AUTHOR : LISA WEBB

DATE : JANUARY 1, 2024

High-Risk PSP for Affordable Purchase Group in India

The financial landscape in India has seen a surge in the emergence of Affordable Purchase Groups (APGs), which cater to the needs of individuals seeking cost-effective purchasing options Simultaneously, the evolution of high-risk payment service providers (PSPs) has garnered attention, especially concerning their role in facilitating transactions for such groups.

Introduction to High-Risk Payment Service Providers (PSPs)

High-risk PSPs refer to financial entities that operate in sectors perceived as higher risk various factors, including a higher likelihood of chargebacks, or regulatory scrutiny These entities play a pivotal role in processing transactions for businesses often considered serious, including those in sectors like gaming, adult entertainment, or pharmaceuticals.

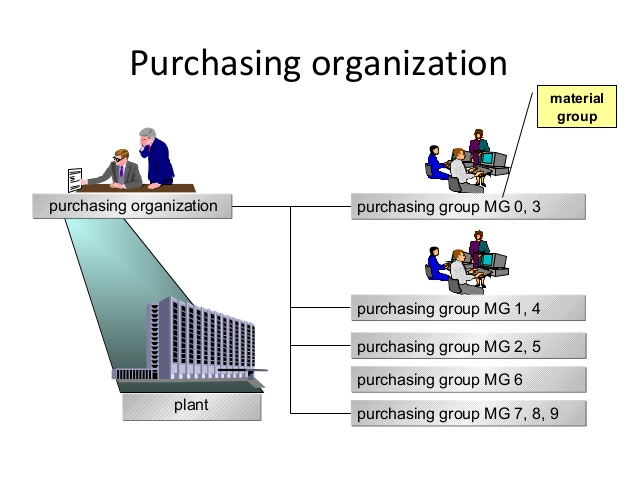

Understanding Affordable Purchase Groups in India

Affordable Purchase Groups (APGs) in India are community-based initiatives aimed at pooling resources to facilitate affordable purchases of goods and services. These groups enable members to benefit from collective bargaining power and access to cost-effective products, thereby promoting financial inclusivity.

Challenges Faced by High-Risk PSPs in Serving Affordable Purchase Groups

The dynamic nature of APGs poses challenges for serious PSPs. Regulatory constraints and compliance requirements demand stringent measures, making it complex for PSPs to operate efficiently within this niche. Additionally, high risk assessment[1] and mitigation strategies must be robust to ensure secure transactions while serving APGs.

Strategies for High-Risk PSPs to Cater to Affordable Purchase Groups

To navigate these challenges, collaboration emerges as a viable strategy. High-risk investment[2] PSPs can form partnerships with established financial institutions or technology firms to enhance their risk management frameworks and optimize service delivery. Leveraging technological advancements like AI-driven fraud detection systems could fortify transaction security.

The Impact of High-Risk PSPs on India’s Financial Inclusion Goals

While high-risk PSPs paymnet processor[3] present opportunities for facilitating transactions within APGs, their impact on India’s financial inclusion goals is multi-faceted. They contribute to fostering financial accessibility but also raise concerns about data privacy, consumer protection, and the need for comprehensive regulatory oversight to maintain a balance.

Exploring the Synergy Between High-Risk PSPs and APGs

The partnership between serious PSPs and Affordable Purchase[4] Groups (APGs) holds promise for revolutionizing the accessibility of goods and services in India. However, this alliance doesn’t come without its set of challenges.

