AUTHOR:AYAKA SHAIKH

DATE:20/12/2023

Introduction to PSPs

In today’s digital age, Payment[1] Service Providers (PSPs) have become integral cogs in the business machinery. But what exactly do they do? Well, in layman’s terms, PSPs act as intermediaries[1] between merchants and customers, facilitating seamless transactions[2]

- Definition and Functionality A PSP essentially enables[3] businesses to accept a variety of payment methods, from credit cards to digital wallets. They handle the technical aspects, ensuring that money moves securely and efficiently.[4]

- Importance in the Business World Think of PSPs as the unsung heroes of the e-commerce world. Without them, businesses would struggle to process payments,[5] resulting in lost sales and frustrated customers.

High-Risk PSPs: What Sets Them Apart?

Not all PSPs are created equal. Some operate in what’s termed as the ‘high-risk’ category. But what does this mean, and why should you care?

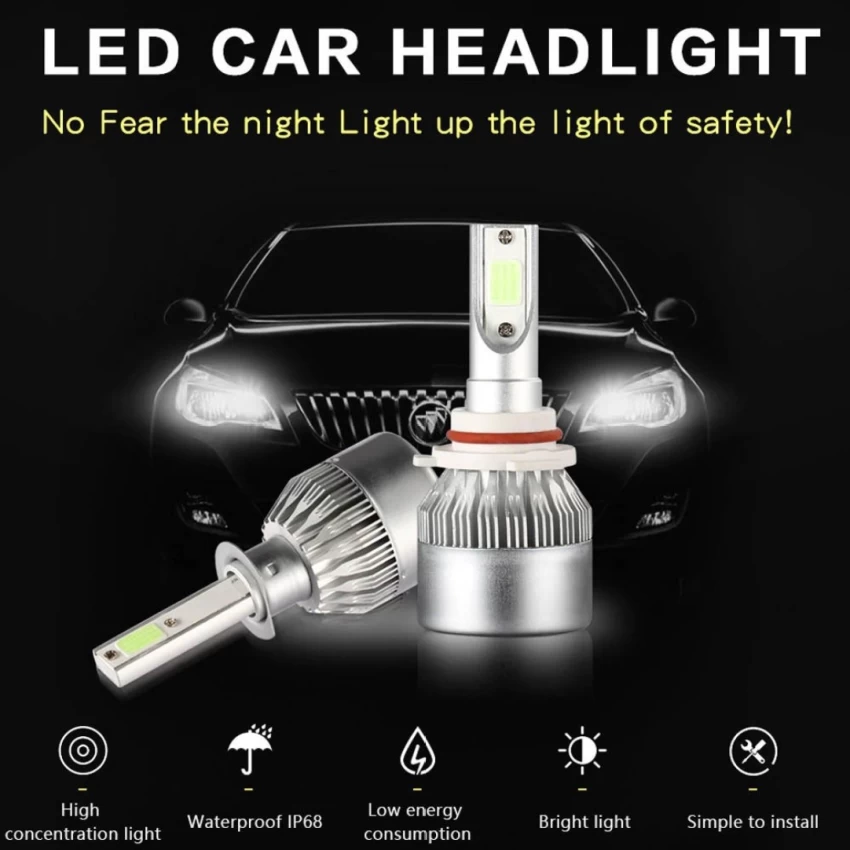

- Criteria for Classification High-risk PSPs typically cater to industries or businesses with elevated levels of risk, such as adult entertainment, gambling, or, in our context, headlights in India.

- Common Challenges Faced Being labeled ‘high-risk’ isn’t a badge of honor. It often means facing stricter regulations, higher fees, and limited access to essential services like banking.

Factors Influencing PSP Risk

The risk associated with PSPs isn’t arbitrary Several factors come into play, shaping their risk profile.

- Industry Regulations Regulations [2]governing specific industries, like automotive parts in India, can influence a PSP’s risk level. Stricter regulations mean higher risk.

