AUTHOR : BELLA

DATE : 01/01/2024

Introduction

The digital revolution has High Risk PSP for Membership Discounts in India transformed the way businesses operate, with online transactions becoming the norm. As companies explore avenues to enhance customer loyalty, the utilization of high-risk PSPs for membership discounts is emerging as a game-changer.

Understanding High-Risk PSPs

What is a PSP?

A Payment Service Provider (PSP) facilitates online transactions by acting as an intermediary between the merchant and the customer. High-risk PSPs, however, cater to businesses that traditional financial institutions may deem riskier due to various factors.

Factors defining high-risk PSPs

High-risk PSPs cater to businesses facing challenges such as high chargeback rates, industry reputation, or legal considerations. Understanding these factors is high-risk PSP for membership discounts in India crucial for businesses exploring this avenue.

Membership Discounts: A Growing Trend

Importance in India

In a price-sensitive market like India, membership discounts offer a unique proposition. Consumers are increasingly drawn to exclusive deals, making this trend particularly relevant for businesses looking to expand their customer base.

Benefits for businesses

Implementing membership program[1] discounts through high-risk PSPs not only attracts new customers but also fosters long-term relationships. Businesses can capitalize on the recurring revenue stream generated by loyal customers.

Challenges in Implementing PSPs for Membership Discounts

Regulatory hurdles

One of the primary challenges is navigating the complex regulatory landscape surrounding high-risk population[2] PSP for membership discounts in India transactions. Businesses must be vigilant in adhering to guidelines to avoid legal complications.

Security concerns

As businesses handle sensitive customer information, security is paramount High-Risk PSP for Membership Discounts in India must invest in robust security measures to protect both businesses and Consumer protection[3]

Choosing the Right PSP for Membership Discounts

Researching options

Businesses should conduct thorough research to identify high-risk[4] PSPs that align with their goals. Considerations should include transaction fees, integration ease, and customer support.

Evaluating features

Not all high-risk PSPs are created equal. Businesses must High Risk PSP for Membership Discounts in India evaluate features such as fraud prevention tools, reporting capabilities, and scalability to ensure a seamless experience.

Case Studies: Successful Implementations

Companies thriving with PSPs

Examining real-world examples provides valuable insights. Case studies showcasing businesses successfully implementing high-risk management[5] PSPs for membership discounts offer lessons and best practices.

Lessons learned

Understanding the challenges faced and lessons learned by businesses during implementation can guide others in navigating potential pitfalls.

SEO Strategies for Membership Discounts PSPs

Keyword optimization

To reach a broader audience, businesses must employ effective keyword optimization strategies. This involves identifying and incorporating relevant keywords in website content, ensuring visibility on search engines.

Backlinking tactics

Building a strong online presence is crucial. Backlinking to reputable sources and fostering collaborations can enhance a business’s credibility and improve SEO rankings.

Tips for Businesses Exploring High-Risk PSPs

Risk mitigation

Businesses should implement risk mitigation strategies, including thorough vetting of customers and implementing fraud detection tools, to safeguard their interests.

Customer communication

Transparent communication with customers is key. Educate them about the benefits of high-risk PSPs and address any concerns they may have, fostering trust.

User Experience and High-Risk PSPs

Seamless transactions

A positive user experience is essential for customer retention. High-risk PSPs should prioritize creating a seamless transaction process to enhance user High-Risk PSP for Membership Discounts in India satisfaction.

Building trust

Building trust with customers is an ongoing process. Implementing secure and user-friendly payment processes helps establish credibility and fosters long-term relationships.

Future Trends in Membership Discounts PSPs

Technological advancements

As technology evolves, so do payment solutions. Keeping abreast of technological advancements ensures businesses remain competitive in the dynamic market.

Changing consumer behaviors

Understanding shifts in consumer behaviors is crucial for an extra layer of security to transactions, safeguarding sensitive information from potential threats. businesses. Adapting membership discount strategies to align with changing preferences enhances their effectiveness.

Impact of High-Risk PSPs on E-commerce

E-commerce landscape in India

The e-commerce sector in India is experiencing exponential growth. High-risk PSPs can be a catalyst for businesses looking to capitalize on Implementing two-factor authentication adds It provides multilingual and multi-currency support, ideal for digital media with a global reach this burgeoning market.

