AUTHOR : SELENA GIL

DATE : 29/12/2023

Introduction

Digital payment systems have Transformed the financial landscape in India. However, within this realm exist high-risk payment service providers (PSPs) that Steer a complex landscape due to their nature and operations.

High-Risk Digital Services in India

Exploring the array of digital services[1] categorized as high-risk in the Indian context sheds light on their diverse nature. This section will delve into the specifics, ranging from Digital currency

exchanges to online gaming platforms.

Regulatory Framework

Compliance Challenges

Navigating the stringent regulatory landscape poses significant challenges for high-risk PSPs in India. Understanding and adhering to compliance frameworks is crucial for their sustained operations.

Risks and Mitigation

Security Measures

The inherent risks associated with high-risk digital services demand robust security measures. Discussing the vulnerabilities and effective strategies is essential.

Future Trends

Innovation and Adaptability

Amidst the challenges, the future of high-risk PSPs in India lies in their capacity to and adapt. This section will explore emerging trends and potential innovations in the industry.

Understanding High-Risk PSPs

In India, high-risk PSPs cover a wide range of digital services such as cryptocurrency exchanges, online gaming platforms, fraudulent monetary dealings, forex trading services, and more. While these services play a crucial role in the digital economy[2], they are frequently subjected to regulatory scrutiny because of their vulnerability to financial crimes like fraud and money laundering.

Regulatory Framework and Compliance Challenges

Navigating the regulatory framework presents a significant hurdle for PSPs. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) norms, among other regulations, demands meticulous attention. Failure to comply can result in severe penalties, including license revocation.

Risks and Mitigation Strategies

The inherent risks associated with high-risk PSPs require robust security measures. Cybersecurity threats, fraud, and financial Weaknesses demand preventive

risk management strategies. Implementing advanced encryption protocols, transaction monitoring, and stringent verification processes are crucial steps toward mitigating risks.

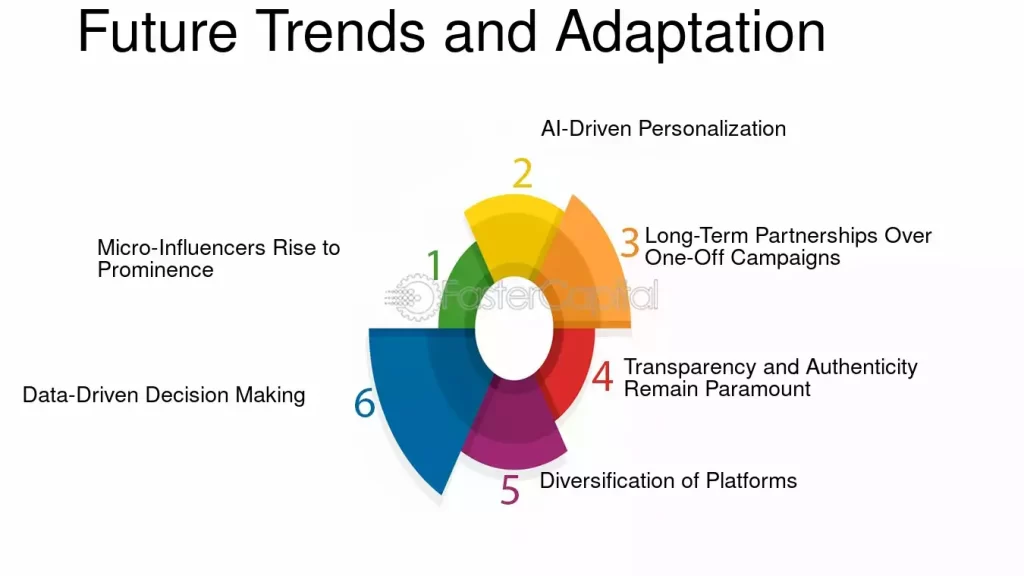

Future Trends and Adaptability

Despite the challenges, the future outlook for Elevated-risk

PSPs in India is promising. Innovations in blockchain technology, AI-driven security solutions, and increased regulatory frameworks are expected to shape the industry. Adaptability and innovation will be key drivers for the sustainable growth of these entities.

India’s digital payment ecosystem has seen exponential growth, but high-risk Payment Service Providers[3] (PSPs) face unique challenges. These include navigating stringent regulations, combating fraud, and managing chargebacks. Leveraging robust security measures and compliance frameworks can mitigate risks. As the market expands, collaboration with trusted fintech[4] partners is key to sustaining growth in this dynamic sector.

Regulatory Challenges and Adherence

Regulatory Compliance

High-risk PSPs in India grapple with complex regulatory frameworks designed to curb financial crimes. Adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) measures is Straying from these guidelines could lead to severe penalties, including license

KYC Norms and Verification Processes

Know Your Customer (KYC) norms impose stringent requirements on users. High-risk PSPs must establish robust backing processes to ensure the safety of users and transactions. This not only aids in compliance but also builds trust among colleagues.

Risk Management and Security Measures

Cybersecurity Protocols

The digital realm is rife with cybersecurity threats. High-risk PSPs must implement cutting-edge encryption methods and regularly update security protocols to safeguard against data breaches and cyberattacks.

Transaction Monitoring Systems

Real-time transaction monitoring systems are pivotal. These systems enable the identification of suspicious activities, allowing prompt intervention to prevent transactions.

Regulatory compliance is another critical aspect, as India’s Reserve Bank (RBI) frequently updates guidelines to enhance digital payment[5] security. PSPs must stay agile, adapting quickly to these changes while ensuring seamless user experiences. Additionally, fostering consumer trust through transparency and robust customer support can significantly boost retention and loyalty.

Conclusion

The digital payment ecosystem in India has witnessed exponential growth, fueled by the proliferation of various payment service providers (PSPs). However, within this burgeoning industry lies a subset of entities categorized as high-risk PSPs. These entities surround a diverse range of digital services that operate in a regulatory landscape fraught with challenges.

FAQs

- What defines a high-risk PSP in India? A high-risk PSP in India is digital services susceptible to financial crimes due to their nature, such as exchanges or online gaming platforms monetary transactions.

- What compliance challenges do these entities face? High-risk PSPs encounter stringent regulatory norms demanding adherence to AML, KYC, and other financial regulations, posing significant compliance challenges.

- How can high-risk PSPs mitigate security risks? Implementing advanced monitoring and stringent verification processes is pivotal to mitigating the security risks associated with Elevated-risk PSPs.

- What role does innovation play for these entities? Innovation and adaptability are crucial for the growth of Elevated-risk PSPs in India, allowing them to challenge and capitalize on emerging trends.

- What is the future outlook for Elevated-risk PSPs in India? Despite challenges, advancements in technology and regulatory frameworks offer a promising future for these entities, provided they embrace innovation and compliance.