- Geographical Considerations Operating in certain regions, like India, brings its own set of challenges. Cultural nuances, legal frameworks, and market dynamics can elevate risk levels.

The Indian Context

India, with its burgeoning e-commerce market and unique challenges, presents a fascinating landscape for PSPs.

- Overview of the Indian Market The Indian market is vast and diverse, with a growing appetite for online shopping. However, navigating its complexities[3] requires expertise and local knowledge.

- Challenges Specific to India From regulatory hurdles to cultural nuances, PSPs operating in India must tread carefully. Understanding local regulations and consumer behavior is crucial.

Solutions and Alternatives

Navigating the high-risk landscape requires strategic thinking and a proactive approach.

- Risk Mitigation Strategies Implementing robust security measures, adhering to regulations, and partnering with reputable providers can help mitigate risks.

- Identifying Reliable Providers Not all PSPs are cut from the same cloth. Researching and vetting potential partners is essential to ensure reliability and compliance.

Conclusion

Understanding[4] high-risk PSPs for headlights in India isn’t just about navigating regulatory hurdles. It’s about leveraging opportunities, mitigating risks, and building a sustainable business model. By adopting a strategic approach and staying informed, businesses[5] can thrive in this ever-evolving landscape

Navigating the Landscape: Tips and Strategies

When diving deeper into the world of high-risk PSPs for headlights in India, it’s essential to have a roadmap. Let’s explore some actionable tips and strategies.

- Understanding Customer Behavior One of the first steps is understanding your target audience. In India, consumer behavior can vary significantly across regions. Conducting market research and leveraging data analytics can provide valuable insights.

- Building Trust Trust is paramount in any business relationship, especially when dealing with high-risk PSPs. Establishing transparent communication channels, offering excellent customer service, and maintaining a strong online presence can help build trust with both customers and partners.

- Staying Updated with Regulations The regulatory landscape in India is constantly evolving. Keeping abreast of changes, consulting with legal experts, and ensuring compliance can help businesses navigate potential pitfalls.

- Diversifying Payment Options Offering multiple payment options can enhance customer experience and mitigate risks associated with a single PSP. From credit cards to digital wallets, providing diverse payment methods can cater to a broader audience.

Case Study: A Success Story

To illustrate the practical application of these strategies, let’s delve into a real-life case study of a company specializing in headlights in India.

- Background XYZ Auto Parts, a leading supplier of headlights in India, faced challenges with their existing PSP due to high transaction fees and regulatory hurdles.

- Strategy Implementation Recognizing the need for a strategic approach, XYZ Auto Parts diversified its payment options, partnered with a reputable high-risk PSP, and invested in robust security measures.

- Results As a result of these initiatives, XYZ Auto Parts experienced a significant reduction in transaction fees, improved customer satisfaction, and expanded its customer base.

Conclusion

Navigating the world of high-risk PSPs for headlights in India requires a blend of strategic thinking, proactive measures, and adaptability. By understanding the unique challenges and opportunities presented by the Indian market, businesses can forge successful partnerships, mitigate risks, and capitalize on growth opportunities. Remember, knowledge is power, and staying informed is the key to success in this dynamic landscape.

FAQs

- What makes a PSP ‘high-risk’ in India?

- Several factors, including industry regulations and geographical considerations, can classify a PSP as high-risk.

- How can businesses mitigate PSP-related risks in India?

- Implementing robust security measures, adhering to regulations, and partnering with reputable providers are key strategies.

- Are all PSPs in India subject to the same regulations?

- No, regulations can vary based on the industry, geographical location, and specific business model.

- What challenges do PSPs face in the Indian market?

- PSPs in India must navigate regulatory hurdles, cultural nuances, and market dynamics to succeed.

- How can businesses identify reliable PSP partners in India?

- Conducting thorough research, vetting potential partners, and seeking recommendations can help identify reliable PSPs.