AUTHOR : BELLA

DATE : 01/01/2024

Introduction

In the dynamic landscape of e-commerce, payment processing plays a pivotal role in ensuring a seamless and secure shopping experience. For budget-friendly shopping clubs in India, the choice of a payment service provider (PSP) is crucial. This article explores the realm of High Risk PSPs and their significance in the context of budget-friendly shopping in India.

Understanding High Risk PSPs

High Risk PSPs, or High Risk Payment Service Providers, are entities that specialize in handling transactions considered to be of higher risk. These transactions may involve factors such as a high frequency of chargebacks, transactions across borders, or industries with elevated fraud risks.

Challenges Faced by Budget-Friendly Shopping Clubs

Budget-friendly shopping clubs in India encounter unique challenges, including intense market competition and price-sensitive consumers. Addressing these challenges requires a strategic approach, with payment processing emerging as a crucial factor influencing the success of these clubs.

The Need for High Risk PSPs in Budget Shopping Clubs

High Risk PSPs merchant account[1] cater specifically to the needs of businesses facing increased transaction risks. For budget-friendly shopping clubs these providers offer tailored solutions that enhance security, reduce fraud, and ensure a smoother payment process, benefitting both the shoppers and the businesses.

Features to Look for in a High Risk PSP

When selecting a High Risk PSP payment process[2] certain features must be considered. Security measures, transaction processing speed, and compatibility with budget-friendly platforms are key factors that contribute to the effectiveness of the chosen provider.

Case Studies: Successful Implementation in India

Several budget-friendly[3] shopping clubs in India have successfully integrated High Risk PSPs into their payment systems. These case studies showcase positive outcomes, improved transaction security, and increased customer satisfaction.

Navigating Regulatory Compliance

Adherence to regulatory requirements is essential for any payment service provider operating in India. High Risk PSPs are equipped to navigate the complex landscape of payment regulations, ensuring compliance while providing innovative solutions for budget-friendly shopping clubs.

Mitigating Risks in Budget-Friendly Shopping

To mitigate risks associated with High Risk PSPs, shopping clubs[4] implement strategies such as enhanced security protocols, robust fraud detection mechanisms, and transparent communication with customers.

User Experience and High Risk PSPs

The impact of payment processing on user satisfaction cannot be overstated. High Risk PSPs contribute to a positive user experience by ensuring secure transactions, quick processing times, and reliable payment methods tailored to the preferences of budget-conscious[5] shoppers.

The Future of Payment Processing in India

As technology advances, the future of payment processing in India holds exciting possibilities. High Risk PSPs are expected to play a pivotal role in shaping this future, with innovations aimed at further improving security, efficiency, and accessibility for budget-friendly shopping.

Comparing High Risk PSPs to Traditional Payment Solutions

Comparing High Risk PSPs to traditional payment solutions reveals both advantages and disadvantages. While traditional solutions may lack the specialized features required for high-risk transactions, they offer familiarity and broader acceptance. High Risk PSPs strike a balance by providing targeted solutions for specific business needs.

Expert Insights: Interviews with Industry Leaders

To gain deeper insights, we interviewed industry leaders in payment processing and the budget-friendly shopping sector. Their perspectives shed light on the evolving landscape, emphasizing the importance of High Risk PSPs in driving innovation and meeting the unique needs of the market.

Tips for Choosing the Right High Risk PSP

For shopping club owners and managers, choosing the right High Risk PSP involves careful consideration of business requirements, scalability, and the provider’s track record. Tips and recommendations guide decision-makers in making informed choices aligned with their specific needs.

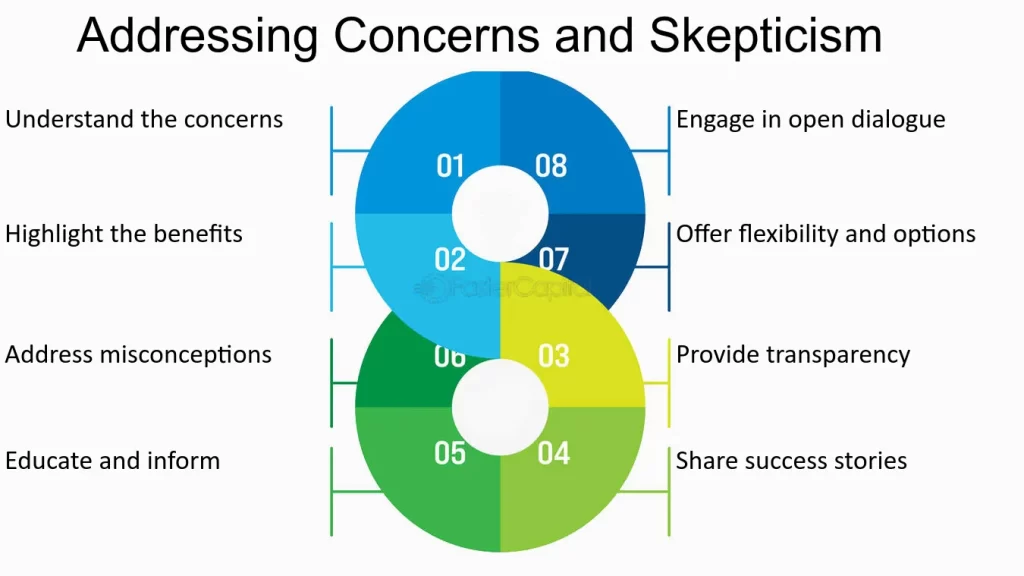

Addressing Concerns of Skeptical Users

Skeptical users may have concerns about the safety and reliability of High Risk PSPs. Dispelling common misconceptions through transparent communication and providing accessible information helps build trust and encourages wider adoption.

Conclusion

In conclusion, the integration of High Risk PSPs into the payment ecosystem of budget-friendly shopping clubs in India is a strategic move towards addressing unique challenges and enhancing overall efficiency. By prioritizing security, user experience, and compliance, these providers contribute significantly to the growth and success of the budget-friendly shopping sector.

FAQs

- Are High Risk PSPs only for budget-friendly shopping clubs?

- High Risk PSPs can be beneficial for various industries, but they are particularly advantageous for budget-friendly shopping clubs facing specific transaction risks.

- How do High Risk PSPs enhance security?

- High Risk PSPs employ advanced security measures, including fraud detection systems and encryption protocols, to ensure secure transactions.

- What factors make a transaction high risk?

- Factors like frequent chargebacks, cross-border transactions, and industries with elevated fraud risks contribute to categorizing a transaction as high risk.

- Can High Risk PSPs handle international transactions?

- Yes, many High Risk PSPs specialize in handling international transactions, providing businesses with the flexibility to operate on a global scale.

- Is it challenging to integrate a High Risk PSP into an existing payment system?

- Integration may require technical expertise, but many High Risk PSPs offer support and resources to facilitate a smooth and efficient process.