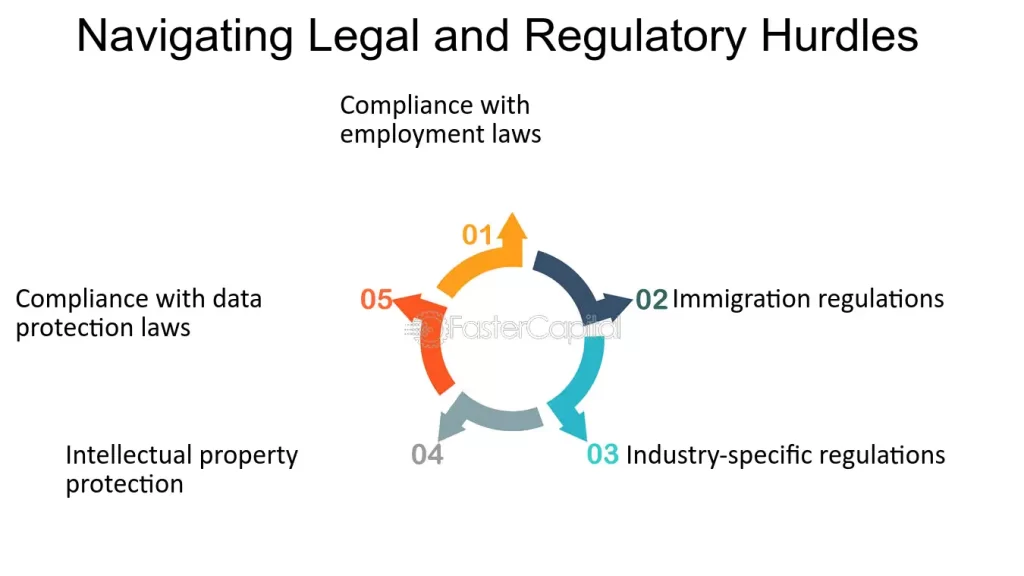

Regulatory Hurdles and Compliance Demands

Navigating through India’s regulatory framework poses a significant challenge for serious PSPs aiming to serve APGs. The stringent compliance requirements and constantly evolving regulations demand a proactive approach to ensure seamless operations within legal boundaries.

Risk Mitigation in Transactions

Transactions involving APGs often require specialized risk assessment and mitigation strategies due to the diverse nature of these groups. High-risk PSPs must deploy robust mechanisms to detect and prevent fraud while maintaining the speed and convenience desired by APGs.

Collaboration as a Strategy

One of the primary pathways for serious PSPs to effectively serve APGs is through collaboration. Teaming up with established financial institutions or leveraging partnerships with innovative tech companies can bolster their risk management[5] frameworks and enhance their service offerings.

The Tech-Driven Future

Technological advancements present a beacon of hope for high-risk PSPs catering to APGs. AI-powered solutions and blockchain technologies offer potential solutions for enhancing security, transparency, and efficiency in transactions, paving the way for a more secure and accessible financial ecosystem.

Balancing Opportunities and Concerns

While the synergy between serious PSPs and APGs holds immense potential for driving financial inclusivity, it also raises concerns. Issues related to data privacy, consumer rights, and the need for comprehensive regulatory oversight call for a delicate balance to ensure mutual benefits without compromising on security and ethics.

Conclusion

The symbiotic relationship between high-risk PSPs and affordable purchase groups in India is evolving, presenting both opportunities and challenges. Strategic collaborations, technological innovations, and stringent risk management practices can enable serious PSPs to effectively serve APGs while aligning with India’s financial inclusion objectives.

FAQs

- What defines a high-risk PSP?

- High-risk PSPs operate in sectors prone to higher chargebacks, fraud, or regulatory scrutiny, leading to categorization as serious entities.

- How do APGs benefit from high-risk PSPs?

- APGs benefit from PSPs by accessing secure transaction processing, enhancing their purchasing power.

- What role does technology play in mitigating risks for serious PSPs?

- Technology, such as AI-driven fraud detection systems, aids serious PSPs in fortifying transaction security and risk management.

- Are there potential drawbacks to the association between high-risk PSPs and APGs?

- Yes, concerns regarding data privacy, consumer protection, and the need for comprehensive regulatory oversight may arise.

- How can serious PSPs contribute to India’s financial inclusion goals?

- By providing secure and accessible transaction services to APGs, serious PSPs can contribute positively to India’s financial inclusion efforts.