AUTHOR: HAANA TINE

DATE :28/12/2023

Introduction

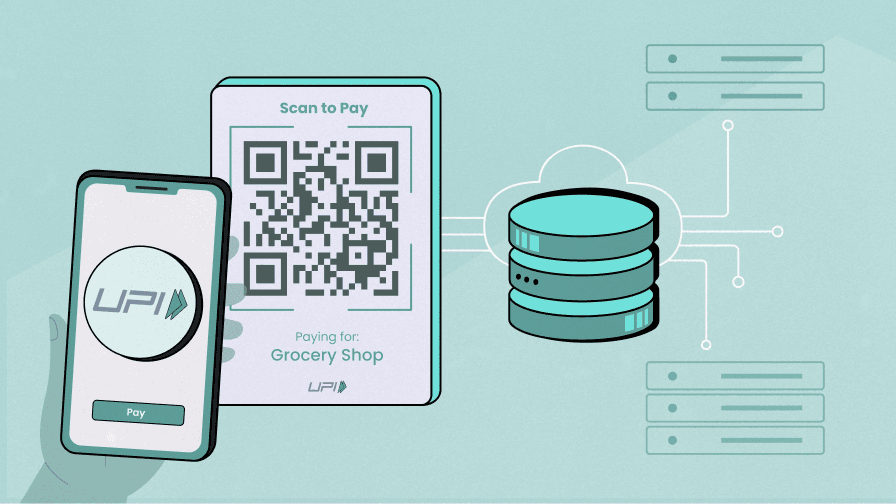

In recent years, the landscape of financial assets in India has witnessed a significant transformation with the emergence of high-risk PSP digital assets. These digital assets, ranging from cryptocurrencies to tokenized securities, have captured the attention of investors and regulators alike. This article explores the intricacies of these assets, the associated risks, and the evolving regulatory landscape in India.

Understanding Digital Assets

Digital assets[1] encompass a wide array of financial instruments that exist in electronic form. Cryptocurrencies, such as Bitcoin and Ethereum, represent a form of digital currency, while non-fungible tokens (NFTs) and tokenized securities are unique digital representations of real-world assets.

The regulatory landscape in India

The regulatory framework governing high-risk PSP digital assets in India is currently in flux. While there are existing regulations, the dynamic nature of the digital asset space requires continuous adaptation. This section delves into the current regulations and the ongoing efforts to create a more comprehensive framework.

Risks Associated with High-Risk PSP Digital Assets

Investing in high-risk PSP digital assets comes with its share of challenges. Market volatility, security concerns, and a lack of consumer awareness are among the prominent risks. Understanding and mitigating these risks are crucial for investors looking to navigate this space.

Opportunities and Challenges

Despite the risks, high-risk PSP digital assets present unique investment opportunities. This section explores the potential returns and the challenges that investors may encounter, providing a balanced perspective on the digital asset landscape.

Opportunities for PSPs in the Digital Asset Space

Expanding Market Reach

The growing adoption of digital assets in India provides PSPs with opportunities to target a broader customer base, including tech-savvy millennials and institutional investors.

Innovation in Financial Services

PSPs can integrate innovative solutions like DeFi protocols, enabling customers to access decentralized financial products.

Building Trust in Emerging Markets

By offering secure and reliable services, high-risk PSPs can position themselves as trusted players in the digital asset ecosystem

Case Studies

Examining real-world examples of success and failure in the digital asset space offers valuable insights. From the meteoric rise of certain cryptocurrencies to instances of fraud and market manipulation, case studies shed light on the unpredictable nature of this market.

Security Measures

Ensuring the security of digital assets is paramount. Best practices and technological advancements play a crucial role in safeguarding investments. This section provides actionable advice for individuals seeking to secure their digital portfolios[2].

Future Outlook

Predicting the future of high-risk PSP digital assets involves analyzing current trends and anticipating shifts in the market. From the integration of blockchain technology to the rise of new digital currencies, the future outlook explores potential developments.

Tips for Investors

For those considering entering the digital asset market, due diligence is key. This section offers practical tips and diversification strategies to help investors make informed decisions.

Expert Opinions

Insights from industry experts provide a nuanced understanding of the digital asset landscape. Experts weigh in on potential pitfalls, market trends, and the role of digital assets in the broader financial ecosystem[3]

Impact on Traditional Financial Systems

As high-risk PSP digital assets gain prominence, their impact on traditional financial systems[4] cannot be ignored. This section explores the challenges and potential disruptions that may arise as digital assets become more integrated into the financial landscape.

Educational Initiatives

Addressing the lack of consumer awareness requires educational initiatives. The importance of financial literacy[5] and ongoing efforts to educate the public about digital assets are discussed in this section.

Comparisons with Global Markets

Contrasting India’s approach to digital assets with that of other countries provides valuable insights. Learning from international experiences can inform regulatory decisions and investor strategies.

Real-world Use Cases

Examining practical applications of high-risk PSP digital assets showcases their versatility. Success stories highlight instances where digital assets have been harnessed for real-world benefits.

Conclusion

In conclusion, the landscape of high-risk PSP digital assets in India is dynamic and evolving. Investors should approach this space with caution, conducting thorough research and staying informed about regulatory developments. The potential for returns is significant, but so are the risks.

FAQs

- Is investing in high-risk PSP digital assets safe for beginners? Investing in digital assets requires a level of understanding and risk tolerance. Beginners should start with small investments and educate themselves before diving in.

- How can investors secure their digital assets? Employing best practices such as using hardware wallets, implementing two-factor authentication, and staying informed about security updates are crucial for securing digital assets.

- What role do regulatory developments play in the digital asset market? Regulatory clarity is essential for the stability and growth of the digital asset market. Investors should closely monitor regulatory developments and adjust their strategies accordingly.

- Can digital assets replace traditional forms of investment? While digital assets offer unique opportunities, they are not a one-size-fits-all replacement for traditional investments. Crafting a well-rounded investment portfolio often involves a blend of traditional and digital assets.

- How can individuals contribute to the growth of the digital asset market in India? Supporting educational initiatives, staying informed, and advocating for clear and fair regulations are ways individuals can contribute to the growth and legitimacy of the digital asset market in India.

High-Risk PSP Cyber Products in India