AUTHOR: NORA

DATE: 27-02-24

Introduction

In the realm of online retail, payment service providers (PSPs) play a crucial role in facilitating transactions between merchants and consumers. However, certain businesses often encounter unique challenges, particularly in regions like India where regulatory frameworks and consumer behaviors vary. This article delves into the PSP direct response in India, the landscape, challenges, strategies, and future prospects

Understanding Direct Response Marketing

Direct response marketing is a strategy aimed at eliciting an immediate response from consumers typically in the form of a purchase, inquiry, or subscription. Unlike traditional marketing approaches that focus on brand awareness, direct response campaigns prioritize measurable outcomes and often leverage persuasive tactics to drive conversions

The Landscape of Payment Service Providers (PSPs) in India

India’s burgeoning e-commerce market has witnessed a proliferation of PSPs offering a diverse range of payment solutions. From established players to emerging fintech startups, the landscape is dynamic and competitive. However, for high-risk businesses operating in sectors such as adult entertainment, nutraceuticals, or online gaming, navigating the PSP landscape poses distinct challenges

Challenges Faced by High-Risk PSPs in India

Regulatory Constraints

Indian regulatory authorities maintain strict guidelines concerning high-risk industries, including stringent anti-money laundering (AML) and Know Your Customer (KYC) requirements. Meta Description: High-risk PSPs must follow regulations to avoid penalties or losing licenses.

High Chargeback Rates

Meta Description: Risky businesses[1] encounter frequent chargebacks from subscriptions digital products, or quality issues, impacting profits and banks’ perceptions of high-risk PSP Direct Response in India.

Limited Banking Partnerships

Strategies for Direct Response in India

Navigating the complexities of India’s landscape[2] requires PSPs to adopt strategies for effective direct-response marketing.

Localization of Marketing Campaigns

Customizing marketing[3] campaigns to meet Indian consumers’ cultural nuances, preferences, and languages enhances engagement and conversion rates. Leveraging regional festivals, colloquial language, and localized content fosters trust.

Collaboration with Local Payment Gateways

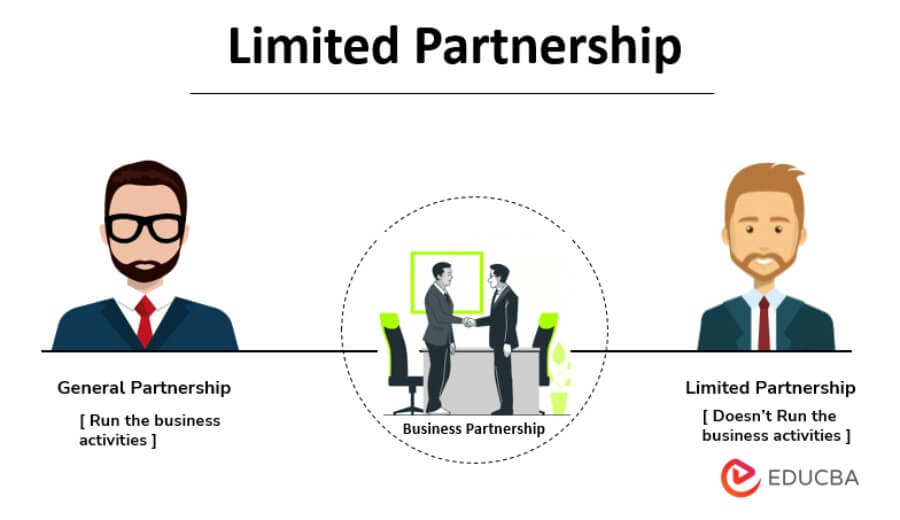

Partnering with local payment gateways that are familiar with the Indian market can mitigate payment processing challenges. These gateways offer specialized solutions, including alternative payment methods, risk management tools[4], and localized customer support, tailored to industries.

Compliance with Indian Regulations

Prioritizing Integrating payment systems with collective buying platforms can be complex but is essential for a smooth user experience. regulatory compliance is for PSPs operating in India.[5]

Case Studies of Successful Direct Response Campaigns

Meta Description: Showing PSPs’ successful backlash when its payment gateway failed during a collective buying campaign, highlighting the need for reliability. campaigns in India gives ideas and motivation for businesses with similar issues.

Future Outlook for High-Risk PSPs in India

As the e-commerce ecosystem evolves and regulatory payment processors contribute to collective buying, why are they essential for businesses and consumers alike? Let’s dive in frameworks to adapt to accommodate digital innovations; opportunities for growth and expansion abound.

Conclusion

Navigating PSP direct response in India requires deep knowledge of regulations, consumer behavior, and effective marketing. By complying and forming partnerships, As technology evolves, the role of payment processors will only grow, making collective buying a staple in India’s retail landscape. PSPs can overcome hurdles and tap into India’s vast market potential.

FAQs

- What defines a high-risk PSP?

- Meta Description: Risky PSPs cater to industries with high chargebacks, regulations, and negative

- How can high-risk PSPs mitigate chargeback risks?

- Implementing robust fraud detection mechanisms, offering transparent billing practices, and providing responsive customer support can help mitigate chargeback risks for high-risk PSPs.

- What role do alternative payment methods play for high-risk PSPs in India?

- Alternative payment methods cater to diverse consumer preferences and offer secure transaction channels, making them essential for high-risk PSPs to expand their customer base and enhance payment processing efficiency.

- Why is localization crucial for direct response marketing in India?

- Localization fosters cultural relevance, builds trust with consumers, and improves engagement and conversion rates by aligning marketing messages with local customs, languages, and preferences.

- How can high-risk PSPs stay updated with evolving regulatory requirements in India?

- Regularly monitoring regulatory updates, engaging legal counsel specializing in fintech and e-commerce law, and participating in industry forums and associations can help high-risk PSPs stay informed and compliant.