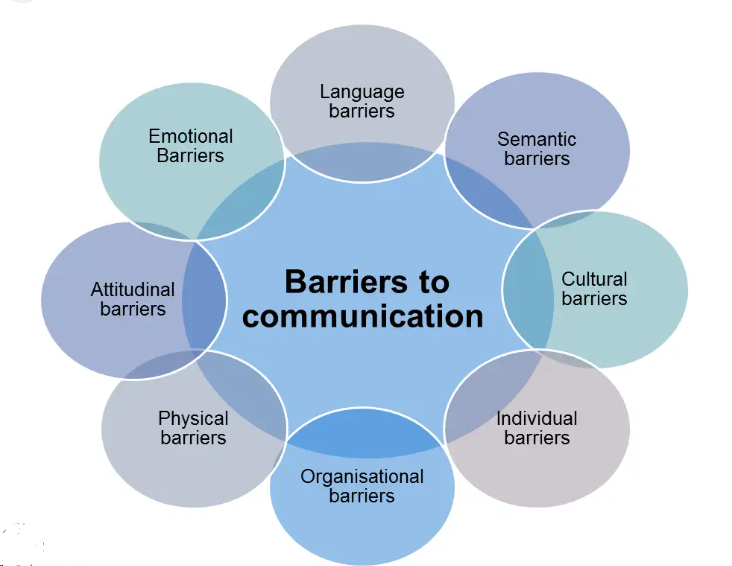

Communication Barriers

Effective communication is pivotal in debt settlement. Barriers can hinder negotiations and exacerbate high-risk situations[4].

Negotiation Struggles

Balancing creditor and debtor interests

Negotiating terms that balance the interests of both creditors and debtors is a delicate process requiring finesse.

Ensuring fair terms

Striking a fair deal is challenging but crucial for sustainable debt settlement. Both parties must find common ground.

Strategies for Effective High-Risk PSP Debt Settlement

Professional Mediation Services

Engaging professional mediators can streamline the debt settlement process[5], providing a neutral ground for negotiations.

Customized Debt Repayment Plans

Tailoring plans based on financial capabilities

Customizing repayment plans based on the debtor’s financial capabilities increases the likelihood of successful settlement.

Collaborative approaches

Encouraging collaboration between creditors and debtors fosters a cooperative environment, enhancing the chances of reaching mutually beneficial agreements.

Case Studies

Success Stories in High-Risk Debt Settlement

Examining success stories offers valuable insights into effective strategies and practices.

Learning from Failures

Analyzing failures provides lessons on pitfalls to avoid and challenges to address in the debt settlement process.

The Role of Technology

Innovations in Debt Settlement Platforms

Technological advancements are transforming debt settlement platforms, offering efficient solutions.

Advantages and Challenges

While technology provides advantages, it also presents challenges that need careful consideration for successful implementation.

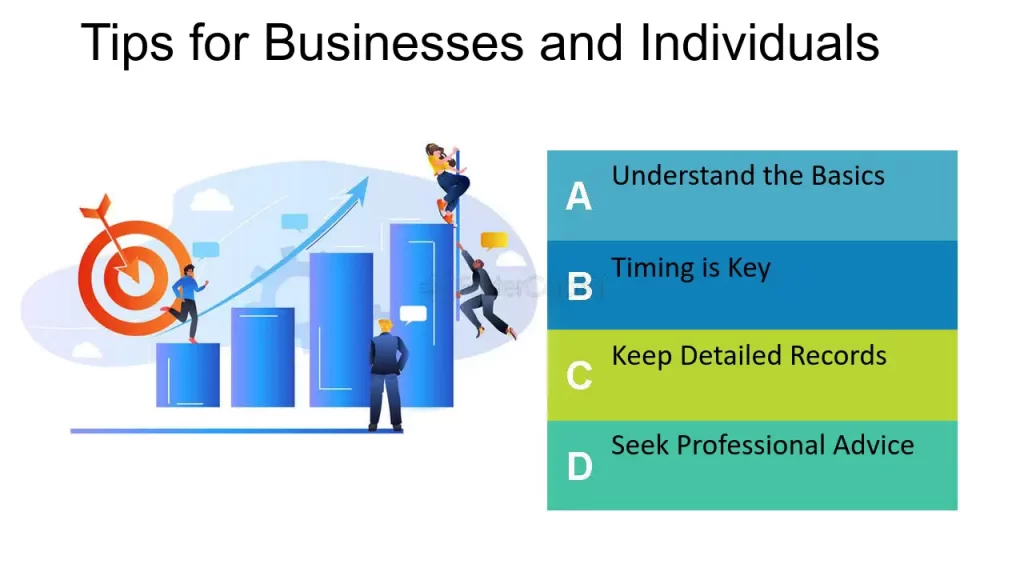

Tips for Businesses and Individuals

Early Detection of High-Risk Debt

Early detection allows businesses and individuals to address high-risk debt situations promptly, minimizing potential damage.

Proactive Measures for Debt Resolution

Taking proactive measures, such as seeking professional advice, can significantly contribute to successful debt resolution.

Future Trends in High-Risk PSP Debt Settlement

Technological Advancements

Continued advancements in technology are expected to shape the future of high-risk debt settlement.

Evolving Regulatory Frameworks

Changes in regulatory frameworks will influence how high-risk PSP debt settlement is approached in the future.

Conclusion

In conclusion, navigating high-risk PSP debt settlement in India requires a comprehensive understanding of the challenges involved and strategic approaches to resolution. As technology evolves and regulatory frameworks adapt, businesses and individuals must stay informed to secure their financial stability.

FAQs

- Q: How can businesses identify high-risk debt situations early?

A: Businesses can employ financial analysis tools and closely monitor transaction patterns to detect signs of high-risk debt early. - Q: Are there specific regulations governing PSP debt settlement in India?

A: Yes, India has regulations in place to govern debt settlement, and compliance with these regulations is crucial for a lawful resolution. - Q: Can individuals negotiate directly with payment service providers for debt settlement?

A: Yes, individuals can negotiate directly, but professional mediation services are often recommended for a smoother process. - Q: What role does technology play in modern debt settlement practices?

A: Technology facilitates efficient debt settlement through innovative platforms, but it also presents challenges that require careful consideration. - Q: Is there a proactive approach for businesses and individuals to prevent high-risk debt situations? A: Yes, adopting proactive measures such as seeking professional advice and implementing robust financial management practices can prevent high-risk debt situations.