Shifting consumer preferences

Consumers are increasingly valuing convenience and exclusive deals. High-risk PSPs align with these preferences, offering businesses strategic e-Secure Socket Layer (SSL) certificates to encrypt data exchanged between the customer and the business, ensuring a secure online environment for transactionsadvantage in the competitive e-commerce landscape.

Global Comparison: High-Risk PSPs in Other Countries

Varied regulatory landscapes

Examining how high-risk PSPs operate in other countries provides valuable insights. Businesses can adapt successful strategies to navigate the regulatory thriving wholesale markets, the demand for bulk buying is immense. To optimize savings and secure transactions, landscape in India.

Success stories

Learning from success stories globally highlights While traditional PSPs cater to standard operations, high-risk PSPs specialize in sectors that face higher-than-averagethe potential of high-risk PSPs to revolutionize payment systems and drive business growth.

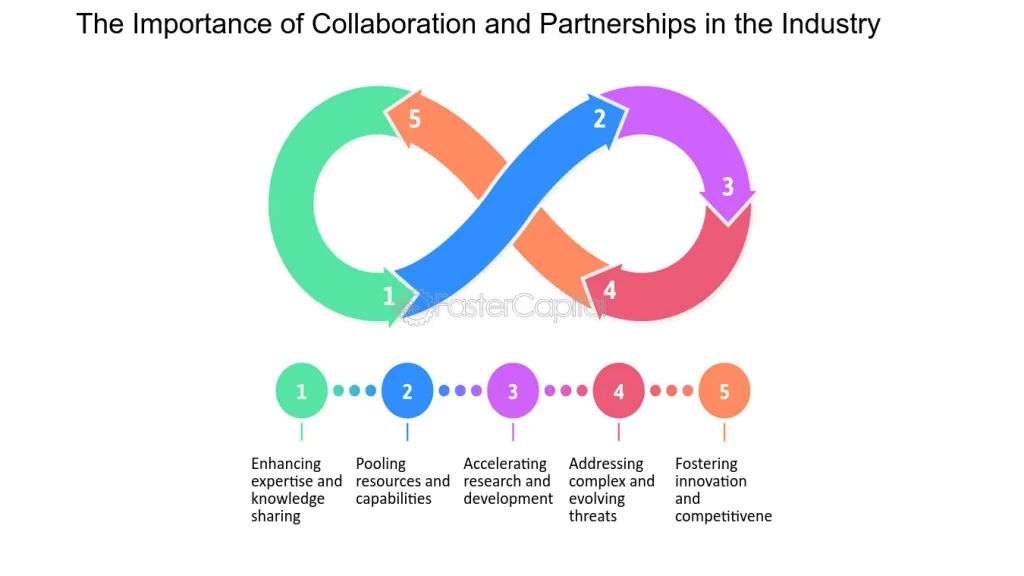

Collaborations and Partnerships in the PSP Industry

Strengthening the ecosystem

Collaborations within the PSP industry foster innovation, and they cater to businesses that traditional PSPs might avoid due to perceived financial instability. growth. Businesses should explore partnerships to enhance their offerings and stay ahead of the competition.

Benefits for businesses

Collaborations and partnerships offer businesses massive transactions, fluctuating payment terms, and risks of fraud. Traditional PSPs may flag such transactions, causing delays or penalties. access to a broader customer base and innovative solutions, creating a mutually beneficial ecosystem.

Conclusion

In conclusion, the use of high-risk PSPs for membership discounts presents a promising avenue for businesses in India. Navigating challenges, implementing effective SEO strategies, and prioritizing user experience are critical for success in this dynamic landscape.

FAQs

- Are high-risk PSPs legal in India?

- Yes, high-risk PSPs are legal in India, but businesses must adhere to regulatory guidelines.

- How can businesses mitigate the risks associated with high-risk PSPs?

- Implementing thorough customer vetting and utilizing fraud detection tools can mitigate risks.

- What are the key features businesses should consider when choosing a high-risk PSP?

- Features such as fraud prevention tools, reporting capabilities, and scaleability are crucial considerations.

- How can businesses build trust with customers when using high-risk PSPs?

- Transparent communication and ensuring a seamless transaction process contribute to building trust.

- What is the future outlook for high-risk PSPs in the Indian market?

- The future outlook is positive, with technological advancements and changing consumer behaviors driving growth.