Author : Sweetie

Date : 20/12/2023

Introduction

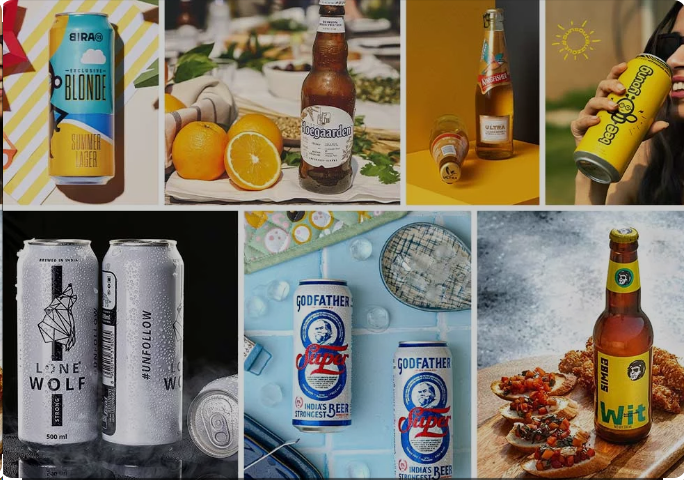

India’s brewing industry[1] has witnessed a significant shift in recent years, with an increasing number of breweries experimenting with seasonal beer releases. This trend has brought forth unique flavors and experiences for consumers, but it has also posed challenges, especially in the realm of online transactions. Traditional Payment Service Providers (PSPs) often fall short in meeting the specific needs of breweries engaged in seasonal beer releases. In this article, we delve into the world of high-risk PSPs and their crucial role in facilitating secure and efficient transactions for the brewing industry.

The brewing landscape PSP for Seasonal Beer Releases in India is evolving, and so are consumer preferences. Seasonal beer releases, once a rarity, have become a popular trend, enticing beer enthusiasts with innovative flavors and ingredients. As breweries embrace this trend, the need for a reliable payment infrastructure becomes apparent.

Seasonal Beer Releases in India

Seasonal beer releases have become a hallmark of the Indian brewing scene, offering consumers a diverse range of flavors throughout the year. From fruity summer brews to spiced winter ales, breweries are pushing the boundaries of creativity. However, the challenge lies in ensuring that these unique brews are accessible to consumers online.

Payment Service Providers (PSPs)

Beer Releases in India Traditional PSPs are designed to cater to a broad range of businesses, but breweries engaged in seasonal releases often find themselves categorized as high-risk. This classification can lead to complications, including higher transaction fees and increased scrutiny.

The Need for High-Risk PSPs in the Brewing Industry

Breweries specializing in seasonal releases face distinct challenges that traditional High-Risk PSP for Seasonal Beer Releases in India may not adequately address. These challenges include the need for flexible payment solutions to accommodate varying consumer demands and the seasonal nature of their products.

Benefits of High-Risk PSPs for Seasonal Beer Releases

High-risk PSPs Seasonal Beer Management[2] offer tailored solutions that align with the unique requirements of breweries. They ensure secure and efficient payment processing, allowing consumers to seamlessly enjoy their favorite seasonal brews without disruptions.

Challenges Faced by Breweries

Breweries often encounter challenges such as transaction failures and delays when using conventional PSPs. These issues not only impact business operations but also affect the overall customer experience.

High-Risk PSPs: Tailored Solutions

High-risk PSPs Customers[4] understand the intricacies of the brewing industry and provide tailored solutions. From accommodating fluctuating transaction volumes to offering specialized support, these providers cater to the specific needs of breweries engaged in seasonal releases.

Security Measures

One of the primary concerns for breweries is the security of online High-risk PSPs transactions[3] implement robust security measures, ensuring the protection of sensitive consumer and business data.

Selecting the Right High-Risk PSP

Choosing the right high-risk PSP is crucial for breweries looking to enhance their online payment processes. Factors such as fees, reliability, and customer support should be carefully evaluated to make an informed decision.

Case Studies

High-risk merchant accounts[5] Several breweries in India have successfully integrated high-risk PSPs, experiencing notable improvements in sales and customer satisfaction. These case studies highlight the positive impact of embracing specialized payment solutions.

Future Trends

As the trend of seasonal beer releases continues to grow in India, high-risk PSPs are likely to play an increasingly vital role. Advancements in payment technology may further enhance the efficiency and security of online transactions for breweries.

Tips for Successful Implementation

To successfully implement high-risk PSPs, breweries should prioritize effective communication with consumers. Clear messaging and user-friendly interfaces contribute to a positive online shopping experience.

The Impact on Consumer Experience

A smooth and secure payment process positively influences the overall consumer experience. High-risk PSPs contribute to a seamless transaction process, ensuring consumers can easily access and purchase their favorite seasonal brews.

Regulatory Compliance

Navigating regulatory challenges is crucial for both high-risk PSPs and breweries. Ensuring compliance with local laws and regulations is essential to building a sustainable and legally sound business model.

Conclusion

In conclusion, high-risk PSPs provide a lifeline for breweries engaged in seasonal beer releases in India. As consumer preferences continue to evolve, these payment solutions offer the flexibility and also security necessary to navigate the challenges of the brewing industry.

FAQs

- Are high-risk PSPs only for breweries engaged in seasonal beer releases?

- No, high-risk PSPs cater to a variety of businesses facing unique challenges in online transactions.

- How do high-risk PSPs ensure the security of transactions?

- High-risk PSPs implement advanced security measures, including encryption and also fraud detection, to protect sensitive information.

- Can breweries switch to a high-risk PSP mid-season?

- Yes, transitioning to a high-risk PSP can be done with careful planning to minimize disruptions.

- Do high-risk PSPs charge higher transaction fees?

- While fees may be slightly higher, the benefits in terms of tailored solutions often outweigh the costs.

- What role do case studies play in the decision to choose a high-risk PSP?

- Case studies provide valuable insights into how other breweries have successfully integrated high-risk PSPs and the resulting improvements in their business.